|

|

|

|

|||||

|

|

Lockheed Martin’s LMT shares have lost 6% over the past six months, underperforming the Zacks Aerospace-Defense industry’s growth of 3.3%. The company is under pressure from shortage of skilled labor while also absorbing major losses across multiple fixed-price and classified programs. However, LMT’s major contract wins and a solid backlog underscore its solid long-term revenue and growth outlook.

Other defense stocks, such as Northrop Grumman NOC, have outperformed, while The Boeing Company BA has underperformed during the same period. Shares of Northrop Grumman have risen 11.7% while those of Boeing have declined 7.2% during the same time frame.

Let's examine the factors and assess the stock's investment prospects to make an informed decision.

Lockheed Martin is one of the largest U.S. defense contractors with a platform-centric focus that guarantees a steady inflow of follow-on orders from a leveraged presence in the Army, Air Force, Navy and IT program. Lockheed Martin continued to secure major defense contracts in third quarter of 2025, including a $10.9 billion CH-53K helicopter deal, a $9.8 billion PAC-3 MSE interceptor order, and a $720 million JAGM/Hellfire missile contract.

These wins helped boost its backlog to $179.1 billion as of Sept. 28, 2025. The company expects to recognize approximately 36% of its backlog over the next 12 months and approximately 61% over the next 24 months. Such a consistent level of contract flows and subsequent backlog count bolster its long-term revenue prospects.

The company's long-term growth potential is also supported by a strong and consistent order flow as well as several programs entering growth phases, including F-35 sustainment, increased PAC-3 production, expanding HIMARS and GMLRS demand, radar systems, CH-53K helicopters and enhancements to the Trident II D5 missile.

In December 2025, Lockheed Martin opened a Hypersonics System Integration Lab at its Huntsville campus. This strengthens its position in the fast-growing hypersonic weapons market by accelerating development, testing, and integration of advanced systems. The lab also supports long-term growth by expanding the company’s ability to deliver next-generation hypersonic capabilities and strengthening the company's position as a top supplier in a high-priority defense market.

During the same month, Lockheed Martin, with Blackshark.ai, unveiled Prepar3D® Fuse, a next???generation simulation solution. This enhances the company’s training and simulation capabilities by delivering highly realistic, artificial intelligence-generated terrain, real-time graphics, and advanced sensor and weather modeling.

Lockheed Martin faces significant operational and financial pressures caused by workforce shortages and substantial program losses. The aerospace-defense industry is confronting an aging workforce and high early-career attrition, creating risks of retiring expertise and difficulty retaining younger engineering and manufacturing talent. These labor challenges compound performance issues across multiple fixed-price and classified programs.

The company experienced performance issues on a classified fixed-price incentive fee contract in its Aeronautics business segment and periodically recognized reach-forward losses. During the first nine months of 2025, the company recorded losses of $950 million on this program. It also reported losses of $570 million on the Canadian Maritime Helicopter Program, $95 million on the Turkish Utility Helicopter Program at its RMS business segment and $105 million of unfavorable profit adjustments on C-130 programs at its Aeronautics business segment.

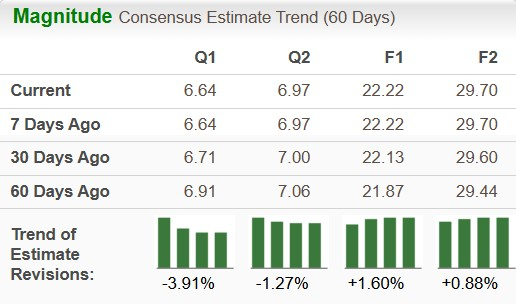

The Zacks Consensus Estimate for 2025 and 2026 earnings per share (EPS) indicates an increase of 1.6% and 0.88%, respectively, over the past 60 days.

The Zacks Consensus Estimate for Boeing’s 2025 and 2026 EPS indicates a decrease of 353.81% and 55.91%, respectively, over the past 60 days. The consensus estimate for Northrop Grumman’s 2025 EPS indicates an increase of 2.44% and that for 2026 EPS implies a decline of 0.1% over the past 60 days.

The company beat on earnings in each of the trailing four quarters, delivering an average surprise of 13.29%.

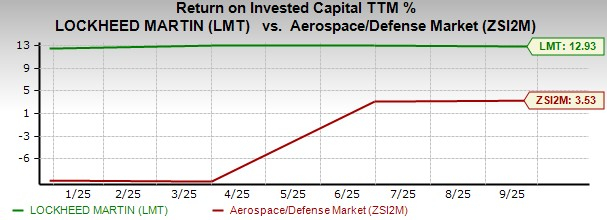

The image below shows that Lockheed Martin’s trailing 12-month return on invested capital (ROIC) beats the peer group’s average. This suggests that the company's investments are yielding sufficient returns to cover its expenses.

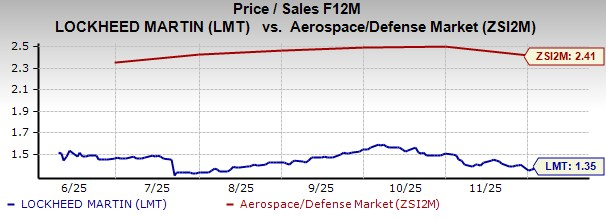

In terms of valuation, LMT’s forward 12-month price-to-sales (P/S) is 1.35X, a discount to the industry’s average of 2.41X. This suggests that investors will be paying a lower price than the company's expected sales growth compared with that of its peer group.

Lockheed Martin’s strong presence across major U.S. defense programs and robust contract wins underpin its long-term growth, further supported by multiple programs entering expansion phases and new investments such as its Hypersonics System Integration Lab and the AI-driven Prepar3D® Fuse simulation platform, which enhance its capabilities in next-generation weapons and advanced training systems.

However, considering its price underperformance, operational and financial pressures, new investors should wait and look for a better entry point. Those who already have this Zacks Rank #3 (Hold) stock in their portfolio may continue to retain it, considering the company’s impressive earnings growth projection and better ROIC.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 4 hours | |

| 6 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours |

IPO Leader Set To Launch Breakout As Top Funds Jump In. Impact Of Iran War Raises Questions.

LMT

Investor's Business Daily

|

| 8 hours |

Dow Jones Defense Giant Boeing, AT&T In Or Near Buy Zones Amid Market Volatility

BA

Investor's Business Daily

|

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 13 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite