|

|

|

|

|||||

|

|

Carnival Corporation & plc CCL is entering its next stage of operational recovery with a meaningfully stronger return profile, highlighted by return on invested capital (ROIC) reaching 13% in the third quarter of fiscal 2025 — its highest level since 2007. While booking momentum and destination upgrades continue to influence broader performance trends, the renewed efficiency of the company’s asset base is emerging as a central indicator of its medium-term value-creation potential.

Carnival attributed the improvement to stronger commercial execution and disciplined cost management. During the fiscal third quarter, same-ship yields rose 4.6% year over year, supported by healthy close-in demand and elevated onboard spending, while unit costs came in better than expected, driven by ongoing efficiency efforts. Management also highlighted that a majority of system capacity is now generating double-digit returns — already above the cost of capital — though still short of historical highs for several brands. This indicates additional room for ROIC expansion as modernization programs continue to roll through the fleet.

Carnival’s capital allocation strategy is reinforcing this momentum. The company reduced secured debt by nearly $2.5 billion and refinanced more than $11 billion of obligations at favorable rates. In fiscal 2025, CCL expects the net-debt-to-EBITDA ratio to be 3.6x, and anticipates a further decline in early fiscal 2026. With no new ship deliveries scheduled for 2026 and only one per year in the years that follow, the company expects a materially lighter capital-spending profile. This gives Carnival greater flexibility to continue lowering debt and strengthens the path toward eventually reinstating shareholder returns once its balance-sheet targets are met.

At the brand level, the majority of system capacity is now generating double-digit returns, though several brands still have room to close the gap with historical peaks. Initiatives such as AIDA’s multi-year Evolutions modernization program, Carnival Cruise Line’s upcoming marketing and loyalty enhancements, and continued destination-driven upgrades are expected to support further return accretion over the coming years.

With improving commercial execution, declining leverage and a pipeline of operational enhancements, Carnival appears to be building the foundation for a more sustainable, higher-return cycle heading into 2026.

Norwegian Cruise Line Holdings NCLH is sharpening its return profile through a combination of commercial upgrades, fleet optimization and cost discipline designed to lift ROIC over the next several years. To accelerate returns, NCLH is repositioning the NCL brand toward higher-occupancy short Caribbean itineraries, a shift already driving stronger Load Factors and better profitability per sailing. Investments in Great Stirrup Cay — including a new pier, pool complex and the upcoming Great Tides Water Park — are aimed at raising asset productivity and deepening onboard monetization. Commercial enhancements such as a revamped brand campaign, upgraded website and increasingly personalized pre-cruise offers are contributing to record pre-cruise revenues. These measures sit alongside a $300 million multi-year cost-savings program and the full elimination of secured debt, moves that likely lower NCLH’s cost of capital and provide clearer visibility on ROIC expansion as earnings compound.

Royal Caribbean Cruises Ltd. RCL is pursuing a more advanced return trajectory, guided by its long-term “Perfecta” framework, which targets high-teens ROIC by 2027. Management highlighted that years of sustained yield growth — now up more than 30% versus 2019 — combined with a disciplined cost approach, are positioning the company to deliver on that objective. To support sustained return accretion, RCL is leaning into a slate of high-ROIC assets, including the Icon-class ships, the upcoming Star of the Seas and Celebrity Xcel and a growing portfolio of exclusive destinations such as Royal Beach Club Paradise Island, Royal Beach Club Santorini and Perfect Day in Mexico. Technology and AI-driven commercial tools are further strengthening yield management and pre-cruise onboard sales. With leverage already below 3x and capital returns active through dividends and buybacks, RCL’s balance-sheet strength enables the company to fund high-return growth while still returning cash to its shareholders.

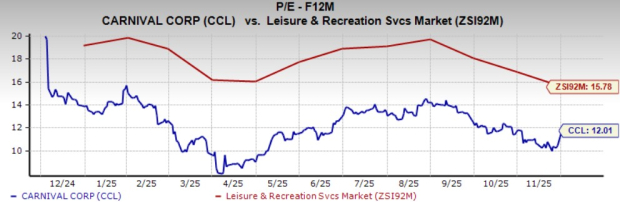

Shares of Carnival have declined 17.5% in the past three months compared with the industry’s fall of 13.8%.

From a valuation standpoint, CCL trades at a forward price-to-earnings ratio of 12.01, significantly below the industry’s average of 15.78.

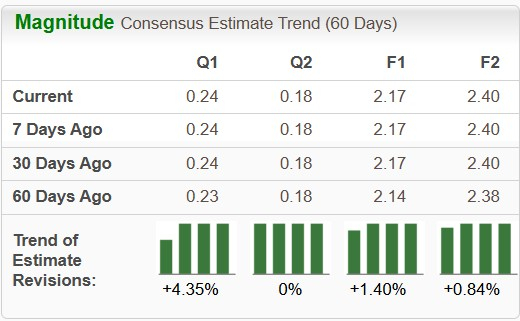

The Zacks Consensus Estimate for CCL’s fiscal 2025 and 2026 earnings implies a year-over-year uptick of 52.8% and 10.8%, respectively. The EPS estimates for fiscal 2025 and 2026 have increased in the past 60 days.

CCL stock currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow, Nasdaq Eke Out Gains; Gold, Silver Names Slide (Live Coverage)

NCLH +12.15%

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Norwegian Cruise Line Jumps On Activist Investor Stake, Turnaround Plans

RCL

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Stock Market Today: Nasdaq, Dow Climb; Airline Name Flies Higher (Live Coverage)

NCLH +12.15%

Investor's Business Daily

|

| Feb-17 |

Fiserv, Norwegian, Tripadvisor: Stocks Rally as Activists Take Aim

NCLH +12.15%

The Wall Street Journal

|

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite