|

|

|

|

|||||

|

|

Alexandria Real Estate Equities ARE recently resorted to a major dividend cut to boost its financial flexibility. The company announced the fourth-quarter 2025 dividend on its common stock of 72 cents per share, representing a 45% reduction from the prior paid dividend. The dividend will be paid out on Jan. 15, 2026, to its shareholders on record as of Dec. 31, 2025.

This comes amid a challenging life science environment hit by a series of market, regulatory, policy and global headwinds. Through the dividend cut, the company plans to strengthen its balance sheet, adding liquidity of around $410 million annually.

Shares of Alexandria slumped more than 10% at yesterday’s market closing time, reflecting shareholders’ concern about its prospects.

The current life science industry is being plagued by four critical pillars, under pressure due to the following reasons: NIH proposal to cap indirect grant costs at 15%, limiting access to critical funding for biomedical research institutions. The high cost of capital in the public markets limits the formation and growth of platform-based biotech companies. The leadership issues related to the FDA and significant employee turnover have resulted in broad regulatory uncertainty. The government’s push to drive down drug prices by curbing reimbursement on invested capital for innovative medicines.

Moreover, while the onset of the COVID pandemic led to a significant 7.5X surge in life science real estate availability since 2021, the demand for the same has declined by a whopping figure of more than 60%. This demand-supply imbalance is pressurizing occupancy owing to the slower lease-up of the development and redevelopment pipeline, and resulting in higher capital expenditure to lease up vacant spaces.

Alexandria has outlined a future path forward plan to overcome the current demanding scenario. The company aims to reduce its asset base size by disposing of non-core assets and focusing predominantly on the growth of megacampuses to increase occupancy and create value. ARE is targeting to achieve 90-95% of its annual rental revenues from megacampuses by the end of 2026.

The company aims to maintain sufficient liquidity and targeted leverage, reduce capital spending and funding needs. Alexandria plans to invest in its operating portfolio and highly leased near-term projects to drive occupancy and net operating income.

The company is actively managing the general and administrative expenses such that it can cumulatively save around $72 million for 2025 and 2026 compared with 2024. With the proceeds from asset dispositions, the company plans to buy back its outstanding shares, which represent a significant discount to the net asset value.

Alexandria’s 2026 guidance signals a challenging year ahead, with FFO per share projected at $6.25-$6.55, indicating a sharp pullback from 2025 levels. The outlook reflects pressure from expected occupancy declines into the high-80% range, sizable 2026 lease expirations, weak rental spreads and a notable drop in same-property NOI of 7.5-9.5%. Further, lower capitalized interest, higher interest expenses and reduced investment gains weigh on profitability. With these headwinds, management plans to rely heavily on roughly $2.9 billion of non-core asset sales to support its balance-sheet positioning and navigate the softer operating environment.

Alexandria’s dividend cut signals deeper structural pressures in the life science sector and mounting stress on its cash flows. While management’s shift toward megacampuses and cost controls may help over time, weak demand makes recovery uncertain. Industry headwinds, slower lease-up and reliance on asset sales leave limited near-term visibility, keeping the outlook tilted to the downside.

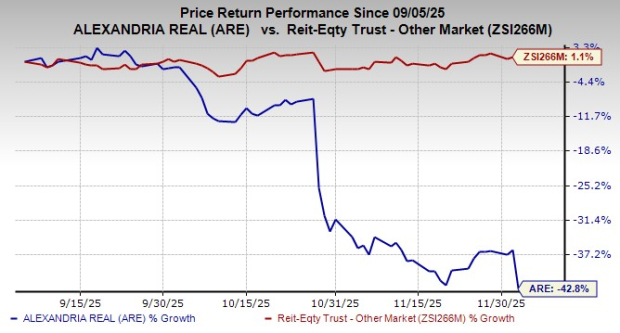

In the past three months, shares of this Zacks Rank #5 (Strong Sell) company have declined 42.8% against the industry's growth of 1.1%.

Some better-ranked stocks from the broader REIT sector are W.P. Carey WPC and Terreno Realty TRNO, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for WPC’s 2025 FFO per share has been moved northward marginally over the past week to $4.92.

The consensus estimate for TRNO’s 2025 FFO per share has been revised upward by 4.6% to $2.71 over the past month.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite