|

|

|

|

|||||

|

|

Shares of Carnival Corporation & plc CCL have declined 18.6% in the past three months compared with the Zacks Leisure and Recreation Services industry’s 14.3% fall and the Zacks Consumer Discretionary sector’s 8.3% dip. However, the S&P 500 rose 6.4% over the same timeframe.

Investor sentiment toward Carnival has softened in recent months as several company-specific headwinds have introduced greater uncertainty into the near-term outlook. Rising destination-related operating expenses, coupled with a step-up in planned dry-dock activity for 2026, have raised questions around the company’s ability to sustain margin progression. This, coupled with the anticipated yield drag from the Carnival Rewards launch, is adding to investor caution.

These factors have been compounded by renewed discussion around Caribbean capacity growth, as competitors add new hardware into the region and investors scrutinize Carnival’s pricing leverage across its Caribbean portfolio. Although the company’s longer-term earnings trajectory remains fundamentally constructive, the combination of elevated cost visibility and competitive uncertainty has likely contributed to recent volatility in CCL shares.

From a technical perspective, CCL stock is currently trading below its 50-day moving average, signaling a bearish trend.

Given the significant pullback in Carnival’s shares currently, investors might be tempted to snap up the stock. But is this the right time to buy CCL? Let’s find out.

Despite recent pressure on the stock, Carnival remains well-positioned to capitalize on resilient consumer demand and an increasingly disciplined commercial strategy as it approaches 2026. Management underscored continued strength in pricing across both North America and Europe, with nearly half of next year already booked at higher prices — the longest booking curve in company history. Momentum extends even further out, with 2027 bookings off to an unprecedented start, signaling durable demand and healthy consumer intent despite broader market volatility.

The company is simultaneously advancing a more sophisticated commercial framework designed to enhance yield quality and deepen guest engagement. Investments in revenue management, upgraded marketing capabilities and stronger brand-level accountability have begun to lift performance across all banners. Carnival stated that even historically lagging brands are now moving up the internal performance leaderboard, supported by sharper pricing discipline and refreshed product strategies. With booking and pricing gains broad-based across the fleet, the company is benefiting from a more aligned and data-driven go-to-market approach.

Carnival’s destination development strategy continues to differentiate the company meaningfully within the global cruise industry. Celebration Key, launched in July 2025, is performing in line with expectations and driving meaningful ticket premiums on itineraries that include the new private destination. The mid-2026 pier expansion at RelaxAway (Half Moon Cay) will likely further scale capacity and enhance product breadth, enabling CCL to deliver more than 8 million guest visits to its exclusive Caribbean destinations next year — nearly equal to the rest of the industry combined. These purpose-built assets enhance guest satisfaction, support yield expansion and serve as strategic levers in the company’s long-term competitive positioning.

While management acknowledged that 2026 will bring identifiable cost headwinds, these pressures are being proactively managed. The company emphasized brand-by-brand operating plan reviews to identify efficiency gains and offset inflationary factors, supported by ongoing scale initiatives. With leverage expected to move toward 3.5x early in fiscal 2026, Carnival is nearing the point where it can balance continued deleveraging with the resumption of capital returns. Against this backdrop, the company’s strengthened commercial engine, differentiated destination assets and resilient demand trends suggest a constructive long-term outlook for shareholders.

Analysts have been revising earnings per share (EPS) estimates for CCL upward for fiscal 2026. This trend aligns with the company’s robust fundamentals, underscoring expectations of continued growth and profitability. The Zacks Consensus Estimate for Carnival’s fiscal 2026 EPS has been revised upward, increasing from $2.38 to $2.40 over the past 60 days.

The company is likely to report solid earnings, with projections indicating a 10.8% rise in fiscal 2026. Conversely, industry players like Norwegian Cruise Line Holdings Ltd. NCLH, OneSpaWorld Holdings Limited OSW and Royal Caribbean Cruises Ltd. RCL are likely to witness an increase of 27.2%, 14.5% and 14.7% respectively, year over year in 2026 earnings.

CCL has shown impressive profitability, with a trailing 12-month return on equity of 27.86%, higher than the industry average of 27.17%. This metric suggests that the company is efficiently using shareholders’ funds to generate returns, which can be a positive sign for long-term investors.

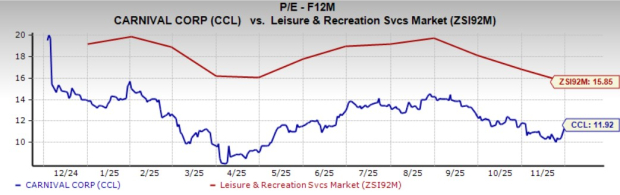

Carnival stock is currently trading at a discount. It is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 11.92, well below the industry average of 15.85, reflecting an attractive investment opportunity. Other industry players, such as Royal Caribbean, Norwegian Cruise and OneSpaWorld, have P/E ratios of 14.95, 7.06 and 17.37, respectively.

While Carnival’s recent pullback reflects a period of heightened caution, the company’s strengthening fundamentals point to meaningful upside potential ahead. Record booking curves for 2026, an unprecedented start to 2027, and broad-based pricing gains across North America and Europe continue to reinforce long-term earnings visibility. Additionally, the expansion of high-margin destination assets such as Celebration Key and RelaxAway is supporting yield momentum and enhancing Carnival’s competitive standing. These demand-driven tailwinds, combined with disciplined commercial execution and ongoing efficiency initiatives, position the company to navigate near-term cost pressures while sustaining its broader recovery trajectory.

Carnival’s improving leverage profile and upward earnings estimate revisions further reflect growing confidence in its operational and financial outlook. Yet despite this constructive backdrop, the stock continues to trade at a discount to peers, offering an appealing valuation opportunity for investors.

For investors seeking to capitalize on this disconnect, Carnival offers a compelling opportunity. The combination of robust underlying fundamentals, operational momentum and an appealing valuation backdrop makes the current pullback a timely entry point for those looking to participate in the company’s ongoing recovery and long-term value creation.

CCL stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite