|

|

|

|

|||||

|

|

Stride, Inc. LRN is currently trading at a discount compared with the Schools industry peers and the broader Consumer Discretionary sector, with a forward 12-month price-to-earnings (P/E) ratio of 7.11. The industry’s average currently stands at 12.59, while the sector’s valuation is 18.65.

The discounted valuation of LRN stock is enticing for investors looking for a favorable entry point into exploring the education market. But the current ongoings with this education service provider are not promising, especially in the near term.

The hurdles from the technical glitches that started in August 2025 are concerning the company, even though they are working on fixing the issue to offer a better customer experience. Nonetheless, the mid and long-term prospects of Stride are indeed promising given its career learning offerings, besides K-12 programs and necessary AI integration. The company still sticks to its fiscal 2028 targets and aims to achieve them.

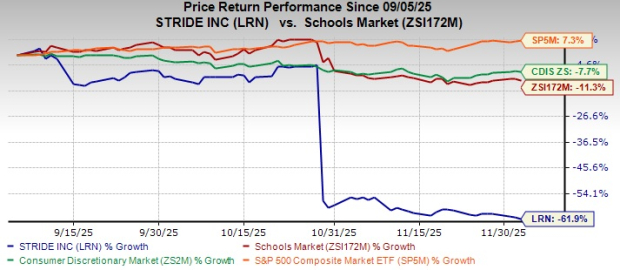

Shares of this Virginia-based education company have plunged 61.9% in the past three months, underperforming the industry, the broader sector and the S&P 500 Index.

Let us decode the positive and negative sides of the coin.

Focus on Career Learning: Apart from offering K-12 online school programs, this Virginia-based education company is expanding into hybrid and in-person options through a career learning platform for areas like healthcare, IT and advanced manufacturing. As the market is shifting from traditional school choices to more virtual and career-oriented options, the diversified offerings by the company fit perfectly into the puzzle.

Stride started fiscal 2026 strong, with its Career Learning segment’s revenues growing 16.3% year over year to $257.8 million in the first quarter. The enrollments in this segment also grew 20% during the quarter. This segment’s revenues outpaced the revenue growth for the General Education segment, which was 10.2% year over year in the first quarter of fiscal 2026. As policymakers push for educational models that better prepare students for modern careers, Stride’s hybrid infrastructure could serve as a blueprint for future schooling.

Affordable Offerings: Amid an inflationary economic scenario with ongoing challenges regarding affordability, Stride is working on providing its students with affordable learning options. The company is working on sculpting programs that meet the current market demand trends, as well as being affordable at the same time.

During the start of fiscal 2026, LRN rolled out free ELA tutoring for every second and third grader in its serving community. This program enables a child to work on reading, writing and communication skills. Moreover, regarding career-focused programs, Stride is also working on providing personalized career-forward and tech-enabled education programs at an affordable price.

Fiscal 2028 Goals: During the Investor Day in 2023, Stride shed light on its fiscal 2028 targets, including revenues expected between $2.7 billion and $3.3 billion (10% CAGR at mid-point), adjusted operating income projected between $415 million and $585 million (20% CAGR at mid-point) and earnings per share (EPS) to be between $6.15 and $8.35 (20% CAGR at mid-point). These expectations were laid out on the back of improving macro trends, new product investments and improving margins.

The structural shift in U.S. education as families seek career-aligned and skills-based pathways is boding well for LRN’s prospects amid near-term headwinds. As the company is heavily investing in career-focused high school and adult programs, alongside integrating AI and offering affordable learning options, its mid and long-term prospects seem promising. If execution improves as promised, the company still appears positioned to hit its 2028 targets.

Stable Liquidity Position: Despite facing near-term headwinds, LRN is working on maintaining a stable and sufficient liquidity position. As of Sept. 30, 2025, the company had cash and cash equivalents of $518.4 million, down from $782.5 million as of fiscal 2025. Although the cash position declined sequentially, it is sufficient to meet its long-term obligations worth $416.8 million.

Stride focuses on a balanced capital allocation approach, with excess being utilized across organic business enhancements, inorganic strategies and returning value to its shareholders.

At the start of August 2025, Stride started to witness withdrawals due to poor platform performance after its two technology platform rollouts, a front-end learning platform and a back-office platform. Issues regarding login and other platform-related glitches surfaced, which resulted in lower-than-expected conversion rates. The company’s approach of continuously investing in upgrading its learning and technology platforms is encouraging. However, the new upgrades did not go as planned, leading LRN to expect approximately 10,000-15,000 fewer enrollments in fiscal 2026, which could have been achieved without such disruptions.

The company is currently working on minimizing these technical issues and offering a seamless customer experience, but the entire process might take some time. The presence of these technical challenges is expected to pull back the enrollment growth in fiscal 2026, unlike previous years, as indicated by the management.

Stride occupies a hybrid competitive position in career learning and adult programs, but does face substantial competition from key market players, including Grand Canyon Education, Inc. LOPE, Strategic Education, Inc. STRA and Adtalem Global Education Inc. ATGE.

Grand Canyon competes with a campus-plus-online model that leverages brand strength, steep enrollment momentum and broad program arrays to capture adult learners seeking traditional degree pathways and continuing-education funnels. Moreover, its scale in enrollments and campus resources gives it a durable recruitment engine for career-oriented programs. On the other hand, Strategic Education emphasizes employer partnerships, scalable online platforms and verticalized workforce products, moving quickly into subscription and employer-funded models that shorten time-to-hire and increase measurable outcomes for adult learners.

Besides, Adtalem is more concentrated in healthcare and allied professions, pairing deep vocational program expertise with employer-aligned pipelines and emergent credentialing (including AI-for-healthcare initiatives) that make it a go-to for clinical workforce upskilling and high-touch credential markets.

Stride’s competitive advantage lies in cross-age platform scale and an increasingly diversified Career Learning portfolio that can bundle K-12 pathways into adult upskilling funnels, when compared with Grand Canyon, Strategic Education and Adtalem. However, durable edge will depend on fixing platform execution, deepening employer partnerships and proving placement and ROI at scale.

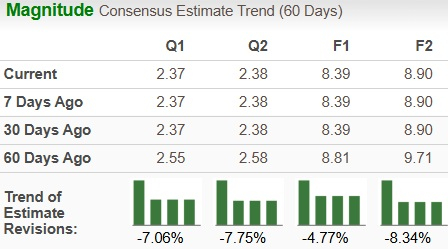

LRN’s earnings estimates for fiscal 2026 and fiscal 2027 have moved south over the past 60 days. The analysts’ expectations are likely to have been hurt by the ongoing in-house concerns and muted enrollment growth outlook hinted at by the company.

Nonetheless, the revised figures for fiscal 2026 and 2027 imply year-over-year improvements of 3.6% and 6.2%, respectively.

Stride presents a mixed investment outlook as its deeply discounted valuation offers an appealing entry point, yet it faces meaningful near-term operational setbacks. Investors remain concerned given the major technical failures in two newly launched platforms, which triggered login disruptions, lower conversion rates and an expected loss of 10,000-15,000 enrollments for fiscal 2026. These issues have pressured sentiment, leading to downward earnings estimate revisions and a weakened enrollment outlook.

However, the longer-term thesis remains intact as Stride continues to benefit from structural shifts toward hybrid, virtual and career-aligned learning models, with its Career Learning segment sustaining strong revenue and enrollment momentum. Affordable offerings and tech-enabled career programs further support LRN’s market positioning, while management remains committed to its fiscal 2028 revenue, margin and EPS targets.

Overall, while near-term execution risks justify caution, LRN stock’s discounted valuation and long-range growth strategy support its balanced but unproven opportunity. Thus, it is prudent for existing investors to hold onto this Zacks Rank #3 (Hold) stock for now. New investors are advised to wait for now and look for a better entry point when the near-term trends favor LRN stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite