|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The Federal Reserve will hold its last FOMC (Federal Open Market Committee) meeting of 2025 on Dec. 9-10. Market participants are hopeful for a 25 basis-point cut in the benchmark lending rate next month. This will mark the third rate cut of 0.25% in 2025.

The CME FedWatch interest rate derivative tool currently shows an 84.7% probability of a 25-basis-point rate cut in December. This probability was as low as 42% last week. The existing Fed fund rate is in the range of 3.75-4%.

On Sept. 17, the Fed in its FOMC meeting decided on a much-hyped 25-basis-point cut in the benchmark lending rate to reduce it to the range of 4-4.25%. This is the first interest rate cut of this year. Moreover, the Fed’s dot-plot has shown two more rate cuts of 25 basis points each this year and one rate cut of 25 basis points in both 2026 and 2027.

The performance of the financial technology (fintech) space is inversely related to the movement of interest rates. A low-interest-rate regime will be beneficial for this space as a higher interest rate significantly affects technological improvement and product innovation of fintech companies.

Fintech's innovative nature positions it as a fascinating choice in the evolving financial landscape. With the expansion of mobile and broadband networks, fintech is poised for significant growth. The rise of artificial intelligence (AI) technologies and machine learning further revolutionizes banking, payments, and investments, offering efficient and secure financial solutions.

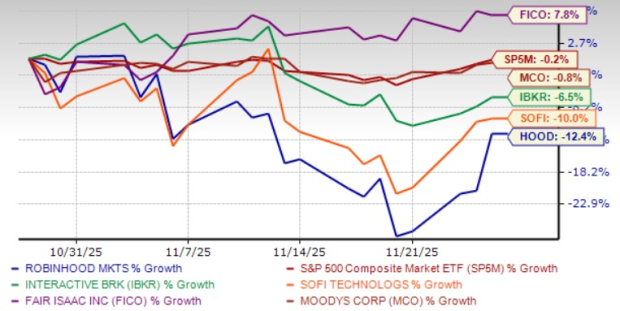

At this stage, we recommend investing in five financial technology bigwigs with a favorable Zacks Rank. These are: Robinhood Markets Inc. HOOD, Interactive Brokers Group Inc. IBKR, Fair Isaac Corp. FICO, SoFi Technologies Inc. SOFI and Moody's Corp. MCO. Each of our picks currently carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks in the past month.

Zacks Rank #1 Robinhood Markets operates a financial services platform in the United States that allows users to invest in stocks, exchange-traded funds, options, gold and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin and other cryptocurrencies using its Robinhood Crypto platform.

Given the higher retail participation in markets, HOOD’s trading revenues are expected to improve in the near future. Buyouts and product diversification efforts to become a leader in the active trader market will likely bolster its financials.

HOOD’s third-quarter 2025 results were aided by solid trading activity and growth in net interest revenues. HOOD’s vertical integration will likely enhance its product velocity. Further, a robust liquidity position will help HOOD to sustain share repurchases.

Robinhood Markets has an expected revenue and earnings growth rate of 21% and 16.2%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 8.6% over the last 30 days.

Zacks Rank #2 Interactive Brokers Group’s efforts to develop proprietary software, lower compensation expenses relative to net revenues, enhance its emerging market customers and global footprint, along with relatively high rates, are expected to continue aiding revenues.

IBKR’s third-quarter 2025 results reflected solid revenue growth and lower expenses. IBKR’s efforts to develop proprietary software and enhance its emerging market customers and global footprint, along with relatively high rates and lower compensation expenses relative to net revenues, are expected to support its top-line growth. IBKR’s initiatives to expand its product suite and the reach of its services will bolster its market share.

Interactive Brokers Group has an expected revenue and earnings growth rate of 5.5% and 8.1%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 1.8% in the last 30 days.

Fair Isaac is benefiting from strong financial performance driven by robust growth in its Scores and Software segments. FICO has expanded its scoring models to incorporate ‘Buy Now, Pay Later’ loan data, enhancing the predictive accuracy of FICO scores.

Advancements in credit modeling, including the development of FICO Score 10T for non-GSE mortgages, present significant growth opportunities. The Software segment has demonstrated strength, with increased adoption of SaaS and license revenues indicating strong platform engagement. FICO's Lenders Leading Inclusion Program supports lenders in making better decisions.

Fair Isaac has an expected revenue and earnings growth rate of 19.7% and 31.3%, respectively, for the current year (ending September 2026). The Zacks Consensus Estimate for current-year earnings has improved 10% in the last 60 days.

Zacks Rank #2 SoFi Technologies positions itself as a leader, leveraging its online banking services and the Galileo platform to expand its market presence. Lower interest rates provide a favorable environment for SOFI’s lending business, encouraging customer growth through competitive loan and refinancing options.

SOFI’s focus on innovation, including new product launches and strategic partnerships, bolsters its reputation as a forward-thinking competitor to traditional banks. SOFI provides various financial services in the United States, Latin America, and Canada. SOFI operates through three segments: Lending, Technology Platform, and Financial Services.

SoFi Technologies has an expected revenue and earnings growth rate of 25.5% and 65.1%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 5.3% in the last 30 days.

Zacks Rank #2 Moody's dominant position in the credit rating industry, along with opportunistic acquisitions and restructuring efforts to diversify revenues and footprint, will support top-line expansion.

MCO has been meaningfully growing through strategic acquisitions, increasing scale and cross-selling opportunities across products and vertical markets. In August 2025, it announced plans to secure a majority equity ownership in Middle East Rating & Investors Service. In June 2025, MCO fully acquired ICR Chile, solidifying its presence in Latin America’s domestic credit markets.

A solid rebound in bond issuance volume is expected to drive MCO’s growth. A strong balance sheet position and earnings strength are likely to keep MCO’s capital distributions sustainable.

Moody's has an expected revenue and earnings growth rate of 6.8% and 11.3%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 0.2% in the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 41 min | |

| Feb-20 | |

| Feb-20 |

Cathie Wood Sells More DraftKings. Goldman Cuts Robinhood Target Due To These Metrics.

HOOD

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Why Robinhood And Bloom Energy Show The Perils Of Investor Preconceptions

HOOD

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite