|

|

|

|

|||||

|

|

The Home Depot Inc. HD reported third-quarter fiscal 2025 results, wherein the top line beat the Zacks Consensus Estimate, while the bottom line missed the same. However, sales and earnings per share (EPS) improved year over year.

The lower-than-expected EPS primarily reflects the absence of storm-related activity in the fiscal third quarter, which reduced demand in several key categories. While overall trends remained relatively stable on a sequential basis, this stability did not translate into stronger sales in the fiscal third quarter. Persistent consumer uncertainty and ongoing housing market pressure continued to weigh on home improvement spending, limiting the company’s ability to capture incremental demand in the quarter.

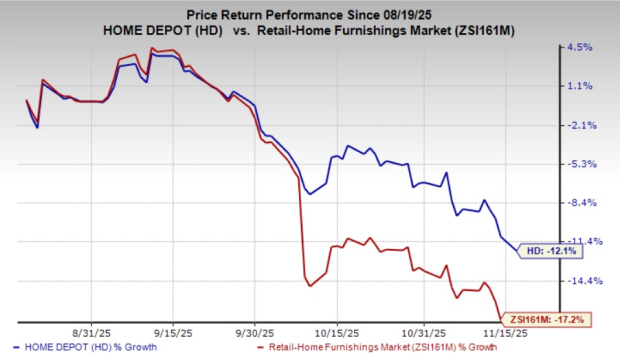

Shares of the Zacks Rank #3 (Hold) company lost 3.8% in the pre-market trading session mainly due to the unimpressive results and a tweaked earnings and margins outlook. The company’s shares have plunged 12.1% in the past three months compared with the industry's 17.2% decline.

Home Depot's adjusted earnings of $3.74 per share decreased 1.1% from $3.78 in the year-ago quarter. However, the bottom line missed the Zacks Consensus Estimate of $3.81 per share.

Net sales increased 2.8% to $41.4 billion from $40.2 billion in the year-ago quarter and beat the Zacks Consensus Estimate of $41 billion. Total sales included a roughly $900 million contribution from the recent acquisition of GMS Inc., representing about eight weeks of activity in the quarter. Excluding this impact, comparable sales (comps) edged up 0.2% in the third quarter of fiscal 2025, with the U.S. comps rising 0.1%.

Customer transactions were 393.5 million, down 1.6% year over year. Average ticket improved 1.8% year over year in the quarter under review.

The Home Depot, Inc. price-consensus-eps-surprise-chart | The Home Depot, Inc. Quote

In dollar terms, gross profit rose 2.9% year over year to $13.8 billion in the fiscal third quarter. The gross margin was approximately 33.4%, up 2 basis points (bps) year over year. Our model predicted 10-bps year-over-year growth in the gross margin to 33.5% for the fiscal third quarter.

SG&A expenses of $7.8 billion increased 5.9% from $7.6 billion in the year-ago quarter. As a percentage of sales, SG&A was about 18.5%, up roughly 60 bps year over year.

Operating income was $5.4 billion, down 1.2% year over year, while the operating margin of about 12.9% contracted 60 bps year over year.

Our model predicted the SG&A expense rate to increase by 10 bps year over year to 18%. We anticipated the operating income to increase 2% year over year and the operating margin to be flat at 13.8% for the fiscal third quarter.

Home Depot ended third-quarter fiscal 2025 with cash and cash equivalents of $1.7 billion, long-term debt (excluding current installments) of $46.3 billion and stockholders’ equity of $12.1 billion. For the first nine months of fiscal 2025, the company generated $13 billion of net cash from operating activities.

Management updated its sales and earnings per share view for fiscal 2025. Reflecting its third-quarter fiscal 2025 performance, the company expects continued pressure in the fiscal fourth quarter due to the absence of major storm activity, ongoing consumer uncertainty, and softness in the housing market, along with the added impact of integrating GMS.

Home Depot anticipates sales to increase 3% year over year compared with 2.8% growth predicted earlier. The increase reflects a $2 billion incremental sales contribution from GMS. The company expects comps to increase slightly for the 52 weeks of fiscal 2025 compared with 1% growth mentioned earlier.

HD estimates the gross margin for fiscal 2025 to be 33.2%, with an operating margin of 12.6%. Earlier, the company predicted a gross margin of 33.4% and an operating margin of 13%. The company expects an adjusted operating margin of 13% compared with the prior expectation of 13.4%. HD plans to open 12 stores for fiscal 2025 against the previously planned 13 store openings.

Home Depot expects net interest expense of $2.3 billion for fiscal 2025, and the effective tax rate is anticipated to be 24.5%. The company anticipates capital expenditures to be 2.5% of total sales.

Home Depot anticipates EPS to decline 6% year over year for fiscal 2025, while adjusted EPS is estimated to fall 5% year over year. The company earlier expected an EPS decline of 3% and an adjusted EPS decrease of 2%.

Some better-ranked stocks are American Eagle Outfitters Inc. AEO, Somnigroup International Inc. SGI and Boot Barn Holdings Inc. BOOT.

American Eagle is a specialty retailer of casual apparel, accessories and footwear for men and women aged 15–25 years. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle’s fiscal 2025 sales and earnings indicates declines of 0.1% and 35.6%, respectively, from the year-ago numbers. AEO has a trailing four-quarter earnings surprise of 30.3%, on average.

Somnigroup is a bedding company that designs, manufactures, distributes and retails sleep solutions. It carries a Zacks Rank #2 (Buy) at present.

The Zacks Consensus Estimate for Somnigroup’s 2025 sales and earnings indicates growth of 52.9% and 5.5%, respectively, from the previous year’s figures. SGI has a trailing four-quarter average earnings surprise of 6.3%.

Boot Barn operates as a lifestyle retail chain devoted to western and work-related footwear, apparel and accessories. It currently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Boot Barn’s current fiscal-year sales and earnings indicates growth of 16.2% and 20.5%, respectively, from the year-ago numbers. BOOT has a trailing four-quarter earnings surprise of 5.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite