|

|

|

|

|||||

|

|

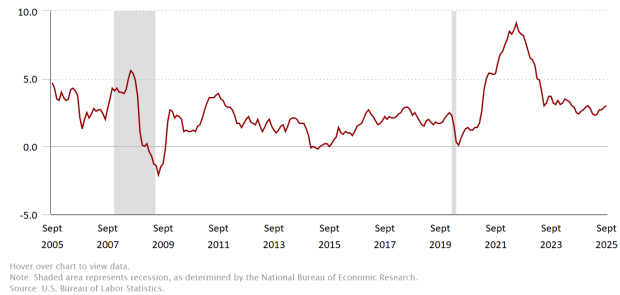

In the wake of U.S. President Donald Trump’s ‘Liberation Day’ reciprocal tariff rollout in April, stocks plummeted and many investors sold their stocks. In addition to the temporary market spook, the Trump Administration’s tariff policy triggered inflation fears, especially among left-leaning economists and market participants. For instance, in a November 2024 interview, former U.S. Treasury Secretary and famous economist Larry Summers stated that Trump’s economic plans would lead to a “a more inflationary policy by far than what happened under President Biden in 2021.” Recall that in 2022, CPI inflation spiked to 9%, marking the highest inflation rate in 40 years.

Thus far, the expected “3rd wave” of inflation has not occurred. The consumer price index (CPI) is hovering around 3%, right in line with historical norms.

Nevertheless, the adverse post-COVID inflation still lingers, and many consumers are struggling. Additionally, many analysts believe that there will be a delayed inflationary reaction to President Trump’s tariff policies.

Current U.S. Treasury Secretary Scott Bessent, a Wall Street legend known for helping George Soros to “break the Bank of England” and make a billion dollars in a single day, has a plan to combat inflation and spur economic growth. The U.S. will take a page from the late 1990s ‘productivity boom,’ when interest rates were low, inflation was under control, and innovation was front and center.

Regardless of where one stands on the inflation debate, one thing is certain – the Trump Administration has proven it will do whatever it can to spur AI-driven productivity growth to win the global AI race.

Already President Trump has appointed the first-ever ‘AI Czar’, removed cumbersome regulations, and unveiled the ‘AI Action Plan,’ a plan focused on accelerating innovation, building AI infrastructure, and leading in international diplomacy and security. Currently, Wall Street investors are infatuated with the first wave of AI: large language models such as ‘ChatGPT’ and ‘Gemini.’

However, earlier this week President Trump announced his plan to issue a robotics-specific executive order in 2026. Meanwhile, U.S. Commerce Secretary Howard Lutnick has been meeting with robotics CEOs to help accelerate the industry. Additionally, industry experts such as Advanced Micro Devices (AMD) CEO Lisa Su see ‘physical AI’ as the next long-term growth opportunity. Below are stocks from five key verticals to monitor as the next wave of AI emerges:

Humanoid/Industrial/Automation/Manufacturing Robots:

Tesla (TSLA), Honeywell International (HON), Teradyne (TER), UiPath (PATH).

Drone/Defense:

Ondas Holdings (ONDS), Unusual Machines (UMAC)

Delivery/Logistics:

Serve Robotics (SERV).

Consumer:

iRobot (IRBT).

Robotics Industry:

VanEck Robotics ETF (IBOT).

Bottom Line

Policymakers are determined to drive productivity through AI and robotics. Although many investors are hyper-focused on LLMs, they would be wise to shift some attention to the coming robotics revolution.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 18 min | |

| 31 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite