|

|

|

|

|||||

|

|

U.S. stock markets have continued their northward journey in 2025 following an impressive rally over the previous two years. Meanwhile, November saw mixed trading. The Dow and the S&P 500 Index gained 0.3% and 0.1%, respectively. However, the Nasdaq Composite fell 1.5%.

Volatility reappeared last month due to investors’ concerns about the sustainability of artificial intelligence (AI) trade. Wall Street’s rally in the past three years was solely driven by AI-centric stocks. Extremely overstretched valuation of this space makes market participants nervous regarding the space’s near-term return potential.

Nevertheless, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — have rallied 12.6%, 16.7% and 21.2%, respectively, year to date. This trend is likely to continue in December buoyed by another expected interest rate cut by the Fed.

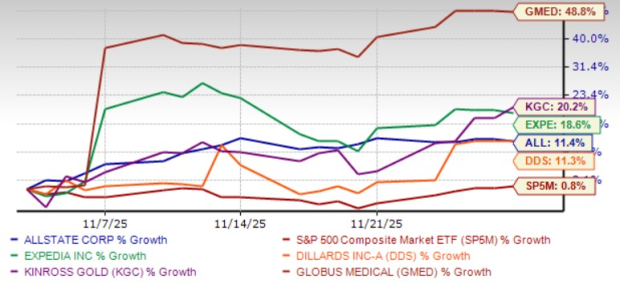

At this stage, it will be prudent to invest in stocks with a favorable Zacks Rank that have momentum in December. Five such stocks are: Expedia Group Inc. EXPE, The Allstate Corp. ALL, Dillard's Inc. DDS, Kinross Gold Corp. KGC and Globus Medical Inc. GMED. Each of our picks currently sports a Zacks Rank #1 (Strong Buy) and has a Zacks Momentum Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

The chart below shows the price performance of our five picks in the past month.

Expedia Group benefits from a strong platform model that enhances customer insights, strengthens supplier ties, and helps in revenue growth. EXPE’s diverse brand portfolio spanning major travel services enables it to target a broad range of global traveler needs, while boosting traffic and bookings.

A broad multi-product supply network, including lodging, airlines, rental cars, and cruises, positions EXPE well to capture demand in the growing leisure travel space. Strong liquidity, share buybacks, and dividends further highlight EXPE’s financial resilience.

Expedia Group has an expected revenue and earnings growth rate of 6.3% and 20.8%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 7.9% over the last 30 days.

The Allstate is witnessing consistent growth in premiums, thanks to strategic acquisitions and expanding ventures. ALL’s net premium earned rose 7.6% YoY in the first nine months of 2025. Its focus on optimizing core operations has allowed it to redirect resources toward high-growth areas. Cost-saving initiatives are projected to boost profits.

ALL’s Protection Services unit’s revenues benefited from the solid performance of Allstate Protection Plans and Arity. We expect the Protection Services unit’s revenues to rise 12.9% YoY in 2025. ALL’s cash-generating abilities are crucial for returning capital to its shareholders. ALL repurchased shares worth $805 million in the first nine months of 2025.

The Allstate has an expected revenue and earnings growth rate of 5.7% and -14.5%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 0.1% over the last seven days.

Dillard's is benefiting from its efforts to capture growth opportunities in brick-and-mortar stores and the e-commerce business, aiding in retaining existing customers and attracting new ones. DDS’ delivered steady growth in retail sales, with comps rising 1% year over year.

DDS is a leading player among fashion apparel, cosmetics and home furnishing retailers. The company offers a broad array of merchandise in its stores, featuring products from both national and exclusive brands. DDS’ strategy of providing fashion-forward and trendy products acts as a catalyst for attracting more customers.

Despite a challenging retail backdrop, DDS’ sales growth was supported by strength in juniors’, children’s apparel, ladies’ accessories, and lingerie. This reflects the company’s ability to drive category-specific momentum even as certain segments like home and furniture underperformed.

Dillard's has an expected revenue and earnings growth rate of 0.8% and -8.2%, respectively, for next year (ending January 2027). The Zacks Consensus Estimate for next year’s earnings has improved 3.6% over the last seven days.

Kinross Gold has a strong production profile and boasts a promising pipeline of exploration and development projects. These projects are expected to boost production and cash flow and deliver significant value. KGC is focusing on organic growth through its Tasiast mine, where the Phase One expansion boosted production capacity, and the Tasiast 24K expansion further increased throughput and production.

KGC’s Manh Choh project at Fort Knox is expected to extend operations and benefit from higher gold prices. The Great Bear project in Ontario also offers a promising long-term opportunity with substantial gold resources. Higher gold prices should also boost KGC’s profitability and drive cash flow generation.

Kinross Gold has an expected revenue and earnings growth rate of 6.3% and 32%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 7.9% over the last seven days.

Globus Medical’s Nevro acquisition is set to further solidify its position in the musculoskeletal space, with its differentiated technologies and expansion into new markets. Continued strength in the U.S. Spine business is encouraging.

GMED’s NuVasive merger boosts its top line. Strong industry trends, driven by a rising aging population and musculoskeletal disorders, are expected to spur demand for GMED’s core products. Its debt-free balance sheet bodes well. GMED’s expanding product portfolio and a strong pipeline, looks promising.

Globus Medical has an expected revenue and earnings growth rate of 7.2% and 11.3%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 10.2% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 4 hours | |

| 8 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite