|

|

|

|

|||||

|

|

As 2025 draws to a close, investors looking for the next frontier of exponential value creation should be turning their attention to pure-play quantum computing companies. D-Wave Quantum QBTS stands out as one of the most compelling choices. Its third-quarter 2025 earnings performance made one thing clear: quantum technology is moving from theory into real business use, with paying customers, real-world applications and growing revenues. D-Wave’s strong pipeline, rising demand for its annealing systems and progress toward its next-generation Advantage2 system show that the company is moving along a growth path similar to early-stage NVIDIA NVDA or Palantir PLTR.

This is the kind of moment when early investors often see the biggest long-term gains, before the rest of the market catches on. As we head into 2026, it is a great time for investors to learn about QBTS and consider getting in at the early phase of its journey, when the upside potential is at its highest.

p>

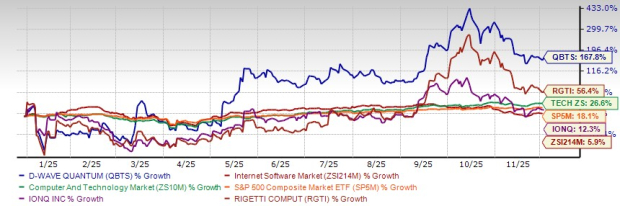

Year to date, shares of D-Wave have rallied 167.8%, outperforming the broader industry, sector and the S&P 500’s 5.9%, 26.6% and 18.1% growth, respectively. During this period, the company’s direct peers like Rigetti Computing RGTI and IonQ IONQ gained 56.4% and 12.3%, respectively.

QBTS’ core growth driver is accelerating commercial adoption of its annealing quantum platform, which is now delivering measurable value across logistics, manufacturing, financial services and defense. The third-quarter 2025 performance highlighted a significant rise in production-grade workloads, with many customers moving from exploratory proofs-of-concept (POCs) to multi-year commitments. Strong renewal rates, an expanding enterprise pipeline and recurring usage from long-term customers signal a shift from experimentation to predictable revenues. With its systems already deployed in real-world operations, D-Wave remains the only pure-play quantum company with commercial-scale annealing, which positions it for accelerating demand within this niche space.

The second major growth driver for D-Wave is its strong technology roadmap. The company has made steady progress on its next generation of annealing systems, which will offer more qubits, better connectivity and improved coherence. These upgrades will let customers solve bigger, more complex problems that have real commercial value. D-Wave is also improving its hybrid solvers, API tools and cloud access, making it easier for enterprises to start using and scale quantum workloads. Because the roadmap is tightly aligned with customer demand across optimization, machine learning and materials research, each technical advance feeds directly into revenue potential. With constant hardware advancements supported by strong software and integration tools, D-Wave remains the most commercially advanced player in annealing and is best positioned to deliver real business impact in the near term.

Despite its surging revenues, growing customer base and increasingly validated technology, QBTS still faces one clear stumbling block. Operating leverage remains elusive, with high operating expenses driving elevated adjusted EBITDA losses and masking progress on the commercial front. While system sales and QCaaS capacity have expanded meaningfully, the company’s cost structure—particularly R&D intensity tied to simultaneous annealing and gate-model development—continues to outpace near-term revenue scale, preventing the business from showing a visible path to sustainable profitability.

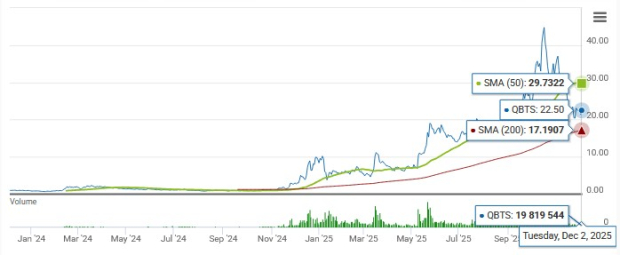

D-Wave Quantum trading below its 50-day moving average but above its 200-day moving average signals short-term weakness within a still-intact long-term uptrend. For investors, this means that though near-term momentum has cooled, the stock’s broader trend remains positive, showing ongoing institutional support.

D-Wave’s long-term story is compelling, marked by rapid commercial adoption, a differentiated annealing platform and a technology roadmap that could unlock substantial future value. The stock’s current setup suggests that investors may benefit from exercising patience. Despite rising customer traction, QBTS still lacks operating leverage, with costs climbing faster than revenues and shares trading below key technical levels. Until margins stabilize or the stock reclaims momentum, investors may be better served waiting for a cleaner entry point into this promising quantum play. D-Wave currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite