|

|

|

|

|||||

|

|

Serve Robotics Inc. SERV expanded its autonomous sidewalk delivery service to Alexandria, VA, in partnership with Uber Technologies UBER through Uber Eats. The launch gives residents and businesses in North East Alexandria, Del Rey, Potomac West and Old Town North an option to receive orders through Serve Robotics’ autonomous robots.

The expansion reflects steady progress in Serve Robotics’ 2025 plan to scale its last-mile network. Alexandria’s layout supports the deployment of the company’s next generation of sidewalk robots, making this an important step in broadening Serve Robotics’ operating reach.

Serve Robotics continued to build on the broader rollout as it moved this service into Alexandria. The expansion aligns with SERV’s plan to bring autonomous delivery to dense urban areas. The company has added new markets nationwide in recent months and worked with partners to improve access to automated last-mile options. SERV plans to extend coverage within Alexandria as deployment progresses.

The launch also fits into Alexandria’s efforts to add new mobility options. Serve Robotics worked with local groups to ensure a smooth and safe deployment that supports the city’s transport goals. Looking ahead, SERV expects additional market entries across the United States through 2026, which will further expand its operating footprint.

Serve Robotics is expanding its autonomy capabilities as part of the broader plan to improve the performance and efficiency of the delivery network. The recent integration of Vayu adds large-scale AI models and a simulation-based data engine to the autonomy stack, supporting SERV’s goal to advance physical AI and reduce operational complexity. These enhancements are expected to lower data costs, strengthen key performance metrics and accelerate model improvements as SERV scales its robot fleet.

The company is also expanding its autonomy capabilities through recent technology integrations. These support SERV’s long-term plan for a more efficient delivery platform. As the fleet grows, SERV benefits from a stronger data engine that helps train smarter AI systems. This approach aligns with the company’s focus on scaling efficiently, deploying capital with discipline and building a durable operating model in the emerging physical AI landscape.

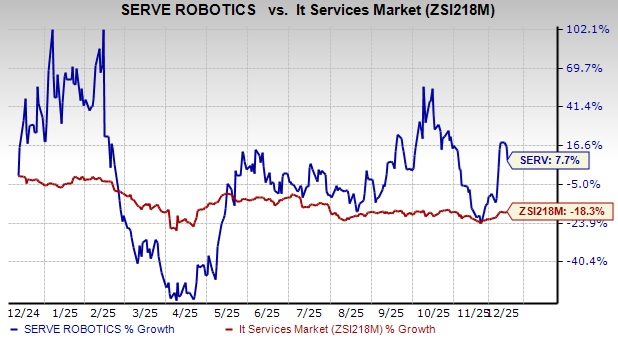

SERV stock has climbed 7.7% in the past year, outperforming the Zacks Computers - IT Services industry’s 18.3% decline. The company’s momentum has been driven by strategic acquisitions, high-impact platform partnerships and rapid expansion across a wide range of industries. SERV is also investing deeply in autonomy and robotics capabilities, highlighted by the integration of Vayu and Phantom Auto.

Currently, Serve Robotics carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Computer and Technology sector are:

NVIDIA Corporation NVDA sports a Zacks Rank of 1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company delivered a trailing four-quarter earnings surprise of 2.8%, on average. NVIDIA stock has gained 36.8% year to date. The Zacks Consensus Estimate for NVIDIA’s 2026 sales and earnings per share (EPS) indicates growth of 61.4% and 54.5%, respectively, from the prior-year levels.

Amphenol Corporation APH presently sports a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 17.9%, on average. Amphenol stock has soared 99.7% year to date.

The Zacks Consensus Estimate for Amphenol’s 2026 sales and EPS indicates growth of 12.4% and 20.7%, respectively, from the year-ago period’s levels.

Vertiv Holdings Co VRT flaunts a Zacks Rank of 1 at present. The company delivered a trailing four-quarter earnings surprise of 14.9%, on average. Vertiv stock has surged 60% year to date.

The Zacks Consensus Estimate for Vertiv’s 2026 sales and EPS indicates growth of 20.8% and 26.6%, respectively, from the prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 39 min | |

| 39 min | |

| 41 min | |

| 48 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Stock Market Today: Dow, Nasdaq Eke Out Gains; Gold, Silver Names Slide (Live Coverage)

NVDA

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite