|

|

|

|

|||||

|

|

The Gap, Inc. GAP is expected to register top-line growth and a bottom-line decline when it reports third-quarter fiscal 2025 numbers on Nov. 30, after the closing bell.

The Zacks Consensus Estimate for the fiscal third-quarter revenues is pegged at $3.91 billion, implying 2.2% growth from the year-ago quarter's reported figure. For quarterly earnings, the consensus mark is pegged at 58 cents per share, suggesting a 19.4% decline from 72 cents reported in the prior-year quarter. The consensus mark for earnings has moved up by a penny in the past 30 days.

The Gap, Inc. price-consensus-eps-surprise-chart | The Gap, Inc. Quote

In the last reported quarter, the company registered an earnings surprise of 3.6%. It has delivered an earnings surprise of 24.5%, on average, in the trailing four quarters.

Our proven model conclusively predicts an earnings beat for GAP this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is exactly the case here. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Gap currently has an Earnings ESP of +2.31% and a Zacks Rank #3.

Gap’s third-quarter fiscal 2025 results are expected to benefit from its ability to gain market share and revive its brand position. Management has been committed to creating a trend-right merchandise assortment, deepening relations with customers via marketing, enhancing the digital commerce agenda and efficiently controlling expenses. Gains from these actions are expected to have bolstered the company’s performance in third-quarter fiscal 2025.

GAP’s third-quarter earnings are expected to be significantly influenced by strong early back-to-school trends, particularly at Old Navy and Gap. Both brands entered the quarter with strong category performance in denim, activewear and seasonal essentials, supported by culturally resonant campaigns like “Better in Denim” and Old Navy’s active launch featuring Lindsay Lohan.

GAP’s third-quarter fiscal 2025 results are expected to benefit from its strong execution, brand momentum and financial discipline, positioning it for sustained growth. As a longstanding force in the apparel industry, the company maintains a significant market presence through its diverse brand portfolio, which includes Old Navy, Banana Republic and Athleta.

On the last reported quarter’s earnings call, management guided sales for the fiscal third quarter to increase 1.5% to 2.5% year over year, supported by strong performance so far, especially at Old Navy and Gap, where back-to-school demand is performing well.

A key positive factor for the fiscal third-quarter earnings is the continued payoff from the company’s multi-year brand reinvigoration strategy. Old Navy, Gap and Banana Republic are benefiting from clearer merchandising, trend-right assortments and a more efficient media mix. Old Navy’s category leadership in denim and active, Gap’s viral cultural positioning through creator-driven content and Banana Republic’s improved product aesthetic and customer acquisition are expected to support higher traffic, stronger AUR and improved full-price sell-through in the to-be-reported quarter.

However, a major factor shaping the fiscal third-quarter earnings is the significant tariff impact, which will begin to flow through the weighted-average cost of inventory. Gap expects gross margin to deleverage by 150-170 bps in the quarter under discussion, with tariffs alone contributing roughly 200 bps of pressure, more than offsetting the company’s underlying margin expansion driven by pricing discipline, improved assortments and reduced discounting in its big brands. Gap has been working aggressively on mitigation efforts, but due to the timing of the August tariff announcement, complete mitigation will not materialize until 2026, leaving the fiscal third quarter particularly exposed.

We expect the adjusted gross margin to decline 160 bps and adjusted operating expenses, as a percentage of sales, to increase 20 bps year over year for the fiscal third quarter. Our model indicates a decrease of 180 bps in the adjusted operating margin to 7.5% in the to-be-reported quarter.

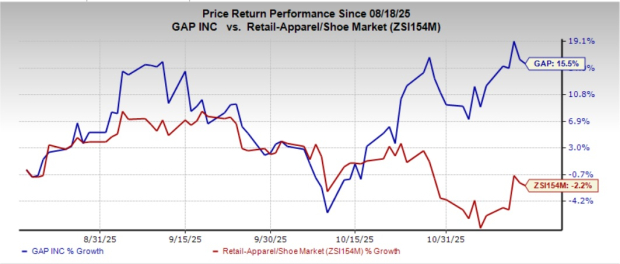

The recent market movements show that GAP shares have gained 15.5% in the past three months against the industry's 2.2% decline.

From a valuation perspective, Gap shares present an attractive opportunity, trading at a discount to industry benchmarks. With a forward 12-month price-to-earnings ratio of 11.25X, significantly below the industry’s average of 16.72X, the stock offers compelling value for investors seeking exposure to the sector.

Here are some companies worth considering, as our model shows that these too have the right combination of elements to beat on earnings this reporting cycle.

Ulta Beauty, Inc. ULTA has an Earnings ESP of +00.24% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Ulta Beauty’s third-quarter fiscal 2025 earnings is pegged at $4.47 per share, implying a decline of 13% from the year-ago quarter. For Ulta Beauty’s quarterly revenues, the consensus mark is pegged at $2.7 billion, which indicates an increase of 7.1% from the year-ago quarter. ULTA delivered a trailing four-quarter earnings surprise of 16.3%, on average.

Five Below, Inc. FIVE currently has an Earnings ESP of +74.71% and a Zacks Rank of 2. FIVE is likely to register a top-line increase when it reports third-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $969.9 million, indicating a 15% rise from the figure reported in the prior-year quarter.

The consensus estimate for Five Below’s earnings is pegged at 22 cents per share, implying a 47.6% decline from the year-ago quarter. FIVE delivered a trailing four-quarter earnings surprise of 50.5%, on average.

Dollar General Corporation DG currently has an Earnings ESP of +12.31% and a Zacks Rank #2. The Zacks Consensus Estimate for DG’s third-quarter fiscal 2025 earnings per share is pegged at 95 cents, implying 6.7% year-over-year growth.

The Zacks Consensus Estimate for quarterly revenues is pegged at $10.62 billion, which indicates an increase of 4.3% from the figure reported in the prior-year quarter. Dollar General delivered a trailing four-quarter earnings surprise of 11.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite