|

|

|

|

|||||

|

|

Dolby Laboratories, Inc. DLB reported fourth-quarter fiscal 2025 non-GAAP earnings per share (EPS) of 99 cents, surpassing the Zacks Consensus Estimate of 70 cents. It reported 81 cents in the prior-year quarter.

Total revenues were $307 million, up from $304.8 million in the year-ago quarter and surpassed the Zacks Consensus Estimate by 0.5%. This uptick was driven by higher revenues in the Product and Services segment.

The company closed fiscal 2025 on a strong note, with growth in Dolby Atmos, Dolby Vision and its imaging patents, while also broadening its addressable market through the continued momentum of Dolby OptiView and the launch of a new imaging patent pool for content streaming.

For fiscal 2026, management is confident in its strategy to drive business growth by delivering meaningful value across both existing and emerging ecosystems of creators, content distributors and device manufacturers.

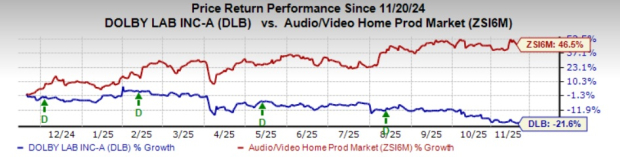

Following the announcement, shares of the company marginally declined in the after-market trading session yesterday. In the past year, shares have lost 21.6% against the Zacks Audio Video Production industry’s growth of 46.5%.

Revenues from Licensing were $281.6 million, down 0.4% year over year. Licensing revenue was in line with the company’s guidance of $263 million to $293 million.

Products and Services’ revenues were up 14.9% year over year to $25.4 million.

Our estimates were pegged at $281 million and $24.5 million for the Licensing and Products and Services revenues, respectively.

Broadcast Licensing contributed 38% to total licensing revenues in the quarter under review. Mobile Licensing, Consumer Electronics (CE), PC Licensing and Licensing from Other Markets accounted for 18%, 12%, 10% and 22% of licensing revenues, respectively.

Gross profit in the fiscal fourth quarter was $267.5 million compared with $270.8 million in the year-ago quarter. Total operating expenses increased to $237.8 million from $224.5 million reported in the year-ago quarter.

Operating income was $29.7 million compared with $46.4 million in the year-ago quarter.

For the fiscal year ended on Sept. 26, 2025, Dolby generated $472.2 million of net cash from operating activities.

As of Sept. 26, 2025, the company had $701.9 million in cash and cash equivalents, with $595.8 million in total liabilities. It had $698.6 million in cash and cash equivalents, with $581.8 million in total liabilities, as of June 27, 2025.

The company repurchased approximately 479,000 shares of its common stock for about $35 million during the quarter and ended the quarter with roughly $277 million remaining under its stock repurchase authorization.

The company declared a cash dividend of 36 cents per share, payable on Dec. 10, 2025, to shareholders on record as of the close of business on Dec. 2, 2025.

For the first quarter of fiscal 2026, the company estimates revenues between $315 million and $345 million. First-quarter revenue is projected to decline about 8% year over year at the midpoint, mainly because of a tough comparison with last year’s sizable true-up and the timing of recoveries and minimum volume commitments.

The company anticipates first-quarter licensing revenues to be between $290 million and $320 million.

On a GAAP basis, operating expenses are expected to be in the range of $235-$245 million. On a non-GAAP basis, the same is anticipated to be between $195 million and $205 million.

It expects GAAP EPS of 28-43 cents and non-GAAP EPS between 39 cents and 54 cents.

Dolby Laboratories price-consensus-eps-surprise-chart | Dolby Laboratories Quote

For fiscal 2026, the company expects revenues to be in the $1.39-$1.44 billion band. The company reported revenues of $1.35 billion in fiscal 2025.

Licensing revenues are projected to range from $1.285 billion to $1.335 billion, with revenue from Foundational Audio Technologies expected to decline in the low single digits due to deal timing in Mobile and lower anticipated unit shipments in PC and CE. By end market, the company expects full-year revenue to grow at a high-teens rate in Other, rise mid-single digits in Broadcast and Mobile and decline by high single digits in CE and PC.

GAAP operating margin is expected to be 21%, while the non-GAAP operating margin is projected to be nearly 34%.

On a GAAP basis, operating expenses are expected to range from $930 million to $950 million. On a non-GAAP basis, it is anticipated to range from $780 million to $800 million.

The company expects GAAP EPS of $2.61 to $2.76, and non-GAAP EPS is anticipated to be $4.19-$4.34. Dolby reported non-GAAP EPS of $4.24 in fiscal 2025.

Dolby continued to broaden its global footprint this quarter across entertainment, social media, devices and automotive. Peacock began streaming its NFL Sunday Night Football and NBA games in Dolby Atmos, while Dolby also introduced Dolby Vision 2, extending the advantages of Dolby Vision beyond HDR to better leverage modern displays and provide creators with enhanced tools. Major TV manufacturers, including TCL, Samsung, Hisense, Xiaomi and Amazon, launched new models featuring Dolby Atmos and/or Dolby Vision, further expanding consumer access.

On the app front, Instagram for iOS became the first Meta platform to support Dolby Vision, and Douyin (TikTok in China) enabled users to capture, edit and share content in Dolby Vision. Dolby also strengthened its automotive presence by signing agreements with Maruti Suzuki in India, Deepal in China and VinFast in Vietnam. Additionally, the first in-car game with Dolby Atmos, Loner, debuted on Li Auto vehicles, showcasing new interactive possibilities for immersive audio.

Dolby currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GoPro, Inc. GPRO reported third-quarter 2025 non-GAAP loss per share of 9 cents, wider than the Zacks Consensus Estimate of a loss of 3 cents. The company forecasted non-GAAP adjusted loss of 4 cents per share (+/- 2 cents). The firm reported break-even earnings in the year-ago quarter.

GPRO generated revenues of $162.9 million, down 37.1% year over year. The figure was within the company’s expectation of $160 million (+/- $10 million). The top line beat the consensus mark by 0.5%.

Sonos, Inc. SONO reported fourth-quarter fiscal 2025 non-GAAP loss per share of 6 cents. The Zacks Consensus Estimate was pegged at earnings of 5 cents. The company incurred a loss of 18 cents in the prior-year quarter. On a GAAP basis, the company reported a loss of 31 cents compared with a loss of 44 cents in the year-ago quarter.

Quarterly revenues increased 12.7% year over year to $287.9 million. Moreover, the figure came near the high end of the company’s guidance of $260 million to $290 million. The Zacks Consensus Estimate for the top line was pegged at $283.1 million.

Sony Group Corporation SONY reported second-quarter fiscal 2025 net income per share (on a GAAP basis) of ¥51.71, up from ¥48.04 in the year-ago quarter. Adjusted net income came in at ¥311.4 billion compared with ¥291.8 billion in the prior-year quarter.

Quarterly total revenues rose 5% year over year to ¥3,107.9 billion, driven by higher revenues in the Game & Network Services (G&NS), Music and Imaging & Sensing Solutions (I&SS) segments, partially offset by a decline in the Entertainment, Technology & Services (ET&S) segment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-07 | |

| Mar-07 | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite