|

|

|

|

|||||

|

|

AppLovin Corporation APP and Arm Holdings plc ARM stand out as two tech companies deeply intertwined with the accelerating adoption of artificial intelligence. While both firms operate in very different segments of the technology ecosystem, each has carved out a meaningful leadership position within AI.

AppLovin is using sophisticated machine learning systems to optimize advertising performance, app monetization and marketing automation. Arm, on the other hand, provides the architectural backbone for AI hardware, powering next-generation chips used across cloud, data center, mobile and edge computing. Their shared focus on AI-driven innovation makes both companies options for investors seeking exposure to transformative technologies reshaping global industry landscapes.

AppLovin has continued to ramp up its AI and automation initiatives as part of its long-term technology strategy. The company’s upcoming priorities revolve around improving advertiser onboarding, rolling out AI-based support tools, experimenting with generative AI for ad creation and advancing marketing efforts for its Axon Ads platform. These enhancements aim to streamline customer acquisition, improve campaign outcomes and attract a wider variety of advertisers outside the company’s traditional gaming-centric base.

These technological upgrades underscore AppLovin’s evolution from a gaming-heavy business into a broader and more sophisticated digital advertising platform. By integrating machine learning-driven insights with extensive user data, AppLovin is improving its ability to predict user behavior, fine-tune ad placement and increase advertiser return on investment. This not only boosts near-term operating metrics but also strengthens the company’s ability to deliver consistent, long-term revenue performance even when broader ad spending becomes volatile.

AppLovin’s disciplined approach and focus on optimizing advertiser performance highlight its ability to capture expanding market opportunities. The company’s overarching strategy centers on building scalable growth through continuous AI innovation. As the digital advertising ecosystem becomes increasingly automated and performance-driven, AppLovin appears well positioned to reinforce and extend its competitive advantage.

The company’s recently third-quarter report provides strong evidence of this momentum. Revenues rose to $1.41 billion, ahead of expectations and up 68% year over year. Adjusted EBITDA climbed 79% to $1.16 billion, representing an exceptionally strong 82% margin. Free cash flow surged 92% from the prior year to $1.05 billion, underscoring the efficiency and powerful cash-generation capabilities of the underlying business model. Nearly every incremental dollar of revenue has been translating directly into profit expansion, a sign of a highly optimized platform with tremendous scale advantages.

Growth continues to be supported by improvements in AppLovin’s ad-serving and monetization systems, particularly within the gaming ecosystem. MAX, the company’s supply-side platform, posted solid growth fueled by rising advertiser demand and increasingly effective campaigns. These results affirm that AppLovin remains a dominant presence in app-based advertising.

Arm Holdings continues to build momentum as its ecosystem expands and more companies adopt its architectural designs. A newly formed partnership with Meta aims to enhance AI efficiency across the entire compute spectrum, from wearables and mobile devices to large-scale data centers. Combining ARM’s expertise in energy-efficient architectures with Meta’s AI compute capabilities could yield significant improvements in performance, power consumption, and global usability.

Arm Holdings remains a critical technology partner for the world’s largest hyperscalers. NVIDIA’s Grace, AWS’ Graviton, Google’s Axion and Microsoft’s Cobalt are just a few of the major platforms built on Arm-based designs. These chips consistently show major improvements in energy efficiency and cost performance. Google’s Axion, for example, delivers up to 65% better price performance while reducing energy use by 60%, highlighting the growing importance of ARM’s contribution to modern computing.

Meanwhile, Arm Holdings’ Compute Subsystem (CSS) designs are fundamentally altering the chip development process, reducing both time-to-market and technical risk for manufacturers. New CSS licenses broaden the company’s reach across mobile, data center, and consumer devices. Major Android manufacturers have already begun shipping devices with CSS-powered chips, demonstrating the rapid adoption of this advanced technology.

Arm Holdings’ Lumex CSS platform, its most advanced mobile AI architecture yet, is set to power upcoming flagship devices from OPPO and vivo. The platform enables real-time translation, superior image processing and robust on-device AI capabilities, signaling ARM’s leadership in next-generation mobile compute.

Arm Holdings recently delivered its strongest second quarter ever, posting $1.14 billion in revenues, up 34% year over year and marking its third straight billion-dollar quarter. Operating income rose 43%, achieving a 41.1% margin. Non-GAAP EPS of 39 cents surpassed expectations, benefiting from both robust revenue growth and prudent expense management. These results reflect Arm’s increasingly central role in powering AI workloads across smartphones, servers, IoT devices and automotive applications.

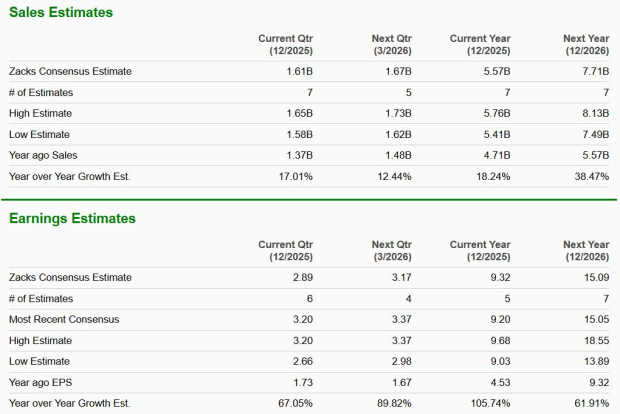

According to the Zacks Consensus Estimate, AppLovin is expected to achieve 18% revenue growth and a striking 106% increase in earnings this year. This points to meaningful operational leverage and significant profitability gains, driven by its AI-enhanced ad platform.

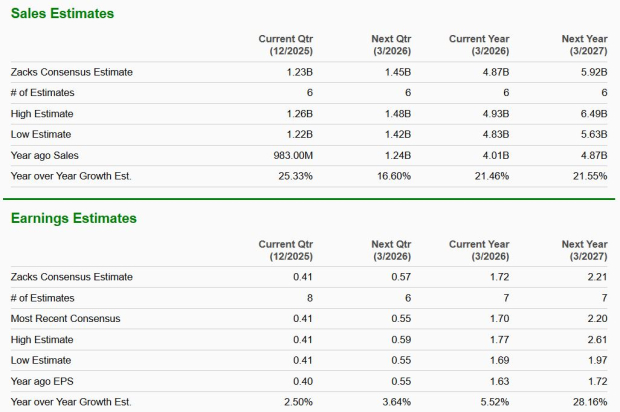

In contrast, ARM is projected to deliver 21.5% revenue growth but only a 5.5% increase in EPS, signaling more gradual earnings expansion as the company scales investments in AI chip design and licensing. While both companies benefit from powerful industry tailwinds, APP currently shows stronger earnings momentum, which could translate into more immediate upside potential.

ARM trades at a forward P/E of 65.71x, lower than its historical median of 123.45x, but still expensive. Its valuation reflects high expectations tied to its long-term AI and IoT opportunities. AppLovin, by comparison, trades at 38.55x forward earnings, only slightly below its median of 41.48x. With stronger earnings growth and accelerating operational efficiency, APP’s valuation looks comparatively more compelling.

For investors seeking near-term upside supported by strong profitability, AppLovin currently stands out as the more balanced and attractive buy. At the same time, Arm remains a powerful long-term play on global AI chip adoption.

Both AppLovin and ARM remain fundamentally strong, yet neither justifies moving beyond a prudent Zacks Rank #3 (Hold) at this stage. Still, if one must be identified as better positioned within a hold-rated framework, AppLovin edges ahead. Its improving earnings trajectory and rising operational efficiency suggest clearer room for valuation to realign with future performance. Arm Holdings continues to command a premium based on long-term demand and ecosystem strength, but that premium leaves less flexibility until earnings growth more visibly accelerates. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Therefore, AppLovin can be viewed as the relatively stronger contender in terms of potential valuation catch-up and expected earnings momentum.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 32 min | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite