|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The Gap, Inc. GAP reported third-quarter fiscal 2025 results, wherein both the top and bottom lines surpassed the Zacks Consensus Estimate. Meanwhile, on a year-over-year basis, the company’s top line increased, but the bottom line declined.

Quarterly results benefited from broad-based brand momentum, strong execution and continued progress on the company’s reinvigoration playbook, which together drove healthier sales trends and improved operating discipline. Old Navy, Gap and Banana Republic delivered solid performances, supported by compelling assortments, culturally resonant storytelling and stronger full-price sell-through. While tariffs weighed on the overall margin structure, the underlying merchandise margin improved, driven by lower discounting and consistent customer response to the elevated product.

GAP posted third-quarter earnings of 62 cents per share, which surpassed the Zacks Consensus Estimate of 58 cents but declined 13.9% from the prior-year quarter’s figure.

The Gap, Inc. price-consensus-eps-surprise-chart | The Gap, Inc. Quote

Net sales of $3.94 billion came in slightly above the consensus estimate of $3.91 billion and increased 3% from the prior-year figures. Comparable sales (comps) rose 5% year over year. The company saw sturdy results at Old Navy and Gap, and progress at Banana Republic. Online sales rose 2% year over year, accounting for 40% of the total sales. Store sales increased 3% year over year.

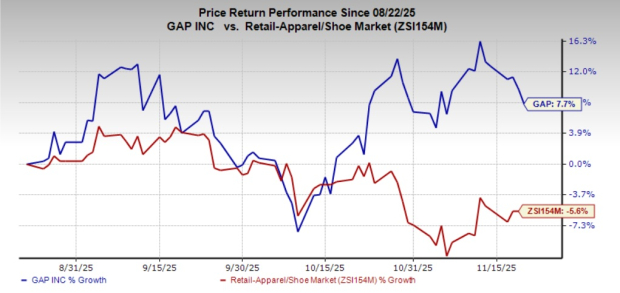

Shares of this Zacks Rank #3 (Hold) company have gained 7.7% over the past three months against the industry’s 5.6% decline.

Old Navy: Net sales at Old Navy Global edged up 5% year over year to $2.3 billion. Comps rose 6% year over year. Old Navy continues to outperform in key strategic categories such as denim, active, and kids and baby, while strengthening momentum through culturally relevant partnerships. Sales for Old Navy Global beat our model’s estimate of $2.2 billion.

Gap Global: Net sales rose 6% year over year to $951 million, while comps increased 7%, highlighting the eighth straight quarter of positive comps. Gap’s strong execution and consistent application of its reinvigoration playbook continue to fuel momentum, enabling the brand to steadily build on its recent successes. Our model estimates sales for Gap Global to be $928.9 million.

Banana Republic: Net sales dropped 1% year over year to $464 million, while comps rose 4%. Sales lagged our estimate of $472.8 million. The company’s foundational efforts, from elevated product offerings to culturally relevant storytelling, are clearly resonating with consumers, supporting a second consecutive quarter of strong performance.

Athleta: Net sales dropped 11% year over year to $257 million and comps also dipped 11%. Net sales were below our estimate of $274.1 million. The brand is starting with the fundamentals and implementing the reinvigoration playbook with discipline to position itself for long-term recovery, a process that will take time.

The gross margin of 42.4% fell 30 basis points (bps) year over year. Meanwhile, we estimated the adjusted gross margin to be 41.1%.

The merchandise margin declined 70 basis points (bps), mainly due to an estimated net tariff impact of roughly 190 bps. Excluding this impact, the underlying merchandise margin expanded, driven primarily by higher average unit retail. Rent, occupancy and depreciation, as a percentage of sales, leveraged 40 bps year over year.

Further, the operating margin of 8.5% fell 80 bps in the reported quarter from last year’s adjusted operating margin. Our model anticipated an adjusted operating margin of 7.5%.

Operating expenses were $1.3 billion, up 4.4% year over year.

Gap ended the fiscal third quarter with cash and cash equivalents and short-term investments of $2.5 billion, up 13% from the year-ago period. As of Nov. 1, 2025, it had a total stockholders’ equity of $3.6 billion and a long-term debt of $1.5 billion.

At the end of the fiscal second quarter, merchandise inventory was up 5% year over year to $2.5 million.

As of Nov. 1, 2025, the company reported net cash from operating activities of $607 million, with free cash flow of $280 million, underscoring its disciplined approach to business management. Capital expenditures for the same period totaled $327 million. GAP paid cash dividends of $62 million during the third quarter, and the board has approved a fourth-quarter dividend of 16.50 cents per share. For fiscal 2025, capital expenditure is expected to be $500-$550 million.

As of Nov. 1, 2025, Gap had around 3,500 stores in more than 35 countries, of which 2,497 were company-operated. Net store closures for fiscal 2025 are likely to be about 35.

The outlook for the company remains constructive, supported by solid third-quarter momentum and growing confidence in the reinvigoration playbook. Management expects continued strength across its largest brands, reflecting healthier product acceptance, disciplined inventory management and stronger brand relevance heading into the holiday season.

For fiscal 2025, management continues to project sales growth of 1.7-2%, up from the prior guidance of 1-2%. This assumes continued strength at Old Navy, Gap and Banana Republic, and a long recovery at Athleta.

The company also raised its profitability expectations, with full-year gross margin now projected to deleverage about 50 basis points, including an estimated 100-110 basis points of tariff impact. Excluding tariffs, this implies underlying gross margin expansion of roughly 50-60 basis points. Regarding SG&A, Gap continues to expect slight leverage for the full year, with roughly $150 million in cost savings likely to be accomplished in fiscal 2025. Part of the cost savings will be reinvested in future growth.

For fiscal 2025, operating margin is now projected at about 7.2%, up from the prior range of 6.7-7%, reflecting stronger full-price sell-through and disciplined cost management. The effective tax rate is estimated to be roughly 28%. Net interest income is expected to be nearly $20 million compared with $25 million recorded in fiscal 2024.

Boot Barn Holdings BOOT operates specialty retail stores in the United States and internationally, and carries a Zacks Rank #2 (Buy) at present. BOOT delivered a trailing four-quarter earnings surprise of 5.4%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Boot Barn Holdings’ current financial-year sales and earnings indicate growth of 16.2% and 20.5%, respectively, from the year-ago reported numbers.

American Eagle Outfitters AEO operates as a multi-brand specialty retailer in the United States and internationally, and currently carries a Zacks Rank #2. AEO delivered a trailing four-quarter earnings surprise of 30.3%, on average.

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year sales indicates a decline of 0.1% from the year-ago period reported number.

Stitch Fix, Inc. SFIX engages in the provision of clothing and accessories in the United States, and currently carries a Zacks Rank #2. SFIX delivered an average earnings surprise of 5.7% in the last four quarters.

The Zacks Consensus Estimate for Stitch Fix’s current financial-year sales indicates growth of 4.12% from the year-ago figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

American Eagle closing MA distribution center, laying off more than 100 workers

AEO

Worcester Telegram & Gazette

|

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite