|

|

|

|

|||||

|

|

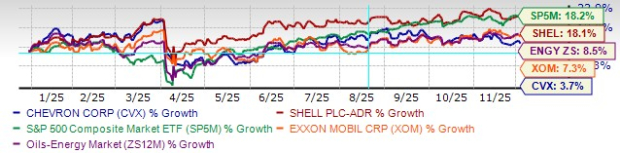

Chevron Corporation (CVX) has lagged the S&P 500, the broader Oil/Energy sector, and even Big Oil peers like ExxonMobil (XOM) and Shell (SHEL) so far this year, but a set of developing tailwinds — including improving commodity trends, rising production and strong shareholder returns — could help the stock close the gap.

With the Hess acquisition poised to strengthen growth visibility and upstream output robust across key basins, Chevron has a clear path to closing — and potentially erasing — its performance gap if broader market conditions cooperate. The company’s outlook for the rest of the year will largely depend on steady crude prices, timely execution on major projects, and investor confidence in cash flows following the deal.

From here, the most important variable for Chevron is — unsurprisingly — crude prices. The stock remains highly sensitive to global benchmarks, and a steady Brent range in the low $70s would give the company the breathing room it needs to convert its record production into more meaningful earnings traction. Investors will also be watching Asia closely, where a recovery in jet fuel and industrial fuel demand has been gradually improving realizations.

This matters because Chevron’s upstream profitability is still more exposed to price volatility than larger peers, such as ExxonMobil and Shell, whose diversified LNG portfolios and international refining footprints create additional buffers. If OPEC+ maintains discipline on supply cuts, that backdrop could help turn Chevron’s modest earnings momentum into something more durable.

If crude prices stay steady and demand remains firm, earnings revisions could finally turn meaningfully positive. Early hints of this are already visible. In the past month, the Zacks Consensus Estimate for Chevron’s 2025 EPS has risen from $7.24 to $7.45, with 2026 projections ticking higher as well.

Chevron’s production engine is running at one of its strongest levels in years. Third-quarter results showed a notable 21% year-over-year increase in total volumes, supported by both steady organic growth and the contribution from Hess. The Permian Basin continues to post efficiency gains, while output is also trending higher across the Gulf of America and Australia.

ExxonMobil and Shell have delivered healthy growth as well, but Chevron’s mix of high-return Permian activity and a widening international base gives it a particularly competitive edge. If operational uptime remains strong and new wells keep coming online smoothly, sequential production growth could become a consistent driver.

The successful ramp-up at Guyana’s Yellowtail and the FID approval for Hammerhead further strengthen Chevron’s high-margin portfolio, setting it apart from competitors like ExxonMobil and Shell in terms of forward-looking resource quality and production depth.

The Hess deal remains one of the most consequential strategic moves Chevron has made in years. The acquisition meaningfully expands the company’s long-term reserve base and strengthens its footprint in Guyana — arguably the most profitable offshore region in the world today. Early synergy realization has been encouraging, and Hess volumes added roughly 12% to Q3 output alone. The real test now revolves around integration milestones and the timing of synergy capture going ahead.

Some investors remain cautious, pointing out that major offshore integrations often face early bumps. Yet, the long-term potential is difficult to ignore. If the market gains confidence in post-deal cash generation — especially as Guyana projects move into later development stages — Chevron’s current valuation premium to peers like ExxonMobil and Shell could become easier to justify. Guyana may not transform results overnight, but it meaningfully extends Chevron’s production runway well into the 2030s, offering exactly the kind of visibility long-term holders value.

Chevron continues to lean on one of the strongest balance sheets in the global energy sector. With a debt-to-total capitalization of under 20% and nearly $8 billion in cash and cash equivalents, the company can support dividends, buybacks, and Hess-related spending without stressing its balance sheet. Management returned $6 billion to shareholders in Q3 alone — a mix of dividends and $2.6 billion in buybacks — and has signaled willingness to accelerate repurchases when commodity prices cooperate.

That’s a key differentiator. While ExxonMobil and Shell also maintain robust repurchase programs, Chevron’s balance-sheet flexibility gives it more room to lean into buybacks during softer oil environments. And with a dividend yield hovering in the 4.5% range, income-focused investors continue to see Chevron as one of the sector’s steadier return vehicles. The company’s payout ratio remains comfortable, and historic behavior suggests that management will defend the dividend even in periods of volatility.

Meanwhile, Chevron’s premium valuation leaves less room for error. The stock trades at roughly 18.7X forward price-to-earnings multiple, notably higher than Shell’s 11X and ExxonMobil’s 16X. This high price is especially striking because the Zacks Consensus Estimate predicts Chevron's actual profits will drop significantly — by 26% — in 2025, primarily due to lower liquid realizations. Chevron’s sensitivity to crude price swings also remains a significant risk.

Furthermore, the company faces immediate margin pressure from unexpected factors. Third-quarter earnings were reduced by severance and transaction costs tied to the Hess integration, and management has warned of substantial scheduled downtime in the final quarter of 2025.

However, recent positive EPS estimate revisions for 2025 and 2026 signal that analysts are beginning to factor in the quicker-than-expected Hess synergy capture and production ramp-up.

The combination of stabilizing oil prices, ongoing production momentum, and the long-term uplift from Hess gives Chevron a credible path forward, even if execution risks persist. In other words, Chevron — despite lagging the market and peers like ExxonMobil and Shell — has the ingredients to narrow the gap.

For now, though, Chevron is a Zacks Rank #3 (Hold) — a steady, income-friendly name with improving fundamentals but still dependent on crude stability. Investors should treat CVX as a high-quality name to own for the long run, but anticipate limited price appreciation until clear evidence of margin expansion appears.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 |

Warren Buffett's company invests in The New York Times 6 years after he sold all his newspapers

CVX

Associated Press Finance

|

| Feb-17 |

Berkshire Hathaway Takes Stake In New York Times, Cuts Apple, Amazon Holdings

CVX

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite