|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Both Ironwood Pharmaceuticals IRWD and Puma Biotechnology PBYI are small biotechs, concentrating on the successful commercialization of their respective products with the goal of establishing leadership in their respective areas. Both companies, having a market cap of less than $1 billion, remain highly dependent on their marketed products. Also, they have a limited pipeline and therefore focus on the successful development of the same to attract investors.

While Ironwood focuses on gastrointestinal (GI) disorders plus a pipeline targeting rare GI conditions, Puma Biotechnology is a cancer biotech focused on developing therapies targeting breast cancer and other tumor types.

Ironwood’s sole marketed drug, Linzess, is approved for the treatment of irritable bowel syndrome with constipation and functional constipation. Puma Biotechnology’s sole marketed product, Nerlynx, is approved for treating certain patients with breast cancer.

But which stock presents a better investment opportunity right now? Let’s dive into their fundamentals, growth outlook and potential challenges to make a well-informed comparison.

Ironwood’s top line primarily comprises revenues recorded through its collaborative arrangements with AbbVie ABBV related to the development and commercialization of Linzess in the United States.

The company markets Linzess in the United States in collaboration with AbbVie, while equally sharing Linzess’ brand collaboration profits and losses in the United States.

Linzess sales have picked up momentum in recent quarters. As reported by ABBV, in the third quarter, Linzess generated net sales of $314.9 million in the United States, up 40% year over year, reflecting strong demand. During the same time, Ironwood’s share of net profit from the sales of Linzess in the United States totaled $119.6 million, reflecting an increase of 35% year over year.

Looking ahead, sales are expected to grow steadily as Ironwood is looking to expand its commercial footprint and strengthen its marketing infrastructure, driving continued momentum for Linzess while focusing on improving demand. Owing to the strong performance of Linzess during the third quarter, Ironwood raised its full-year 2025 revenue guidance. The company now expects total revenues of $290-$310 million for 2025, up from its previous guidance of $260-$290 million.

Ironwood has apraglutide in its pipeline, a next-generation GLP-2 analog. It is being developed for treating patients with short bowel syndrome (“SBS”) with intestinal failure who are dependent on parenteral support (“PS”). Pending alignment with the FDA (anticipated later in the fourth quarter of 2025), IRWD expects to initiate a confirmatory phase III study in the first half of 2026 for apraglutide in patients with SBS who are dependent on PS.

However, the company’s heavy reliance on a single product for revenues and growth remains a concern. Also, in some recent quarters, Linzess sales have been negatively impacted by continued pricing pressure in the United States. Though sales have picked up momentum during the third quarter, we will have to wait for more sustainable growth in 2026.

Nerlynx is approved for treating early-stage HER2-positive breast cancer in patients previously treated with Herceptin-based adjuvant therapy. The drug is also approved in combination with Xeloda (capecitabine) for treating certain patients with advanced or metastatic HER2-positive breast cancer.

Nerlynx sales rose 2.4% on a year-over-year basis to $144.2 million in the first nine months of 2025. The company expects continued demand-driven growth in Nerlynx sales heading into 2026.

PBYI raised its full-year 2025 revenue guidance during the third quarter of 2025. The company now expects total revenues in the range of $220-$223 million compared with the previous expectation of $212–$222 million.

Importantly, Nerlynx’s product sales are now expected to be in the range of $198-$200 million compared with the earlier projection of $192-$198 million.

PBYI is developing its pipeline candidate, alisertib, an aurora kinase A inhibitor, in separate mid-stage studies for treating hormone receptor-positive breast cancer as well as small-cell lung cancer. Management believes that the successful development of the candidate is likely to enhance the company’s position in the anti-cancer drug market.

While the breast cancer market holds immense commercial potential, Puma Biotechnology’s heavy reliance on Nerlynx for its overall revenue growth makes the company vulnerable to any regulatory setbacks for the drug. Also, in some previous quarters, Nerlynx’s sales have suffered due to lower overall demand. Though sales are recovering, a similar instance in the future will hurt the company’s prospects. Stiff competition from other established players in the target market also remains a headwind.

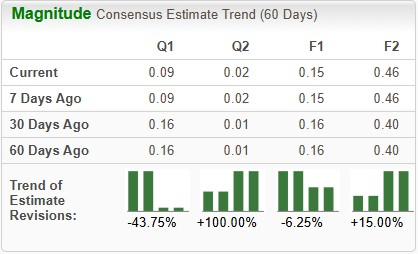

The Zacks Consensus Estimate for Ironwood’s 2025 sales implies a year-over-year decrease of around 14.5% while the same for earnings per share (EPS) implies a year-over-year increase of 275%. EPS estimates for 2025 have been trending down, while those for 2026 have been trending upward over the past 60 days.

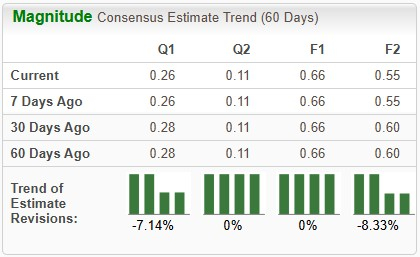

The Zacks Consensus Estimate for Puma Biotechnology’s 2025 EPS implies a year-over-year decrease of around 15%. While EPS estimates have remained stable for 2025, the same for 2026 have been trending down over the past 60 days.

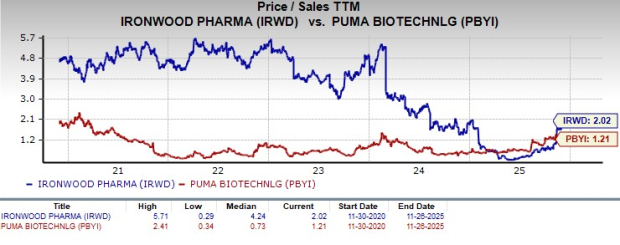

Year to date, shares of IRWD have declined 12.9%, while those of PBYI have surged 65.6%. In comparison, the industry has returned 8.3%, as seen in the chart below.

Ironwood looks more expensive than Puma Biotechnology, going by the price-to-sales (P/S) ratio. IRWD’s shares currently trade at 2.02 times trailing sales value, higher than 1.21 for PBYI.

Ironwood has a Zacks Rank #3 (Hold), while Puma Biotechnology currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

For investors seeking a small-cap biotech with steady earnings momentum and diversified growth potential, Ironwood looks like a better pick over Puma Biotechnology, based on the above discussion.

IRWD’s performance, which has picked up momentum now in 2025, reflects the company’s established revenue stream from Linzess sales. The upbeat guidance for 2025, reflecting increasing Linzess sales, presents an optimistic outlook. Analysts expect IRWD’s 2025 EPS to substantially rise on a year-over-year basis, highlighting its strong upside potential.

On the contrary, Puma Biotechnology’s high reliance on a single cancer drug, Nerlynx, for revenues is not a risk-free strategy. It underscores the company’s vulnerability to regulatory and competitive risks. Revenues can swing more sharply based on competition in the heavily crowded breast cancer market, clinical pipeline data, or regulatory shifts.

Despite a premium valuation, Ironwood’s recent developments with Linzess, promising pipeline progress and rising earnings estimates make it a preferable pick over Puma Biotechnology heading into 2026.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite