|

|

|

|

|||||

|

|

Palo Alto Networks (PANW) and Cisco Systems (CSCO) are well-known players in the cybersecurity domain. While PANW focuses broadly on next-generation firewalls, cloud security and AI-driven threat detection, Cisco Systems is growing its presence based on Threat Intelligence, Detection, and Response offerings, which include the offerings from Splunk, as well as growth in Secure Access Service Edge (SASE) and Network Security offerings.

Palo Alto Networks and Cisco Systems are capitalizing on the rapid improvement of the cybersecurity space, fueled by the rise of complex attacks, including credential theft and abuse, remote desktop protocol attacks and social engineering-based initial access. Per a Mordor Intelligence report, the cybersecurity market is projected to witness a CAGR of 12.45% from 2025 to 2030.

With this strong industry growth forecast, the question remains: Which stock has more upside potential? Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which offers a more compelling investment case.

Palo Alto Networks remains a cybersecurity leader, offering solutions for network security, cloud security and endpoint solutions for customers who need full enterprise security support. Its next-generation firewalls and advanced threat detection technologies are widely recognized and adopted globally.

Palo Alto Networks’ wide range of innovative products, strong customer base and growing opportunities in areas like Zero Trust, SASE and private 5G security continue to support its long-term growth potential. Palo Alto Networks’ ongoing technology advancements make it a compelling long-term investment.

For example, in the first quarter of fiscal 2026, SASE was Palo Alto Networks’ fastest-growing segment, with SASE Annual recurring revenues (ARR) increasing 34% year over year. Growth is mainly coming from customers who want to reduce the number of security tools they use. Many organizations are moving away from older SASE products that do not provide a full view of their networks, cloud workloads, and remote users. A notable example during the first quarter is where a large U.S. cabinet agency signed a $33 million SASE deal covering 60,000 seats after replacing its existing provider.

Palo Alto Networks also reported steady growth in its next-generation security business in the first quarter of fiscal 2026. Next Gen Security (NGS) ARR grew 29% from last year and reached $5.85 billion. PANW’s platformization strategy was a key driver. More customers are choosing to use multiple Palo Alto Networks products together instead of using many different vendors.

During the first quarter, the company added about 60 new platform customers. The number of customers with more than $5 million in NGS ARR rose to nearly 170, and those with more than $10 million increased to 50. Both groups grew by about 50% compared with last year. This shows deeper use of the platform by larger customers.

Moreover, Palo Alto Networks has increased its long-term NGS ARR goal. The company now expects to reach $20 billion in NGS ARR by fiscal 2030, higher than the earlier target of $15 billion.

Cisco Systems is making steady progress in its security business. The company has added several new security products, such as Secure Access, XDR, Hypershield, AI Defense and refreshed firewalls. These newer products are seeing good customer adoption. In the first quarter of fiscal 2026, almost 3,000 customers have already bought these new or refreshed security solutions.

Splunk, which is now part of Cisco Systems, also showed strong signs of growth. Its annual recurring revenues and remaining performance obligations grew at double-digit rates, which means more customers are choosing its security solutions, showing that long-term demand remains strong. Cisco Systems also closed one of its largest Splunk deals in the first quarter, helped by the combined Cisco and Splunk sales teams.

Moreover, orders for Cisco Systems’ next-generation firewalls grew in the mid-teens range. Additionally, Cisco Systems has also announced Cisco Data Fabric, a Splunk-powered architecture that helps customers unify and manage machine data from many different sources. This allows organizations to use their own data to build AI models and gain more value from information that was not used before.

However, in the first quarter of fiscal 2026, Cisco Systems’ security revenues dropped 2% year over year. This happened mainly because older security products are seeing lower demand. Splunk also shifted more customers from on-premise deals to cloud subscriptions. Cloud deals are recognized slowly, which pulled down short-term revenues.

Additionally, the security business is still weaker than Cisco’s networking business. Demand for older products is falling, and the move to cloud-delivered Splunk products reduces near-term revenues, which could potentially hurt overall revenue growth in the near term.

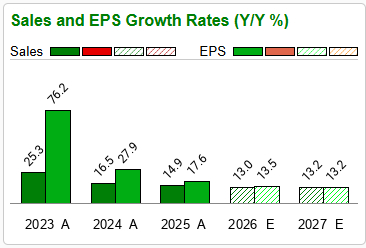

Both companies will benefit from the surging demand for cybersecurity, but Palo Alto Networks’ growth profile appears stronger in the near term. The Zacks Consensus Estimate for PANW’s current fiscal-year 2026 revenues and earnings per share (EPS) indicates a year-over-year surge of 13% and 13.2%, respectively. For fiscal 2027, top and bottom lines are projected to grow 13.5% and 13.2%, respectively.

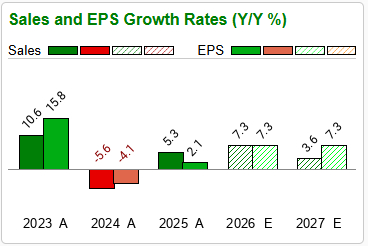

In contrast, Cisco Systems’ fiscal 2026 estimates point to more modest growth with revenues and EPS both projected to increase 7.3% year over year. For fiscal 2027, top and bottom lines are both projected to grow 3.6% and 7.4%, respectively.

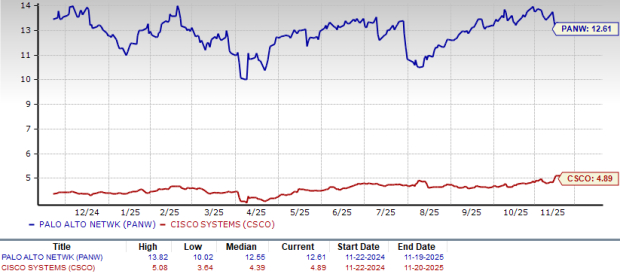

Year to date, Palo Alto Networks shares have appreciated 1.7%, while Cisco Systems shares have surged 27.5%.

Currently, Cisco Systems is trading at a forward sales multiple of 4.89X, lower than Palo Alto Networks’ forward sales multiple of 12.61X. Palo Alto Networks does seem pricey compared with Cisco Systems. However, Palo Alto Networks’ valuations also reflect higher growth expectations for the company.

Palo Alto Networks’ leadership in the cybersecurity space provides strong revenue visibility for years to come. While the stock trades at a higher valuation than Cisco Systems, its explosive growth prospects and strong financial execution more than justify the price. Cisco Systems’ execution risks and a slower growth trajectory suggest that investors should consider holding positions or waiting for more attractive entry points.

Currently, Palo Alto Networks carries a Zacks Rank #2 (Buy), making the stock a stronger pick compared with Cisco Systems, which has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Palo Alto Networks Lifts Revenue Outlook as Second-Quarter Profit Jumps

PANW

The Wall Street Journal

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite