|

|

|

|

|||||

|

|

European carrier, Ryanair Holdings RYAAY, has unveiled its raised traffic outlook for fiscal 2026, concurrent with its second-quarter fiscal 2026 earnings release on Nov. 3, 2025. As we know, higher traffic means more passengers and with travel bookings rising across the industry, passenger revenues at Ryanair should also increase, thereby contributing to the company’s top-line growth.

A raised guidance always acts as a positive indicator of the company’s prospects. Given this backdrop, the question that naturally arises is: Should investors buy, hold, or sell RYAAY stock now? A more in-depth analysis is needed to make that determination. Before diving into RYAAY’s investment prospects, let’s take a glance at its financial numbers.

Ryanair now expects its fiscal 2026 traffic to grow by more than 3% to 207 million passengers (prior view: 206 million), owing to earlier than expected Boeing (BA) deliveries and solid demand during the first half of fiscal 2026. Unit costs performed well in the first half of fiscal 2026 and, as previously guided, RYAAY anticipates only modest unit cost inflation during fiscal 2026 as B-8200 deliveries, fuel hedging and effective cost control help offset increased air traffic control (ATC) charges, higher environmental costs and the roll-off of last year’s modest delivery delay compensation.

Although forward bookings of the third quarter of fiscal 2026 are slightly ahead of the previous year, especially across the October mid-term and Christmas peaks, RYAAY prefers to stay cautious during the second half of fiscal 2026. The third-quarter fare outcome will be determined by close-in Christmas and New Year bookings.

RYAAY is not providing any profit after tax guidance for fiscal 2026. However, the company is hopeful of recovering all of last year’s 7% full-year fare decline, which should lead to reasonable net profit growth in fiscal 2026. The final fiscal 2026 outcome remains exposed to adverse external developments, which include conflict escalation in Ukraine and the Middle East, macro-economic shocks, and any further impact of repeated European ATC strikes & mismanagement.

With travel bookings rising across the industry, Ryanair’s passenger revenues are also increasing. Because of this air-travel demand strength, RYAAY's traffic grew 9% to 183.7 million passengers in fiscal 2024. Further, we would like to remind investors that Ryanair carried 200.2 million passengers (traffic up 9% year over year) in its fiscal year ending March 2025, positioning itself as the first European airline to reach 200 million passengers in a single year. As a result, RYAAY is now the world’s leading low-fare airline in terms of passenger traffic, with low fares and reduced costs acting as the primary catalyst. During the first half of fiscal 2026, RYAAY’s traffic grew 3% year over year to 119 million passengers.

Ryanair’s fleet-modernization initiatives to cater to the improvement in travel demand are encouraging. The inclusion of modern planes in its fleet and the retirement of the old ones align with its environmentally friendly approach. Between March 1999 and March 2025, Ryanair took delivery of 532 Boeing 737NG aircraft, one Boeing 737-700 aircraft and 176 new Boeing 737-8200s under its contracts with Boeing and disposed of 122 Boeing 737NG aircraft, including 77 lease hand-backs. During fiscal 2025, Ryanair took delivery of 30 new Boeing 737-8200 aircraft. The latest inclusions, apart from having all basic amenities, result in improved fuel efficiency.

As of the end of October 2025, 204 of the 210 Boeing 737-8200 aircraft (to be purchased under the 2014 contract) had been delivered. The remaining six aircraft are expected to be delivered ahead of the summer season of fiscal 2026, which encourages the company to expect 4% traffic growth to 215 million passengers during fiscal 2027.

In May 2023, 300 new Boeing 737-MAX-10 aircraft orders were placed for delivery between 2027 and 2033. Ryanair expects these fuel-efficient MAX jets to generate substantial growth.

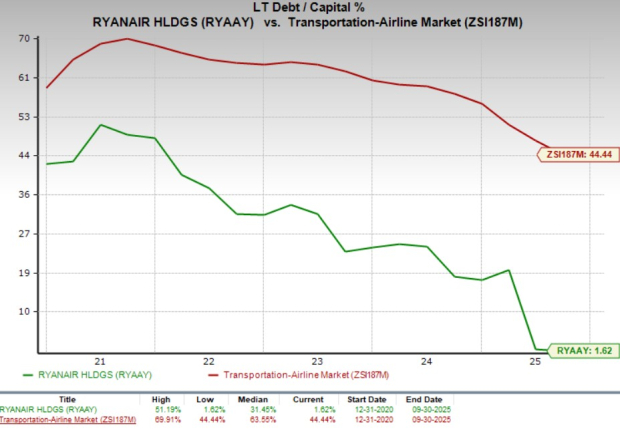

RYAAY has a solid balance sheet. The low-cost carrier ended second-quarter fiscal 2026 with cash and cash equivalents of $3.58 billion, much higher than the current debt level of $1.40 billion. This implies that the company has sufficient cash to meet its current debt obligations. RYAAY's efforts to repay its debts are encouraging as well. As of Sept. 30, 2025, RYAAY made €1.2 billion in debt repayments.

RYAAY is also active on the share buyback front. During fiscal 2025, Ryanair purchased and canceled 7% of its issued share capital, comprising more than 77 million shares, and has now retired almost 36% of its issued share capital since 2008. In April 2025, RYAAY repurchased nearly 1 million shares, completing the €800 million share buyback program. In May 2025, RYAAY’s board approved a follow-on €750 million share buyback program. As of Sept. 30, 2025, RYAAY had purchased (and canceled) more than 7 million shares (almost 25% of the programme) for €188 million.

Shares of RYAAY have had a good time on the bourses of late, improving in double digits so far this year. The encouraging price performance resulted in RYAAY outperforming the Zacks Airline industry in the said time frame. Additionally, RYAAY’s price performance is favorable to that of other airline operators like Alaska Air Group, Inc. (ALK) and Allegiant Travel Company (ALGT) in the same timeframe.

Production delays at Boeing have been hurting the fleet-related plans of most airline companies, and it is no different for RYAAY. RYAAY is actively in talks with Boeing leadership to speed up aircraft deliveries and has also visited Seattle at the beginning of January. Although B737 production is recovering from Boeing’s strike in late 2024, it is still slow to deliver sufficient aircraft ahead of the summer season of fiscal 2026.

RYAAY anticipates the remaining six Gamechangers of the 210 orderbook are likely to be delivered before the summer of 2026. Additionally, Boeing expects the MAX-10 to be certified in mid-2026, followed by the delivery of the first 15 MAX-10s in Spring 2027 (with 300 of these fuel-efficient aircraft delivery due by March 2034).

Escalating operating expenses due to high staff costs and higher air traffic control fees are hurting Ryanair’s bottom line. During the first half of fiscal 2026, staff costs increased 3% year over year due to higher sectors and agreed pay increases. Airport and handling charges rose 4% year over year owing to traffic growth, higher landing, ground air traffic control, and handling rates. As a result, total operating expenses grew 4% year over year, owing to higher staff and other costs, which were in part due to Boeing delivery delays. This was partially offset by fuel hedge savings. High costs naturally put pressure on margins.

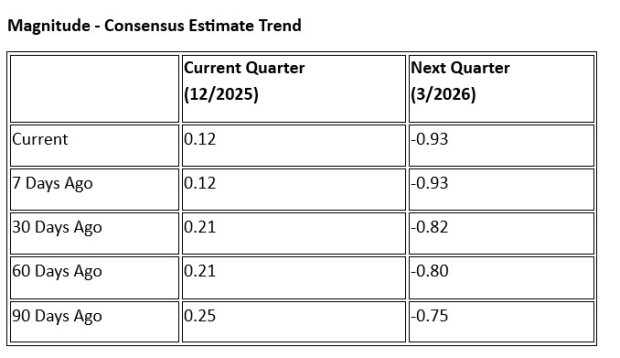

Given these headwinds surrounding the stock, earnings estimates have been southbound, as shown below.

It is understood that RYAAY's top line continues to benefit from the resurgent travel scenario. RYAAY’s raised traffic outlook for fiscal 2026 is an encouraging move, which is likely to impress investors. RYAAY’s measures to expand its fleet, to cater to the rising travel demand, look encouraging. A solid balance sheet allows RYAAY to reward its shareholders in the form of share buybacks and dividend payments. Despite these positives, we advise investors not to buy RYAAY shares now due to headwinds like the production delays at Boeing, high staff costs and escalated air traffic control fees.

We advise investors to wait for a better entry point. For those who already own the stock, it will be prudent to stay invested. The company’s current Zacks Rank #3 (Hold) justifies our analysis. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite