|

|

|

|

|||||

|

|

PVH Corporation PVH is likely to post a year-over-year decline in its bottom line when it reports third-quarter fiscal 2025 results on Dec. 3, after market close. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.3 billion, indicating growth of 0.6% from the prior-year number.

The Zacks Consensus Estimate for PVH’s fiscal third-quarter earnings remained unchanged in the past seven days at $2.56 per share. The consensus estimate indicates a decline of 15.5% year over year.

In the last reported quarter, the company delivered an earnings surprise of 27.92%. It has a trailing four-quarter earnings surprise of 12.30%, on average.

PVH Corp’s third-quarter fiscal 2025 results are likely to reflect the impacts of a challenging operating backdrop. PVH is grappling with a tough operating backdrop in the Asia-Pacific region, particularly in China, where macroeconomic headwinds continue to weigh heavily on consumer sentiment. Management acknowledged that consumer sentiment in China is still weak, and this softness is likely to have weighed on the fiscal third quarter performance.

At the same time, PVH continues to face gross margin pressure, largely tied to a more promotional global retail environment and heightened cost challenges. Management has highlighted that higher promotions, shipment mix effects, Calvin Klein product delays and increasing tariff impacts remain key drivers of gross margin compression heading into the fiscal third quarter. These pressures are expected to have persisted, with the company guiding for a gross margin decline of approximately 175 basis points (bps) year over year in the fiscal third quarter, including roughly 80 bps of unmitigated tariff impact. Elevated freight costs, selective pricing challenges and ongoing operational inefficiencies, particularly around the Calvin Klein global product setup, are likely to have further strained margins in the period.

On the last reported quarter’s earnings call, management projected that third-quarter fiscal 2025 sales will be flat to slightly up on a reported basis, though slightly down on a constant-currency basis. Adjusted earnings per share are expected to be $2.35-$2.50 compared with $3.03 in the year-ago period. This outlook incorporates an estimated 25 cents per share unfavorable unmitigated impact from tariffs currently in place on goods imported into the United States, partially offset by a 10 cents per share benefit from favorable foreign currency translation. Interest expense is expected to rise to $22 million, up from $16 million in the third quarter of fiscal 2024, reflecting the financing costs related to the company’s accelerated share repurchase agreements.

Despite these headwinds, PVH’s diversified global brand portfolio and the momentum behind its PVH+ Plan provide meaningful offsets. The strength of its two flagship brands, Calvin Klein and Tommy Hilfiger, remains evident in product innovation, improved DTC trends in key markets and highly successful global campaigns featuring Bad Bunny, Mingyu, and major cultural tie-ins such as the Tommy-Formula One collaboration. Positive forward-looking wholesale order books in Europe and sequential improvements in North America DTC traffic reinforce that the underlying brand health remains strong across regions. These factors position PVH to maintain top-line resiliency even in a challenging macro environment.

Our proven model does not conclusively predict an earnings beat for PVH Corp. this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here. You can uncover the best stocks before they're reported with our Earnings ESP Filter.

PVH Corp. has an Earnings ESP of -4.30% and a Zacks Rank #4 (Sell).

From a valuation perspective, PVH Corp.’s shares present an attractive opportunity, trading at a discount relative to historical and industry benchmarks. With a forward 12-month price-to-earnings ratio of 7.44X, below the five-year median of 8.30X and the Textile - Apparel industry’s average of 16.11X, the stock offers compelling value for investors seeking exposure to the sector.

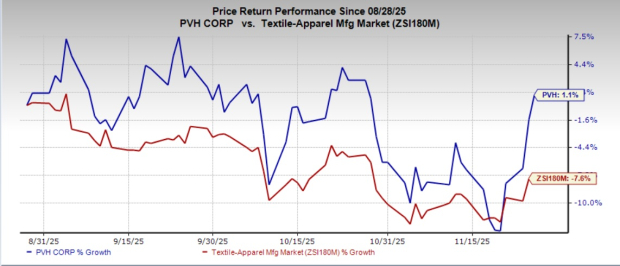

The recent market movements show that PVH’s shares have gained 1.1% in the past three months compared with the industry's 7.6% decline.

Here are some companies, which according to our model, have the right combination of elements to post an earnings beat this season:

Ulta Beauty, Inc. ULTA has an Earnings ESP of +1.20% and a Zacks Rank of 2 at present. The consensus estimate for Ulta Beauty’s third-quarter fiscal 2025 earnings is pegged at $4.48 per share, implying a decline of 13% from the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

For Ulta Beauty’s quarterly revenues, the consensus mark is pegged at $2.7 billion, which indicates an increase of 7.3% from the year-ago quarter. ULTA delivered a trailing four-quarter earnings surprise of 16.3%, on average.

Five Below, Inc. FIVE currently has an Earnings ESP of +74.71% and a Zacks Rank of 2. FIVE is likely to register a top-line increase when it reports third-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $969.9 million, indicating a 15% rise from the figure reported in the prior-year quarter.

The consensus estimate for Five Below’s earnings is pegged at 22 cents per share, implying a 47.6% decline from the year-ago quarter. FIVE delivered a trailing four-quarter earnings surprise of 50.5%, on average.

Dollar Tree Inc. DLTR currently has an Earnings ESP of +0.30% and a Zacks Rank of 3. The company is likely to register top and bottom-line declines when it reports third-quarter fiscal 2025 results. The consensus mark for DLTR’s quarterly revenues is pegged at $4.7 billion, which indicates a plunge of 37.3% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Dollar Tree’s earnings has moved up a penny in the past seven days to $1.09 per share. The consensus estimate indicates a drop of 2.7% from the year-ago quarter’s actual. DLTR delivered a negative trailing four-quarter earnings surprise of 27.5%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite