|

|

|

|

|||||

|

|

Lithium Americas Corp. LAC and Albemarle Corporation ALB both engage in exploration, development, mining, processing and production of lithium. Albemarle is also a leading producer of highly-engineered specialty chemicals geared to meet customer requirements across a broad range of end markets, including petroleum refining, consumer electronics, energy storage, construction and automotive.

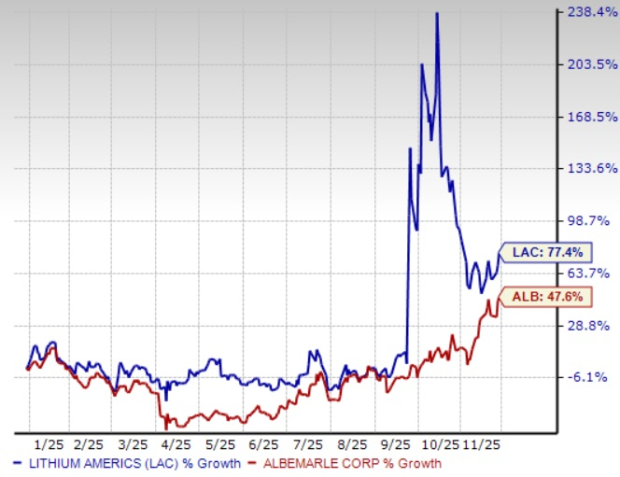

Year to date, Lithium Americas shares have risen 77.4%, and Albemarle shares have surged 47.6%. Let’s dig deeper into the fundamentals of both companies to discover their strengths and weaknesses.

Lithium Americas is developing the Thacker Pass lithium mine in northern Nevada, home to the world’s largest known measured lithium resource and reserve. The project is operated through a joint venture in which Lithium Americas holds a 62% stake and serves as project manager, while General Motors Company GM owns the remaining 38%. The company is working to bring Phase 1 of Thacker Pass into production and is aiming for a planned output of 40,000 tons per year of battery-grade lithium carbonate.

Construction at the Thacker Pass project is moving forward. The company expects to finish mechanical construction of the Phase 1 processing plant by late 2027. Engineering work was more than 80% complete as of Sept. 30, 2025, and is on track to exceed 90% by the end of the year. Completing detailed engineering early helps reduce risks related to the project’s schedule and budget.

The company has also signed purchase agreements for key long-lead equipment, infrastructure and services needed to build the processing plant, as well as for development and mining activities at Thacker Pass. As of Sept. 30, 2025, about $430 million was already committed.

However, Lithium Americas has yet to generate revenues from operations and relies on equity and other financings to fund operations. LAC’s omnibus waiver, consent and amendment (OWCA) loan agreement can limit its operational flexibility, constrain strategic decisions and force actions unfavorable for shareholders. While the OWCA enabled the first $435 million DOE loan advance, issuing required warrants and meeting ongoing conditions introduced financial, accounting and tax uncertainties.

Future loan draws depend on strict compliance with DOE requirements, and any failure could reduce available funding or trigger defaults, which could force immediate repayment and jeopardize the Thacker Pass project. Declining earnings estimates also cast a pall on the company's prospects.

Albemarle is strategically executing its projects aimed at boosting its global lithium conversion capacity. It remains focused on investing in high-return projects to drive productivity. Healthy customer demand, capacity expansion and plant productivity improvements are supporting its volumes.

ALB saw higher sales volumes in its Energy Storage unit in the third quarter of 2025 on record production from its integrated conversion facilities. The Salar yield improvement project in Chile has achieved a 50% operating rate. The ramp-up at the Meishan lithium conversion facility in China is also progressing ahead of schedule.

Moreover, Albemarle is taking aggressive cost-saving and productivity actions in the wake of tumbling lithium prices. The company expects to deliver roughly $450 million in cost and productivity improvements in 2025, having surpassed its initial target of $300-$400 million. ALB is taking actions to maintain its competitive position, including the initiation of a comprehensive review of cost and operating structure, optimization of the conversion network and reduction of capital expenditure. It has lowered the full-year 2025 capital expenditures outlook to around $600 million.

Albemarle remains committed to driving shareholder value by leveraging healthy cash flows and strong liquidity. At the end of the third quarter of 2025, ALB had liquidity of around $3.5 billion, including cash and cash equivalents of around $1.9 billion. Its operating cash flow was around $893.8 million for the first nine months of 2025, up 29% from the prior-year period. ALB expects to generate free cash flow of $300-$400 million in 2025, driven by strong cash conversion, lower capital spending and productivity measures.

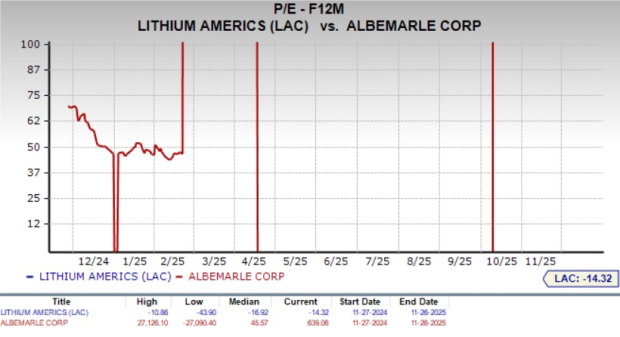

From a valuation standpoint, Lithium Americas is trading at a forward price-to-earnings (P/E) of negative 14.32X, closer to its mean of negative 16.52X over the last five years. ALB is trading at a forward P/E of 639.06X.

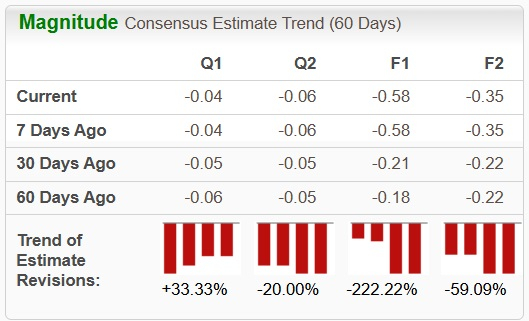

The Zacks Consensus Estimate for LAC’s 2025 EPS implies a year-over-year decline of 176.2%. The consensus estimate for loss for 2025 and 2026 has widened over the past 30 days.

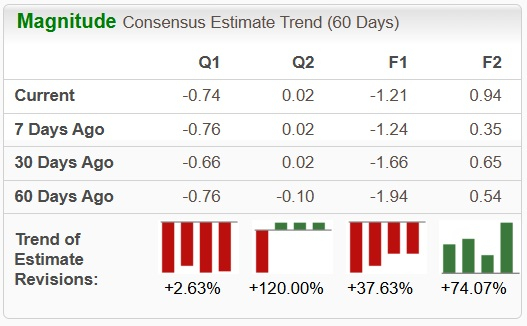

The Zacks Consensus Estimate for ALB’s 2025 EPS implies year-over-year growth of 48.3%. The loss per share estimates for 2025 have been narrowed over the past 30 days, whereas the EPS estimates for 2026 have increased.

While Lithium Americas holds a promising long-term asset in Thacker Pass, the project remains years away from production and continues to face funding, regulatory and execution risks. The company is still pre-revenue, dependent on external financing and constrained by loan conditions that could limit flexibility or jeopardize progress if unmet. The company has a negative EPS growth projection and widening loss estimates for 2025.

On the contrary, Albemarle is already a global leader in lithium and specialty chemicals, supported by established operations, rising production volumes and a diversified revenue base. Its strategic capacity expansions, aggressive cost-saving initiatives and stronger liquidity position provide resilience amid volatile lithium prices. Albemarle is also generating substantial operating and free cash flows and reinvesting them in growth while maintaining shareholder value. Its EPS estimates for 2025 suggest year-over-year growth.

Albemarle emerges as the stronger stock relative to Lithium Americas because it combines operational maturity with financial stability, advantages that LAC has yet to develop.

LAC & ALB both carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Mar-07 | |

| Mar-07 | |

| Mar-07 | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite