|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Resmed Inc. RMD continues to see strong demand for its market-leading mask portfolio, including AirFit, AirTouch and other ranges. The company often relies on strategic acquisitions to strengthen its Residential Care Software business.Expansion efforts into international markets are also highly promising. Meanwhile, headwinds from macroeconomic challenges and intense competition raise concerns for Resmed’s operations.

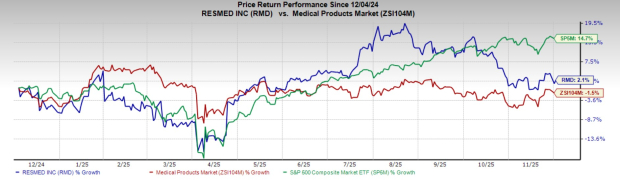

In the past year, this Zacks Rank #3 (Hold) stock has rallied 2.1% against the 1.5% decline of the industry and a 14.7% rise of the S&P 500 composite.

The renowned medical device company has a market capitalization of $36.25 billion. RMD has an earnings yield of 4.4% compared to the industry’s flat yield. Resmed’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 3.04%.

Let’s dive deep.

Robust Mask Sales: In the first quarter of fiscal 2026, revenues from Resmed’s Masks and other businesses grew 12% year over year across the United States, Canada and Latin America, reflecting continued growth in resupply and new patient setups. The newly acquired VirtuOx, an independent diagnostic testing facility (IDTF) for sleep, respiratory and cardiac conditions, also added incremental revenues.

Furthermore, the company is focused on continued strategic expansion of the mask portfolio with new product innovation while driving mask resupply through education, awareness and execution. Resmed recently rolled out two new variants under its AirTouch F30i mask platform, marking the first of their kind in the market. The F30i comfort made its debut in Australia, while the F30i Clear was introduced in U.S. markets. Both these products expand its AirTouch portfolio of fabric-based mask offerings.

Strategic Pacts to Boost Residential Care Software Business: The business is a key enabler of the company’s Sleep and Breathing Health business. Resmed tends to opt for strategic buyouts to boost Residential Care Softwarerevenues, such as the 2022 acquisition of MEDIFOX DAN and MatrixCare. In 2016, it strengthened its global leadership in connected healthcare solutions with the addition of Brightree.

In the first quarter of fiscal 2026, revenues grew 6% on a reported basis and 5% in constant currency, supported by strong performance from MEDIFOX DAN, core Brightree platforms, and good growth in the MatrixCare home health business. As part of the 2030 operating model, Resmed is integrating the revenue and product functions of its Residential Care Software business into the broader organization, building on the previous integration of RCS finance, human resources, cybersecurity and marketing functions and many more.

Increased Focus on International Markets: Resmed is expanding its presence in high-growth markets like China, South Korea, India, Brazil and Eastern Europe by implementing long-term strategies to improve the quality of patient life and reduce overall healthcare costs. Many countries’ national governments, including France, Japan and the United States, have adopted models and taken action to accelerate the adoption of digital health, leading to the rapid evolution of digital reimbursement models across the world. In the first quarter of fiscal 2026, combined sales in the United States, Canada and Latin America, as well as in Europe, Asia and other regions, increased 10%.

A Challenging Macroeconomic Scenario: Resmed’s operations remain exposed to global macroeconomic conditions, geopolitical instability, the impact of tariffs and trade wars on its suppliers and other factors. These factors can potentially lower demand for its products and prices, reduce reimbursement rates by third-party payers and raise operating costs. Furthermore, the global supply chain may be affected, mainly through constraints on or increased cost of acquiring raw materials and electronic components, resulting in higher costs. Fluctuations in foreign currency exchange rates and volatility in capital markets could continue to adversely affect the company’s results of operations.

A Competitive Landscape: The market for SDB products is highly competitive with respect to product price, features and reliability. Resmed's primary competitors include Philips BV, DeVilbiss Healthcare and regional manufacturers. The disparity between the company's resources and those of its competitors may increase due to consolidation in the healthcare industry. Moreover, some of Resmed's competitors are affiliates of its customers, which may make it difficult for the company to compete with them.

The Zacks Consensus Estimate for RMD’s fiscal 2026 earnings per share (EPS) has edged up 0.2% to $10.81 in the past 30 days.

The Zacks Consensus Estimate for the fiscal 2026 revenues is pegged at $5.57 billion, up 8.3% from the year-ago reported figure.

Some better-ranked stocks in the broader medical space are Globus Medical GMED, Boston Scientific BSX and Medtronic MDT.

Globus Medical has an estimated 2025 earnings growth rate of 18.1% compared with the industry’s 13.6% growth. Shares of the company have risen 9% against the industry’s 1.5% fall. GMED’s earnings surpassed estimates in three of the trailing four quarters and missed on one occasion, the average surprise being 16.24%.

GMED sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Boston Scientific, carrying a Zacks Rank #2 (Buy), has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.3%. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 7.36%. BSX shares have gained 13.2% compared with the industry’s 4.9% growth in the past year.

Medtronic, carrying a Zacks Rank #2, has an earnings yield of 5.4% compared to the industry’s flat growth. Shares of the company have rallied 19.6% against the industry’s 1.5% fall. MDT’s earnings outpaced estimates in each of the trailing four quarters, with the average surprise being 2.75%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite