|

|

|

|

|||||

|

|

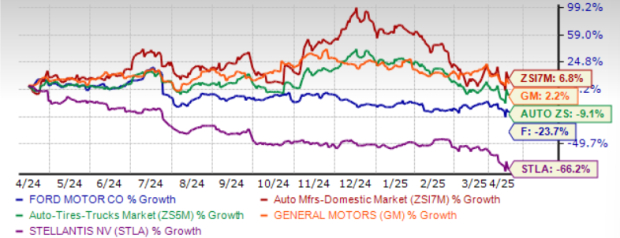

U.S. legacy automaker Ford F is having a tough run on the bourses. The stock is down roughly 24% over the past year. Shares closed at $9.33 in the last trading session, close to its 52-week low of $8.44.

Meanwhile, Ford’s closest rival, General Motors GM, has risen 2.2% in the past year. Italian-American automaker Stellantis STLA, on the other hand, has lost 66% in the same timeframe.

Ford is reeling under persistent losses from its electric vehicle (EV) business, with no clear turnaround in sight. Further, declining ICE (internal combustion engine) business profitability and volumes, along with rising risks from Trump’s tariff policies, are playing spoilsports.

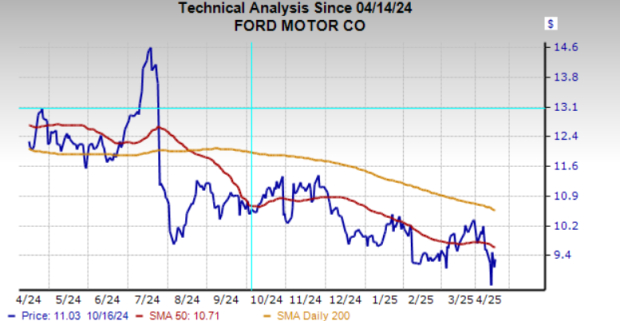

The stock is currently trading below its 50 and 200-day SMA, signaling bearish trend. It has a Momentum Score of C.

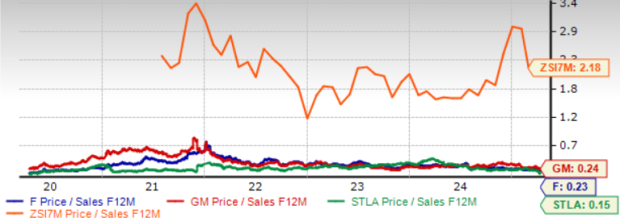

From a valuation standpoint, Ford looks cheap at the first glance. However, ongoing headwinds may be weighing on investor sentiment and contributing to the low multiples. Its 12-month forward sales multiple is lower than industry levels. The metric stands at 0.23 for Ford, compared with 0.24 for General Motors and 0.15 for Stellantis.

Ford’s Model e division (focused on EVs) remains under pressure, hit by intense competition, pricing challenges and high development costs tied to next-gen EVs. Losses from the segment widened to $5.07 billion in 2024 from $4.7 billion in 2023. Ford now expects a deeper loss of $5-5.5 billion for the full year.

Meanwhile, its Ford Blue division is also showing signs of weakness. The company projects 2025 EBIT of $3.5-4 billion, down from $5.3 billion in 2024. Lower ICE vehicle sales, an unfavorable product mix and foreign exchange headwinds are expected to weigh on performance.

Trump’s 25% tariffs on imports from Mexico and Canada pose challenges for Ford. CEO Jim Farley has already warned that tariffs would bring “a lot of cost and a lot of chaos” to the U.S. auto industry.

These tariffs are expected to disrupt supply chains, raise raw material costs and ultimately increase vehicle prices — potentially hurting demand, sales and profits. However, the bigger impact may not come from the 25% levy on imported vehicles alone but from an expected additional 25% tariff on imported auto parts next month. While Ford manufactures around 82% of the vehicles it sells in the United States domestically, only about one-third of those cars are made with domestic parts — leaving the company vulnerable to rising component costs.

Importantly, the guidance doesn’t even factor in potential policy shifts under Trump. For the full year, Ford expects adjusted EBIT between $7 billion and $8.5 billion, down from $10.2 billion in 2024. While strength in Ford Pro and Ford Credit may offer some support, it’s unlikely to fully offset rising pressure from Model e, Blue, warranty costs and generous incentives — all of which threaten to drag down margins and free cash flow. Adjusted FCF is projected in the range of $3.5–$4.5 billion, a sharp drop from $6.7 billion in 2023.

First-quarter 2025 results are likely to be particularly weak. Ford expects first-quarter 2025 adjusted EBIT to break even, a sharp drop from $2.7 billion in the first quarter of 2024 and $2.1 billion in the fourth quarter of 2024 due to lower volumes, a 20% production cut and plant launch activities.

Ford’s high dividend yield of more than 6% is quite appealing to income-focused investors, especially when compared to the S&P 500’s average of 1.38%. The company targets a payout ratio of 40-50% of free cash flow, reinforcing its commitment to shareholder returns. However, that payout could come under pressure. Tariffs—especially when extended to auto parts—will raise costs, squeeze margins and hurt profits. Ford may have to reassess its dividend policy if tariff burden persists long.

That said, a near-term cut appears unlikely. Ford’s strong liquidity position provides a cushion, with $28 billion in cash and around $47 billion in total liquidity at the end of 2024. This financial buffer allows the company time to navigate policy uncertainty. Still, investors relying on the dividend should watch for developments, as prolonged earnings pressure could eventually challenge the sustainability of Ford’s generous yield.

The Zacks Consensus Estimate for Ford’s 2025 sales and EPS implies a decline of 5% and 27%, respectively. Discouragingly, its EPS estimates have been southbound in the past 60 days.

Despite low valuation and strong dividend yield, Ford faces too many headwinds to ignore. Widening EV losses, weakening ICE performance and looming tariffs threaten margins and earnings. Its 2025 outlook is already soft and doesn’t even account for tariff policy shifts. While its liquidity cushion may delay drastic actions like a dividend cut, ongoing operational struggles and weak near-term prospects suggest limited upside. Until there is more clarity, investors should avoid Ford and wait for a more stable setup.

Ford stock currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 5 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 15 hours | |

| 15 hours | |

| 16 hours | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite