|

|

|

|

|||||

|

|

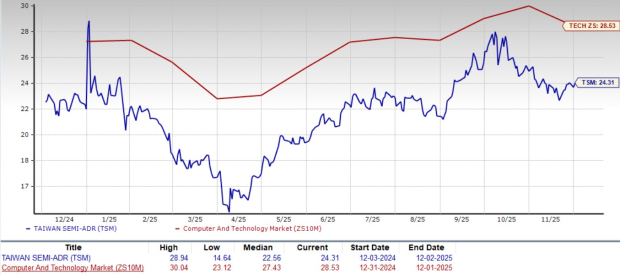

Taiwan Semiconductor Manufacturing Company TSM, also known as TSMC, stock looks attractive from a valuation perspective. TSM is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 24.31, significantly lower than the Zacks Computer and Technology sector’s average of 28.53.

Compared with other major semiconductor players, including Broadcom AVGO, Advanced Micro Devices AMD and NVIDIA NVDA, Taiwan Semiconductor stock is cheaper on a P/E basis. At present, Broadcom, Advanced Micro Devices and NVIDIA trade at P/E multiples of 41.11, 26.36 and 27.26, respectively.

Given TSM’s attractive valuation, investors might be wondering if they should buy, sell or hold the stock.

Taiwan Semiconductor continues to lead the global chip foundry market. Its scale and technology make it the first choice for companies driving the AI boom. NVIDIA, Marvell and Broadcom all count on TSMC to build advanced graphics processing units (GPUs) and AI accelerators.

AI-related chip sales have become a major driver. In 2024, AI-related revenues tripled, making up a mid-teen percentage of Taiwan Semiconductor’s total revenues, and the momentum is far from over. Management expects AI revenues to double again in 2025 and grow 40% annually over the next five years. That makes TSMC central to the AI supply chain.

To keep up with the growing demand for AI chips, Taiwan Semiconductor is spending aggressively. The company is set to invest between $40 billion and $42 billion in capital expenditures in 2025, far outpacing its $29.8 billion investment in 2024. The bulk of this spending, approximately 70%, is focused on advanced manufacturing processes, ensuring TSMC remains ahead of other chip manufacturing rivals.

Taiwan Semiconductor’s latest earnings report highlights just how dominant the company remains. In the third quarter of 2025, TSM’s revenues surged 41% year over year to $33.1 billion, while earnings per share (EPS) jumped 39% to $2.92. This growth was powered by the booming demand for its advanced 3nm and 5nm nodes, which now account for 60% of total wafer sales. Gross margins improved 170 basis points to 59.5%, reflecting better cost efficiencies.

Buoyed by strong demand for its 3nm and 5nm chips, Taiwan Semiconductor raised its revenue growth guidance for full-year 2025 to a mid-30% range from around 30% projected earlier. For the fourth quarter, TSMC expects revenues in the range of $32.2-$33.4 billion. The Zacks Consensus Estimate for fourth-quarter and full-year 2025 revenues is pegged at $32.6 billion and $120.47 billion, respectively. The consensus mark for the fourth quarter and full-year 2025 revenues indicates year-over-year growth of 21.3% and 33.7%, respectively.

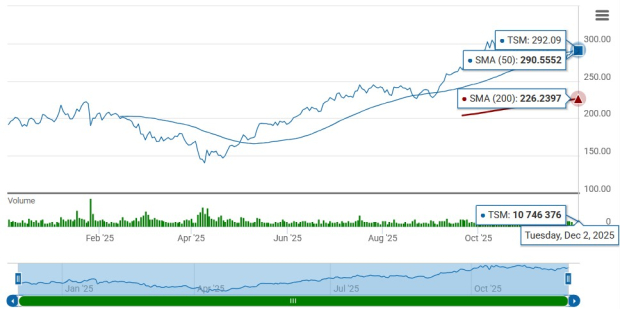

Taiwan Semiconductor shares are trading above their 50-day and 200-day moving averages, a bullish signal that could indicate further upward momentum in the short term.

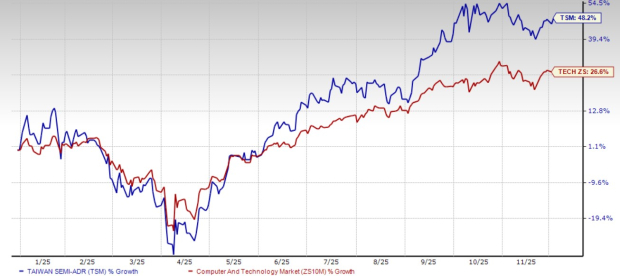

Taiwan Semiconductor has had a remarkable run so far this year, with its shares soaring 48.2% year to date. The stock is benefiting from the AI boom by manufacturing advanced chips for major AI clients like NVIDIA, Broadcom and Advanced Micro Devices, which has led to record profits and a significant increase in revenues.

Despite its strengths, Taiwan Semiconductor witnesses near-term hurdles. Softness in key markets like PCs and smartphones also dampens near-term prospects. These traditionally strong revenue drivers are projected to see only low single-digit growth in 2025, limiting Taiwan Semiconductor’s growth despite rising AI demand.

The company’s global expansion strategy adds further strain. New fabs in the United States (Arizona), Japan and Germany are vital for geopolitical risk mitigation, but they come with higher costs. These facilities are expected to drag down gross margins by 2-3 percentage points annually over the next three to five years due to higher labor and energy costs, along with lower utilization rates in the early stages.

Escalating geopolitical tensions, particularly U.S.-China relations, pose strategic risks. With significant revenue exposure to China, Taiwan Semiconductor is vulnerable to export restrictions, supply-chain disruptions or further regulatory pressure. These uncertainties could weigh on near-term performance.

Taiwan Semiconductor remains a cornerstone of the semiconductor industry. Its unmatched capabilities in advanced chip manufacturing, strong exposure to AI demand and expanding capacity give it a solid long-term trajectory.

However, short-term headwinds, including weakness across the consumer end market, global expansion pressures and geopolitical friction, call for a more cautious stance. Given its attractive valuation, favorable key technical indicators and growth projections, holding the stock makes the most sense right now.

Taiwan Semiconductor carries a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 min | |

| 29 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours |

Stock Market Today: Dow Skids As EU Makes Trump Tariff Move; These Gold Stocks Shine (Live Coverage)

NVDA

Investor's Business Daily

|

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite