|

|

|

|

|||||

|

|

Emerging-market (EM) economies today present a compelling alternative to developed markets, and recent data offers a fresh lens. Going by the International Monetary Fund’s (IMF) October 2025 update, emerging and developing economies are forecast to grow 4.2% in 2025. This is significantly higher than the 1.6% expected growth in real GDP for advanced economies.

The collective output of EM now accounts for 50.6% of global GDP in 2025 and 66.5% of global GDP growth in the past 10 years (World Economics).

This macro strength is reflected in equity markets. According to a 2025 analysis by J.P. Morgan Asset Management, 2025 marks the first year since 2020 in which emerging-market equities have outperformed developed-market equities, driven by improving economic conditions, a softer U.S. dollar and a global macro backdrop favorable to EMs.

Added to this, currently, emerging-market equities are trading at a significant valuation discount. According to RBC Global Asset Management, EM stocks are priced at roughly a 35% discount to developed-market equities on forward price-to-earnings metrics, the largest discount in the last 15 years. J.P. Morgan adds that improving earnings momentum across emerging markets in 2024 and 2025 strengthens the case for a potential valuation re-rating as profitability recovers.

Below, we have discussed three well-positioned EM stocks, such as ICICI Bank IBN in financial services, Taiwan Semiconductor TSM or TSMC in manufacturing and MercadoLibre MELI in e-commerce. These are seen as key beneficiaries of the structural tailwinds and are widely expected to enter 2026 with strong growth momentum.

Easing monetary policies across several developing nations with lower global interest rates are creating easier financing conditions across many EMs, enabling banks to expand credit at healthier margins. As inflation moderates and currencies stabilize in key EM economies, lenders face reduced funding volatility and lower credit-risk pressure, which support stronger return on equity. This has already translated into rising loan demand from households and small businesses, particularly in regions where rate-cut cycles began earlier than in developed markets. Going by multiple sources from recent times, from 2024 till mid-2025, year-over-year bank credit growth in several emerging economies, including India, the Philippines, and Vietnam, rose in double digits as domestic credit expanded.

This apart, global supply-chain diversification is driving a measurable rise in manufacturing activity across emerging markets. India, for example, attracted $19.04 billion in manufacturing FDI in the 2024-25 fiscal, supported by government incentives and expanding industrial parks (India Briefing). Vietnam and Indonesia are also capturing new production as multinational firms shift operations out of single-country hubs. India’s electronics output illustrates this shift. Mobile phone exports surged to $20.5 billion in 2024, up from near zero in 2016.

ICICI Bank: Headquartered in Mumbai, India, ICICI Bank is making commendable progress in improving digital banking services for retail and corporate clients. The company has been striving to provide superior end-to-end seamless digital services, personalized solutions and value-added features to enable data-driven cross-sell and up-sell opportunities. The increasing adoption of the bank’s mobile banking app – iMobile Pay – is helping garner a solid market share. Apart from this, the company’s digital platform for businesses has witnessed tremendous growth in the past few quarters.

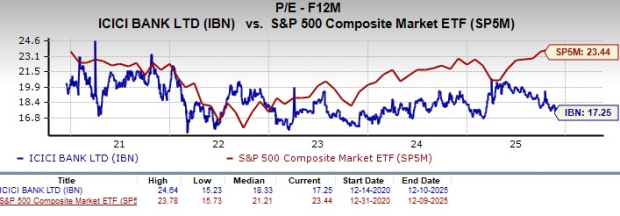

For fiscal 2027 (ending March 2027), this Zacks Rank #2 (Buy) stock is expected to report earnings growth of 13.9% on 13.1% revenue growth. Its long-term historical earnings growth of 32.2% significantly outperforms the industry’s 9.3% growth. Meanwhile, the stock’s forward 12-month price/earnings (P/E) ratio of 17.25 is far below the S&P 500’s 23.44.

Taiwan Semiconductor: The company continues to dominate the semiconductor foundry space. TSMC is known for its advanced production capabilities and has already moved into 3nm production, with 2nm coming soon. Its large scale allows it to handle rising AI chip demand better than most competitors. The company has established itself as the preferred manufacturing partner for AI accelerators, including GPUs and custom silicon developed by major players like NVIDIA NVDA, Marvell Technology and Broadcom.

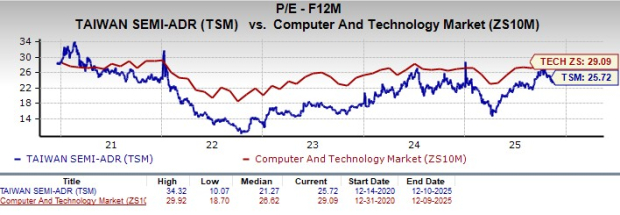

For 2026, this Zacks Rank #2 stock is expected to report earnings growth of 20.2% on 20.6% revenue growth. Its long-term expected earnings growth of 28.7% significantly outperforms the S&P 500’s 10.1% growth. Meanwhile, the stock’s forward 12-month price/earnings (P/E) ratio of 25.72 is below the sector’s 29.09.

MercadoLibre: Buenos Aires, Argentina-based MercadoLibre's leadership across e-commerce and digital banking sectors gives it exposure to two of the region's fastest-growing secular themes, online retail and financial inclusion. Its balance of scale, technology and local execution position it to compound value through market expansion rather than price competition. The 39% revenue growth and 41% total payment volume expansion in the third quarter of 2025 reaffirm that demand remains early-cycle. With infrastructure and trust already built, MercadoLibre's addressable market continues to expand faster than its global peers.

In 2026, this Zacks Rank #3 (Hold) stock is expected to report earnings growth of 50.3% on 28.5% revenue growth. Its long-term expected earnings growth of 34.6% significantly outperforms the industry’s 18.1% growth. The stock’s forward 12-month price/sales (P/S) ratio of 2.75 is below the S&P 500’s 5.3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 28 min | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Stock Market Today: Nasdaq Rallies; Solar Stocks Shine But These Breakout Stocks Wither (Live Coverage)

NVDA

Investor's Business Daily

|

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite