|

|

|

|

|||||

|

|

Novo Nordisk NVO reported disappointing top-line data from the two-year primary analysis of two late-stage studies evaluating Rybelsus (oral semaglutide 14 mg) for early-stage symptomatic Alzheimer’s disease (AD). Shares of the company lost 5.6% on Monday in response to the news.

The phase III evoke and evoke+ studies evaluated the efficacy, safety, and tolerability of once-daily Rybelsus compared to placebo on top of standard of care in the AD patient population. The studies together enrolled 3,808 adults suffering from mild cognitive impairment or mild dementia due to AD with confirmed amyloid positivity, who were randomized equally into two groups receiving either Rybelsus or placebo for 156 weeks (104-week main treatment phase and 52-week extension).

Please note that Rybelsus is currently approved as the only oral GLP-1 therapy to be used alongside diet and exercise for improving blood sugar control in adults with type II diabetes (T2D). The drug’s label has been expanded in the United States and the EU to include cardiovascular (CV) risk reduction in adult T2D patients.

Per the data readout, Novo Nordisk’s phase III evoke and evoke+ studies failed to demonstrate clinical superiority of Rybelsus over placebo in the reduction of progression of AD, as measured by the change in the CDR-SB score at week 104, compared to baseline. Although treatment with Rybelsus improved AD-related biomarkers in both studies, these changes did not lead to a measurable slowing of disease progression.

The CDR scale is a research-standard tool that assesses cognitive and functional abilities in AD through interviews with patients and their care partners. The summary score (CDR-SB) is widely used in clinical studies to gauge disease severity and progression.

However, the drug was well tolerated and demonstrated an acceptable safety profile in the AD patient population in the phase III evoke and evoke+ studies, which was consistent with that observed in previous semaglutide studies.

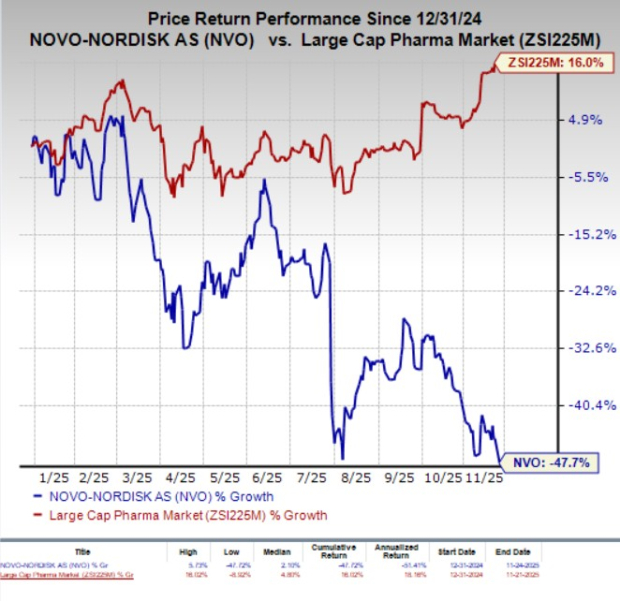

Year to date, shares of Novo Nordisk have plunged 47.7% against the industry’s 16% growth.

Based on the disappointing 104-week efficacy results observed in the overall study population, Novo Nordisk has decided to discontinue the 52-week extension period in the evoke and evoke+ studies. The company plans to present the top-line data at a medical conference in December, followed by full results from the evoke studies in 2026.

Per Novo Nordisk, AD is the leading cause of dementia, responsible for 60–80% of cases globally. Dementia refers to memory loss and cognitive decline severe enough to disrupt daily functioning. AD is a progressive condition, with symptoms that intensify over time and bring evolving challenges for patients and their care partners. There remains a substantial unmet need for therapies that can slow disease progression and lessen the overall impact on individuals, caregivers, and society.

Novo Nordisk also markets its semaglutide medicines as Ozempic and Wegovy injections for T2D and obesity indications, respectively. Wegovy’s label includes CV, HFpEF, liver, and osteoarthritis indications, while Ozempic remains the only GLP-1 approved to slow kidney disease and reduce CV death in patients with T2D.

NVO has filed a supplemental regulatory application in the United States seeking approval of a 25 mg oral formulation of semaglutide (Wegovy pill) for obesity and CV disease, which could become the first oral GLP-1 therapy for chronic weight management, if approved. A decision is expected later this year. Label expansion is also being sought for Ozempic in treating peripheral artery disease in the United States and the EU.

By broadening indications and introducing new formulations, Novo Nordisk is reinforcing semaglutide’s role as a cornerstone therapy across diabetes, obesity and cardiometabolic diseases, supporting long-term revenue expansion.

Novo Nordisk A/S price-consensus-chart | Novo Nordisk A/S Quote

Novo Nordisk currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the biotech sector include Arcutis Biotherapeutics ARQT, Editas Medicine EDIT and ADMA Biologics ADMA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Arcutis Biotherapeutics’ loss per share have narrowed from 44 cents to 24 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from 9 cents to 41 cents. Year to date, shares of ARQT have rallied 120.8%.

Arcutis Biotherapeutics’ earnings beat estimates in each of the trailing four quarters, the average surprise being 64.80%.

In the past 60 days, estimates for Editas Medicine’s loss per share have narrowed from $2.12 to $2.04 for 2025. During the same time, loss per share estimates for 2026 have widened from $1.02 to $1.05. Year to date, shares of EDIT have rallied 96.9%.

Editas Medicine’searnings beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average negative surprise of 13.17%.

In the past 60 days, estimates for ADMA Biologics’ earnings per share have increased from 57 cents to 58 cents for 2025. During the same time, earnings per share estimates for 2026 have improved from 88 cents to 90 cents. Year to date, shares of ADMA have lost 6.8%.

ADMA Biologics’ earnings beat estimates in one of the trailing four quarters, matched once and missed the same on the remaining two occasions, with the average negative surprise being 3.01%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 5 hours |

Novo Nordisk and Vivtex collaborate for oral medicines development

NVO

Pharmaceutical Business Review

|

| 11 hours | |

| 11 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite