|

|

|

|

|||||

|

|

Qualcomm Incorporated QCOM and Intel Corporation INTC are two premier semiconductor firms investing heavily in connectivity and edge computing, with both focusing on AI (artificial intelligence) and advanced chip technologies. Qualcomm’s offering includes high-performance, low-power chip designs for mobile devices, PCs, XR (Extended Reality), automotive, wearable, robotics, connectivity and AI use cases. The company boasts a comprehensive intellectual property portfolio comprising 3G, 4G, 5G and other technologies.

Intel, widely known as the world’s largest semiconductor firm and primary supplier of microprocessors and chipsets, is currently focusing more on data-centric businesses, such as AI and autonomous driving, to reduce its dependence on the PC-centric business. The foundry operating model is a key component of the company's strategy and is designed to reshape operational dynamics and drive greater transparency, accountability and focus on costs and efficiency.

With the growing proliferation of AI in PCs, smartphones, automotive and IoT applications, both Qualcomm and Intel are steadily advancing their semiconductor portfolios to bolster their competitive edge. Let us analyze the competitive strengths and weaknesses of the companies to understand who is better positioned to capitalize on emerging market trends.

Qualcomm is well-positioned to meet its long-term revenue targets driven by solid 5G traction, greater visibility and a diversified revenue stream. The company is increasingly focusing on the seamless transition from a wireless communications firm for the mobile industry to a connected processor company for the intelligent edge. Qualcomm is witnessing healthy traction in EDGE networking, which helps transform connectivity in cars, business enterprises, homes, smart factories, next-generation PCs, wearables and tablets. The automotive telematics and connectivity platforms, digital cockpit and C-V2X solutions are also fueling emerging automotive industry trends such as the growth of connected vehicles, the transformation of the in-car experience and vehicle electrification.

The company is strengthening its foothold in the mobile chipsets market with innovative product launches. It had extended its Snapdragon G Series portfolio with the addition of next-generation gaming chipsets, Snapdragon G3 Gen 3, Snapdragon G2 Gen 2 and Snapdragon G1 Gen 2 chips. Samsung, one of the major smartphone manufacturers, has deployed the Snapdragon 8 Elite Mobile Platform for its premium S25, S25 Plus and S25 Ultra devices. It is also placing a strong emphasis on developing advanced chipsets for the emerging AI PC market. The company has inked agreements to acquire MovianAI to augment its efforts in fundamental AI research.

Despite efforts to ramp up its AI initiatives, Qualcomm has been facing tough competition from Intel in the AI PC market. Shift in the share among OEMs at the premium tier has reduced Qualcomm's near-term opportunity to sell integrated chipsets from the Snapdragon platform. The company is also facing stiff competition from Samsung’s Exynos processors in the premium smartphone market, while MediaTek is gaining market share in the mid-range and budget smartphone market. Competition is also likely to come from rivals like Broadcom Inc. AVGO and NVIDIA Corporation NVDA. Qualcomm’s extensive operations in China are also expected to be significantly affected by the U.S.-China trade hostilities.

Intel has been investing in expanding its manufacturing capacity to accelerate its IDM 2.0 (Integrated Device Manufacturing) strategy. Interim management is committed to keeping the core strategy unchanged despite efforts to drive operational efficiency and agility. The company is emphasizing the diligent execution of operational goals to establish itself as a leading foundry. It is focusing on simplifying parts of its portfolio to unlock efficiencies and create value.

Intel's innovative AI solutions are set to benefit the broader semiconductor ecosystem by driving down costs, improving performance and fostering an open, scalable AI environment. The company has witnessed healthy traction in AI PCs, which have taken the market by storm and remain firmly on track to ship more than 100 million units by the end of 2025. Intel Xeon platforms have reportedly set the benchmark in 5G cloud-native core with substantial performance and power efficiency improvements, additional power-saving capabilities and easy-to-deploy software. This has triggered healthy demand trends from major telecom equipment manufacturers and independent software vendors to optimize and unleash proven power savings for a more sustainable future.

However, Intel derives a significant part of its revenues from China. As Washington tightens restrictions on high-tech exports to China, Beijing has intensified its push for self-sufficiency in critical industries. This shift poses a dual challenge for Intel, as it faces potential market restrictions and increased competition from domestic chipmakers. The company is also lagging in the GPU and AI front compared to peers such as NVIDIA and AMD. Leading technology companies are reportedly piling up NVIDIA’s GPUs to build clusters of computers for their AI work, leading to exponential revenue growth.

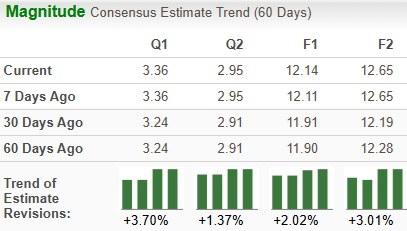

The Zacks Consensus Estimate for Qualcomm’s fiscal 2026 sales suggests year-over-year growth of 2.8%, while that for EPS implies a rise of 0.9%. The EPS estimates have been trending northward over the past 60 days.

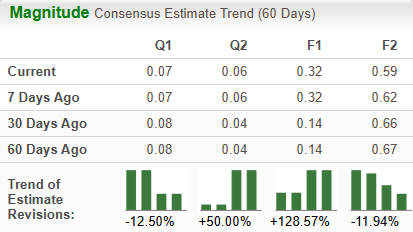

The Zacks Consensus Estimate for Intel’s 2025 sales implies a year-over-year decline of 1.3%, while that of EPS indicates growth of 346.1%. The EPS estimates have been trending northward on average over the past 60 days.

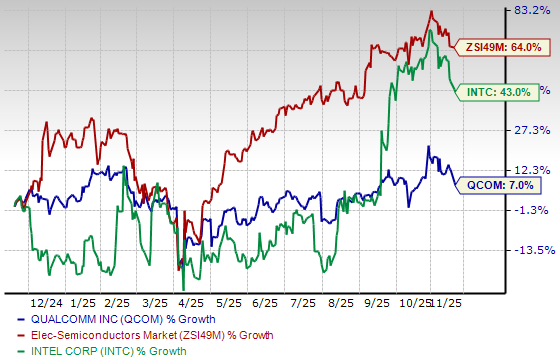

Over the past year, Qualcomm has gained 7% compared with the industry’s growth of 64%. Intel has surged 43% over the same period.

Intel looks more attractive than Qualcomm from a valuation standpoint. Going by the price/sales ratio, Intel’s shares currently trade at 3.04 forward sales, lower than 3.89 for Qualcomm.

Both Qualcomm and Intel carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Both companies expect their earnings to improve in 2025. Long-term earnings growth expectations for QCOM and INTC are 6.1% and 7.1%, respectively. Qualcomm is a bit expensive in terms of valuation metrics. Moreover, with superior price performance and solid inherent growth potential, Intel appears to have a slight edge over Qualcomm. Consequently, Intel seems to be a better investment option at the moment.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 min | |

| 9 min | |

| 15 min |

Stock Market Today: Dow Wavers As Nasdaq Struggles; Cruise Line Sails Higher (Live Coverage)

NVDA

Investor's Business Daily

|

| 19 min | |

| 21 min |

Quantum Computing Stocks: Infleqtion To Start Trading As Public Company

NVDA

Investor's Business Daily

|

| 24 min | |

| 26 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite