|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

In the latest earnings cycle, Intuitive Surgical ISRG and Medtronic MDT delivered clear signals that the next era of medical technology leadership will be defined not only by financial performance but also by ambitious investments in robotics, intelligent systems and digital ecosystems.

ISRG remains the dominant force in soft-tissue robotic surgery, propelled by surging adoption of its new da Vinci 5 platform and hyper-growth from its Ion robotic-assisted bronchoscopy system. MDT, meanwhile, is staging a broad-based resurgence by pairing innovation with scale. The company’s accelerating pipeline, including its fast-rising PFA ablation franchise, long-awaited Symplicity renal denervation launch and the emerging Hugo soft-tissue robotics system, positions it as a formidable competitor across multiple high-growth categories.

While ISRG builds depth through robotics-specialized platforms, MDT advances a diversified strategy that links robotics with cardiology, hypertension, diabetes and digital procedural technologies. Together, the companies present rival visions for the future of minimally invasive, digitally enabled care.

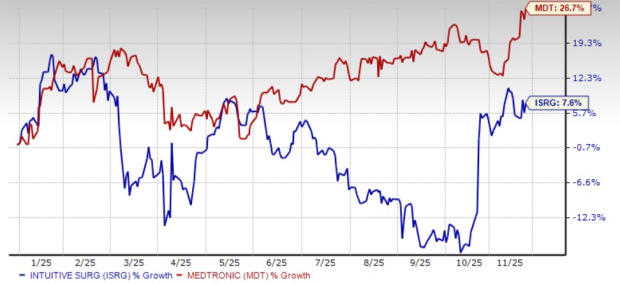

Year to date, shares of Intuitive Surgical and Medtronic have gained 7.6% and 26.7%, respectively.

Intuitive Surgical posted robust third-quarter 2025 results, marked by 23% revenue growth, 20% total procedure growth and 30% earnings per share (EPS) expansion. Performance was anchored by the continuing broad launch of the da Vinci 5 system, which drove high domestic demand and catalyzed fleet upgrades.

ISRG placed 427 da Vinci systems, including 240 da Vinci 5 units, as the installed base climbed to nearly 10,800 systems worldwide. System utilization increased across the portfolio, with 4% growth for multiport systems, 35% growth for the single-port platform and 14% growth for Ion.

International placements of da Vinci 5 in Japan and Europe further validated global enthusiasm for the platform. Enhanced software capabilities, including Force Feedback, telepresence tools, streamlined configuration management and AI-supported intraoperative visualization, strengthened the platform’s clinical and operational value. Early clinical studies on Force Feedback demonstrated meaningful reductions in peak force application during thoracic surgery, supporting ISRG’s argument that da Vinci 5 enables “gentler surgery” and greater surgeon precision.

Ion continued to emerge as one of ISRG’s fastest-growing businesses. Worldwide Ion procedures increased 52%, supported by a 30% expansion of the installed base and improvements in real-time AI navigation and tomosynthesis integration.

Clinical data presented in Europe showed more than a 60-percentage-point improvement in diagnostic yield compared to conventional bronchoscopy, reinforcing Ion’s value in early lung cancer detection and its potential to reshape diagnostic pathways. ISRG’s strategic priorities remain centered on expanding da Vinci 5 availability, scaling its industrial capacity, strengthening global training infrastructure and deepening digital tool adoption across its platforms.

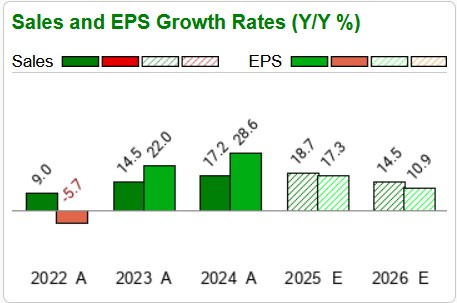

ISRG’s Earnings Growth Estimate

Medtronic’s second-quarter fiscal 2026 sales reflected 6.6% reported growth and 5.5% organic revenue growth. The company also raised its full-year guidance on the strength of accelerating enterprise-wide demand. The performance was geographically balanced, with mid-single-digit growth in the United States, Europe and China.

Gross margins improved 70 basis points on an operational basis, and adjusted EPS rose 8% to $1.36. MDT’s momentum is being driven in large part by its electrophysiology business, where its pulse-field ablation (PFA) franchise grew 71% — a dramatic acceleration that outpaced the broader market.

The installed base of Affera mapping systems doubled during the quarter, and Medtronic noted that new system installations often result in the company capturing the majority of AFib procedure share within those labs. Management reiterated expectations that the PFA business will double from its roughly $1 billion fiscal 2025 base.

Beyond electrophysiology, MDT advanced two major new U.S. product launches. Symplicity, its renal denervation therapy for hypertension, received a broad Medicare national coverage determination, and commercial payers have begun adopting it faster than anticipated.

With an addressable population of 18 million Americans, MDT views Symplicity as one of its largest long-term opportunities. Early momentum is also building for Altaviva, the company’s newly launched tibial nerve stimulation system for urinary urge incontinence. Physician training programs are oversubscribed, and consumer search activity has surged following early clinical publicity.

MDT’s presence in soft-tissue robotics is also strengthening as its Hugo platform moves closer to U.S. approval. Hugo is expected to receive FDA clearance for urology in the second half of the fiscal year, and MDT is expanding indications following positive international studies in hernia and gynecology.

Hugo’s modularity, open console design, integrated imaging, advanced instrumentation and seamless pairing with the Touch Surgery digital ecosystem illustrate a strategic push toward a robotics suite that supports both laparoscopic and robotic workflows. While still far behind da Vinci in scale, MDT is positioning Hugo as a versatile system tailored to hospitals seeking modular and digitally connected robotic solutions.

Across the broader enterprise, Medtronic delivered steady mid-single-digit growth in its Cardiovascular and Neuroscience franchises and saw rising demand in its diabetes business as new sensors such as Simplera Sync and Instinct gained traction. This diversified growth profile demonstrates MDT’s ability to pair innovation in robotics with strength in adjacent clinical domains, enabling multiple revenue engines to accelerate simultaneously.

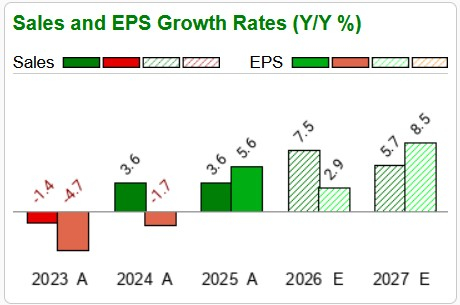

MDT’s Earnings Growth Estimate

Both ISRG and MDT are trading at forward 12-month price to earnings multiples of 59.4 and 17.08, respectively.

Ultimately, ISRG and MDT showcase two distinct but converging approaches to medical technology leadership. ISRG remains highly focused on deepening its robotics ecosystem, enhancing surgical precision, and driving platform utilization across da Vinci and Ion. MDT is executing a broad-based strategy that links robotics with cardiology, hypertension, neuromodulation and diabetes, giving it multiple catalysts to reaccelerate growth.

While ISRG maintains a clear lead in surgical robotics scale, MDT’s expanding pipeline and strengthening momentum suggest a competitive landscape that will become increasingly dynamic in the years ahead.

Although ISRG looks expensive than MDT in terms of valuation, the strong top and bottom-line growth makes it a better bet. Moreover, Intuitive Surgical sports a Zacks Rank #1 (Strong Buy) and Medtronic carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite