|

|

|

|

|||||

|

|

Oracle's ORCL second-quarter fiscal 2026 results presented a mixed picture for investors, with shares declining 11% pre-market despite robust cloud infrastructure growth and record-breaking contracted backlog. The database and cloud infrastructure provider reported total revenues of $16.1 billion for the quarter ending Nov. 30, 2025, representing growth of 14% in U.S. dollars and 13% in constant currency (cc). The figure missed the Zacks Consensus Estimate for revenues by 0.55%

While cloud revenues accelerated significantly, software revenue weakness and aggressive capital expenditure plans raised concerns about near-term profitability, suggesting current shareholders should maintain positions while awaiting improved entry points following execution progress.

The company's cloud business demonstrated remarkable momentum, with total cloud revenues reaching $8 billion, up 34% in U.S. dollars and 33% in cc. Cloud infrastructure revenues surged 66% in cc to $4.1 billion, with GPU-related cloud revenues growing 177%. Cloud applications revenues reached $3.9 billion, up 11%. Cloud revenues now account for half of Oracle's total revenues, marking a fundamental transformation in the company's business model. Software revenues declined 3% in U.S. dollars and 5% in cc to $5.9 billion, reflecting ongoing challenges in legacy product categories.

Oracle's remaining performance obligations reached $523 billion, up 438% year over year and $68 billion sequentially. These increases were driven by new commitments from Meta, NVIDIA, and other customers. Importantly, RPO, expected to be recognized within 12 months, grew 40% year over year, compared with 25% last quarter, indicating accelerated revenue conversion. The company expects $4 billion of additional revenues in fiscal 2027 based on the added backlog that can be monetized quickly starting next year.

The quarter's most concerning metric was free cash flow, which registered a negative $10 billion as capital expenditures reached $12 billion. Operating cash flow totaled $2.1 billion. The company increased its full-year fiscal 2026 capital expenditure guidance by $15 billion to approximately $50 billion, up from the $35 billion forecast following first-quarter results. Management emphasized that the vast majority of CapEx investments are for revenue-generating equipment going into data centers, not for land, buildings, or power, which are covered via leases. Oracle does not pay for these leases until completed data centers and accompanying utilities are delivered.

Non-GAAP earnings per share reached $2.26, up 54% in U.S. dollars and 51% in cc, while GAAP earnings per share totaled $2.10, up 91% in U.S. dollars and 86% in cc. Both metrics benefited from a $2.7 billion pre-tax gain from the sale of Oracle's interest in Ampere.

The Zacks Consensus Estimate for ORCL's fiscal 2026 earnings is pegged at $6.81 per share, marking an upward revision of 1 cent over the past 30 days. The earnings figure suggests 12.94% growth over the figure reported in fiscal 2025.

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

For the fiscal third quarter, Oracle guided total cloud revenue growth of 37% to 41% in cc and 40% to 44% in U.S. dollars. Total revenues are expected to grow 16% to 18% in cc and 19% to 21% in U.S. dollars. Non-GAAP earnings per share guidance ranges from $1.70 to $1.74 in U.S. dollars. Management maintained its full-year fiscal 2026 revenue expectation of $67 billion.

Oracle's strategic initiatives center on its AI data platform and multicloud database partnerships. Chairman Ellison emphasized that Oracle databases contain most of the world's high-value private data, positioning the company uniquely for AI reasoning applications on enterprise data while maintaining security. The company's multicloud database business grew 817% in the quarter. Oracle is the only applications company selling complete application suites, combining back-office, front-office, and industry-specific solutions with embedded AI capabilities.

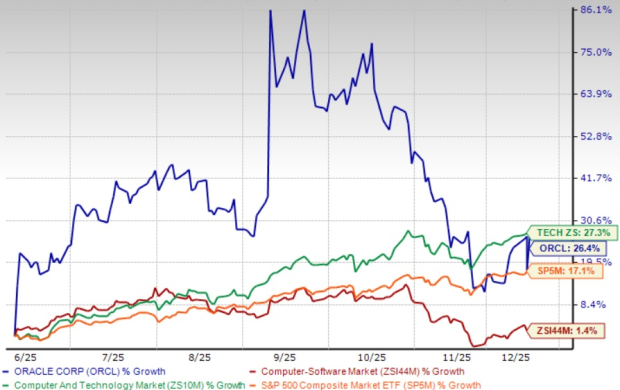

Shares of Oracle have returned 26.4% in the past six-month period compared with the Zacks Computer and Technology sector’s appreciation of 27.3% and the Zacks Computer - Software industry’s growth of 1.4%.

The cloud infrastructure market remains intensely competitive, with dominant players commanding substantial market positions. Amazon AMZN-owned Amazon Web Services maintains approximately 30% market share with comprehensive service breadth, while Microsoft MSFT Azure leverages enterprise relationships and OpenAI partnerships for differentiated AI capabilities. Alphabet GOOGL-owned Google Cloud has achieved 13% market share with strong momentum in data analytics and machine learning services. Oracle competes through its multicloud database offerings embedded in Amazon, Google, and Microsoft clouds, with 45 live multicloud regions and 27 more planned.

From a valuation standpoint, ORCL stock is currently trading at a premium with a forward 12-month Price/Sales ratio of 8.42x, which is higher than the industry average of 7.61x. Oracle carries a Value Score of D.

Given elevated capital expenditures pressuring near-term cash flows, competition from Microsoft, Amazon, and Google in cloud infrastructure, and premium valuation metrics, current investors should hold positions while prospective buyers await a more attractive entry point following improved operational execution and cash flow generation. ORCL stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite