|

|

|

|

|||||

|

|

Navitas Semiconductor NVTS and Advanced Micro Devices AMD are both important players in the semiconductor industry, especially as the industry shifts toward artificial intelligence (AI)-driven computing. While Navitas Semiconductor focuses on Gallium nitride (GaN) and Silicon carbide (SiC) chips used in next-generation AI data centers and energy systems, Advanced Micro Devices is a leading provider of high-performance Central Processing Unit (CPU) and Graphics Processing Unit (GPU) that power AI training, inference, cloud computing, and advanced servers.

Both NVTS and AMD are heavily invested in the new generation of semiconductor chips that are used to power AI. However, from an investment point of view, one stock offers a more favorable outlook than the other right now. Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which stock offers a more compelling investment case.

Navitas Semiconductor is trying to reposition itself around high-power markets, and its inclusion in NVIDIA’s new 800-volt AI factory ecosystem is an important step. The new architecture shifts data center power distribution from traditional AC/DC stages to a high-voltage DC approach that requires faster, more efficient power electronics. This creates an opening for Navitas Semiconductor’s GaN and high-voltage SiC technologies, both of which are now part of the NVIDIA-led ecosystem.

In the third quarter of 2025, Navitas Semiconductor highlighted that it is one of the few companies offering both GaN and SiC solutions across the full power path, from the grid to the GPU. The company has begun sampling mid-voltage GaN devices at 100 volts, which target the last stage of power conversion inside AI servers. It is also sampling 2.3 kV and 3.3 kV SiC modules for grid and energy storage applications that support these new data center designs.

Moreover, the company is witnessing growing customer interest in its GaN and high-voltage SiC products, especially as hyperscalers and GPU vendors work on new power architectures for AI data centers. Navitas Semiconductor’s customers require faster development and deeper collaboration, where the company’s GaN and high-voltage SiC technologies will play a pivotal role to support these new-age AI architectures, driving the company to accelerate its shift to these fast-growing high-power markets.

The transition will take time. Navitas Semiconductor expects 2026 to show gradual quarter-over-quarter growth as high-power programs ramp. The bigger opportunity is expected in 2027, when new AI power designs begin volume adoption. The company also expects margins to improve as high-power products carry higher value and more predictable, multi-generation demand.

Advanced Micro Devices is seeing strong growth in its data center business. In the third quarter of 2025, the company reported record Data Center revenues of $4.3 billion, rising 22% year over year, helped by higher sales of EPYC server processors and Instinct MI350 GPUs. Demand for its EPYC server processors increased as more cloud providers and large companies are buying these CPUs to support AI workloads. Moreover, the management expects CPU demand to stay strong into 2026 because AI tasks need more general-purpose compute.

Advanced Micro Devices’ AI GPU business is also improving. The MI350 series is ramping well, and the next generation MI450 series is planned for launch in the second half of fiscal 2026. Advanced Micro Devices signed a large multi-year agreement with OpenAI to supply MI450 GPUs. This deal could generate well over $100 billion in revenues over the next few years.

Advanced Micro Devices is also improving its AI software. During the third quarter, the company launched ROCm 7, which offers faster training and inference performance. More developers are using ROCm, which helps the company compete better in AI workloads, which bodes well for the company’s prospects in the upcoming quarters.

However, Advanced Micro Devices has some near-term challenges. The embedded segment declined 8% year over year, and its operating margin dropped from 40% to 33% during the third quarter. Operating expenses increased 42%, mainly due to higher R&D spending on AI. AMD also did not include any MI308 GPU revenues from China in its fiscal fourth quarter outlook because the export licensing and demand environment remains uncertain. In addition, the company expects gaming revenues to fall sharply in the fourth quarter. These factors could limit the company’s overall growth.

For the full-year 2025, the Zacks Consensus Estimate for NVTS is pegged at a loss of 21 cents per share, which has narrowed by a penny over the past seven days. NVTS reported loss of 24 cents per share in 2024.

Navitas Semiconductor Corporation price-consensus-chart | Navitas Semiconductor Corporation Quote

For the full-year 2025, the Zacks Consensus Estimate for AMD’s earnings is pegged at $3.96 per share, revised downward by 5 cents over the past 30 days. AMD reported earnings per share of $3.31 in 2024.

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

The earnings estimate revision trend for the two companies reflects that analysts are turning more bullish toward NVTS.

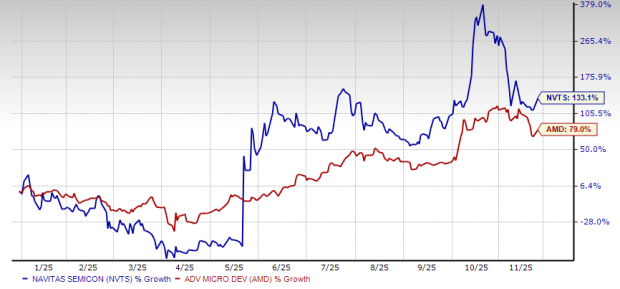

Year to date, Navitas Semiconductor shares have surged 133.1%, while Advanced Micro Devices shares have gained 79%.

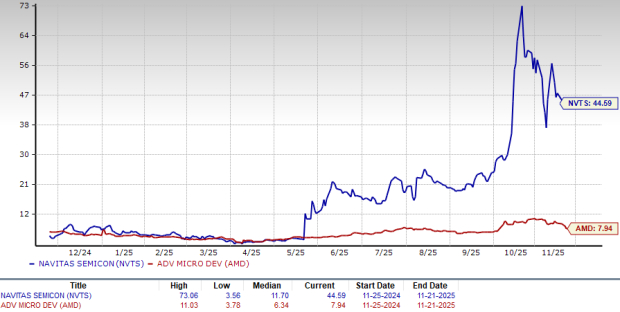

Currently, Advanced Micro Devices is trading at a forward sales multiple of 7.94X, lower than Navitas Semiconductor’s forward sales multiple of 44.59X. Navitas Semiconductor does seem pricey compared with Advanced Micro Devices. However, Navitas Semiconductor’s inclusion in the NVIDIA-led power ecosystem, improving financial performance, and upward earnings estimate revisions justify its higher valuations.

Navitas Semiconductor and Advanced Micro Devices both benefit from the growth in AI chips. Navitas Semiconductor is focused on GaN and SiC power chips that are needed for new AI data center power systems. The company is already part of NVIDIA’s new power ecosystem and has several high-power products that should ramp in 2026 and scale more in 2027. These products also support better margins over time.

Meanwhile, Advanced Micro Devices is growing in Data Center CPUs and AI GPUs, but it also has near-term challenges. The weakness in the Embedded business remains a major headwind for AMD. Moreover, rising costs and uncertainty around its China GPU revenues, along with lower Gaming revenue expectations for the fourth quarter, may hold back AMD’s overall results in the near term.

Navitas Semiconductor carries a Zacks Rank #2 (Buy), making it a clear winner over Advanced Micro Devices, which has a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Riot Rises On Activist Data Center Proposal, ARK Resumes Coinbase Buys

AMD

Investor's Business Daily

|

| 5 hours | |

| 6 hours | |

| 7 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite