|

|

|

|

|||||

|

|

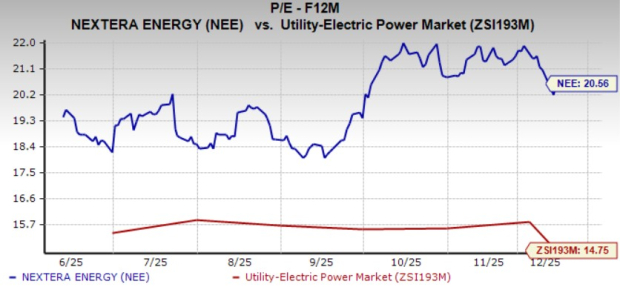

NextEra Energy’s NEE shares are trading at a forward 12-month price/earnings (P/E) ratio of 20.56X, a premium compared with the Zacks Utility - Electric Power industry’s average of 14.75X. NEE’s current valuation is higher than the broader Zacks Utilities sector’s average of 15.43X.

The company benefits from the well-chalked-out investment plan to strengthen operations, strategic acquisitions, rising customer base and improvement in the economic condition in its service regions.

NextEra Energy is trading at a premium compared with other utilities operating in the same industry like The Southern Company SO and Duke Energy Corporation DUK. Both SO and DUK are working to add more clean power generation assets to their portfolio. The current P/E F12M of SO and DUK are pegged at 18.39X and 17.04X, respectively.

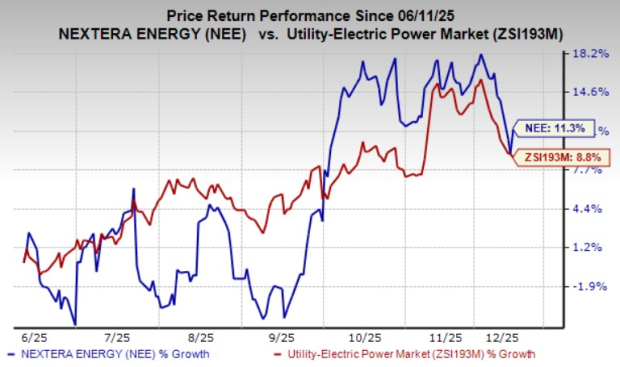

The increase in NextEra Energy’s share prices is a reflection of its strong performance and focus on emission reduction and customer growth.

Is it wise to add NEE to your portfolio solely because the stock is showing positive price momentum? Let’s take a closer look at the key factors that can help investors determine whether now is a favorable entry point for buying NEE’s shares.

Florida’s strengthening economic environment is fueling population growth and rising energy needs, enabling NEE to broaden its customer base. The company’s subsidiary, Florida Power & Light (“FPL”), continues to offer residential electricity rates that are significantly lower than the national average, boosting customer appeal and reinforcing its competitive position.

Nearly 89% of NextEra Energy’s customers are residential, with commercial and industrial users making up the remaining 11%. The company’s exceptional scale, advanced technology and operational proficiency allow it to generate steady, above-average returns. NextEra Energy’s broad operational footprint and growing renewable energy portfolio further strengthen its competitive edge.

FPL plans to invest nearly $43 billion from 2025 to 2029 to enhance system reliability and service quality. Its long-term strategy includes adding more than 25 GW of new generation and storage by 2034, supported by approximately $19.5 billion in clean-energy projects during that same period. These modernization efforts, combined with the nation’s largest owned solar portfolio, have already saved customers nearly $16 billion in fuel costs since 2001. High-quality service and costs lower than the industry average attract more customers.

NextEra Energy is strengthening its long-term clean energy strategy through significant investments and a well-developed project pipeline. The company, through its unit Energy Resources, aims to add 36.5-46.5 GW of new renewable capacity between 2024 and 2027 and plans to invest $31.3 billion from 2025 to 2029 to expand and enhance operations. With a sizable backlog of 29.6 GW in signed contracts, the company maintains strong visibility into growth. The demand for clean energy is increasing in the United States. By 2027, the Energy Resources unit anticipates operating more than 70 GW of generation and storage capacity and catering to the rising demand for clean electricity.

NextEra Energy, a capital-intensive company with a domestic focus, stands to gain from the Federal Reserve's decision to cut interest rates. The Fed has now reduced the benchmark rate to 3.50-3.75% from the peak 5.25-5.5% range. Additional rate cuts anticipated in 2026 could further reduce the company’s capital servicing costs.

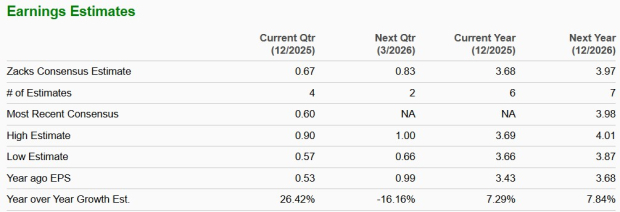

NextEra Energy expects its 2025 earnings per share in the range of $3.45-$3.70 compared with $3.43 a year ago. The Zacks Consensus Estimate for NEE’s 2025 and 2026 earnings per share indicates year-over-year growth of 7.29% and 7.84%, respectively.

Courtesy of the efficient execution of plans and smart capital investment, NextEra Energy's earnings surpassed expectations in the fourth quarter. The company’s earnings surpassed expectations in each of the past four quarters, with an average surprise of 4.39%.

The Southern Company’s earnings surpassed estimates in three out of the last four quarters and missed in another quarter, resulting in an average beat of 2.95%. Duke Energy’s earnings surpassed estimates in the last four quarters, resulting in an average beat of 5.72%.

NextEra Energy plans to increase the dividend rate annually by 10%, at least through 2026, from the 2024 base, subject to its board’s approval. The current annual dividend of the company is $2.27 per share, and the dividend yield of 2.79% is better than the Zacks S&P 500 composite’s yield of 1.43%. NextEra Energy has increased its dividend five times in the last five years. Check NEE’s dividend history here.

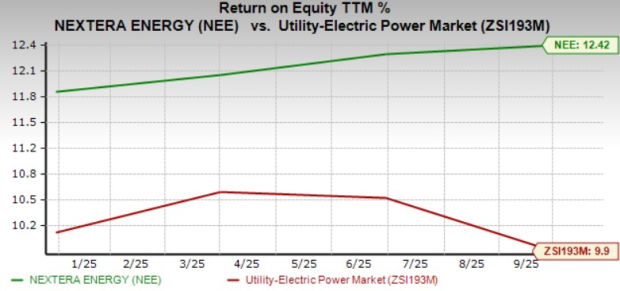

Return on equity (“ROE”) is a financial ratio that measures how well a company uses its shareholders’ equity to generate profits. The current ROE of the company indicates that it is using shareholders’ funds more efficiently than peers.

NextEra Energy’s trailing 12-month ROE is 12.42%, ahead of the industry average of 9.9%.

NextEra Energy continues to post steady performance, driven by rising clean energy demand across its service territories. The company is steadily expanding its clean energy portfolio to keep pace with this growing need. Florida’s healthy economic backdrop is also creating additional growth opportunities for the utility.

Given the improvement in earnings estimates and return on equity, it will be wise to remain invested in this Zacks Rank #3 (Hold) utility. Since NEE is trading at a premium, it is better to wait for a while and look for a better entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite