|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Disney's DIS landmark $1 billion investment in OpenAI positions the entertainment giant at the forefront of generative AI adoption, yet persistent headwinds in linear television and streaming competition suggest investors should maintain their positions rather than add exposure at current levels. The December 2025 agreement makes Disney OpenAI's first major content licensing partner, enabling users to create short-form videos featuring more than 200 iconic characters from Disney, Pixar, Marvel, and Star Wars through Sora and ChatGPT Images starting in early 2026. While this partnership represents a meaningful strategic pivot, the stock's recent weakness following mixed fiscal fourth-quarter results warrants a cautious, hold-oriented approach.

The three-year licensing agreement includes exclusivity provisions and grants Disney warrants to purchase additional OpenAI equity, providing both revenue diversification and investment upside. Beyond content licensing, Disney will become a major OpenAI customer, deploying ChatGPT company-wide for employees and using APIs to build enhanced Disney+ subscriber experiences.

The timing proves strategically significant. At CES 2025, Disney unveiled its Disney Select AI Engine for targeted advertising and Magic Words Live for real-time contextual ad matching. The company's 2025 Accelerator program selected Animaj, an AI startup capable of reducing animated episode production from five months to under five weeks. These initiatives demonstrate Disney's commitment to embedding artificial intelligence across content creation, advertising technology, and theme park operations through advanced robotics and predictive maintenance systems.

Disney's fiscal fourth quarter presented a mixed picture. Revenues of $22.46 billion fell short of expectations, though adjusted earnings per share of $1.11 exceeded the consensus estimate. For the full fiscal year, the company generated $94.4 billion in revenues, up 3% year over year, with adjusted EPS reaching $5.93, representing 19% growth from fiscal 2024.

The Entertainment segment's direct-to-consumer business achieved $1.33 billion in operating income, meeting management's streaming profitability target. Combined Disney+ and Hulu subscriptions reached 196 million by the quarter's end, adding 12.4 million subscribers during the period. However, Linear Networks’ operating income declined due to lower advertising revenues and continued cord-cutting pressures, highlighting the structural challenges facing traditional television distribution.

The Experiences segment delivered record results with $10 billion in full-year operating income, driven by Disney Cruise Line expansion and strong international parks performance. The November launch of Disney Destiny and the March 2026 debut of Disney Adventure in Singapore underscore management's commitment to capitalizing on experiential consumer demand.

Management projects double-digit adjusted EPS growth for both fiscal 2026 and 2027, with operating cash flow expected to reach $19 billion. The Experiences segment should deliver high-single-digit operating income growth, while Entertainment's direct-to-consumer business targets 10% operating margins. Shareholder returns are expanding substantially through a 50% dividend increase to $1.50 per share and $7 billion in planned repurchases, doubling fiscal 2025's buyback pace.

Nevertheless, several near-term headwinds temper enthusiasm. First-quarter fiscal 2026 faces approximately $400 million in adverse theatrical comparisons against the prior year's blockbuster releases of Inside Out 2 and Deadpool & Wolverine. Political advertising shortfalls and Star India's deconsolidation following the Reliance Industries joint venture create additional comparison challenges. Pre-opening expenses for new cruise ships will pressure margins through mid-2026.

The CEO succession question adds uncertainty, with Iger's contract expiring in December 2026 and the board planning to announce his replacement in early 2026. While Disney's franchise portfolio and integrated business model remain unmatched, execution risk during leadership transition warrants monitoring.

The Zacks Consensus Estimate for Disney’s earnings is pegged at $6.59 for fiscal 2026, suggesting year-over-year growth of 11.13%.

The Walt Disney Company price-consensus-chart | The Walt Disney Company Quote

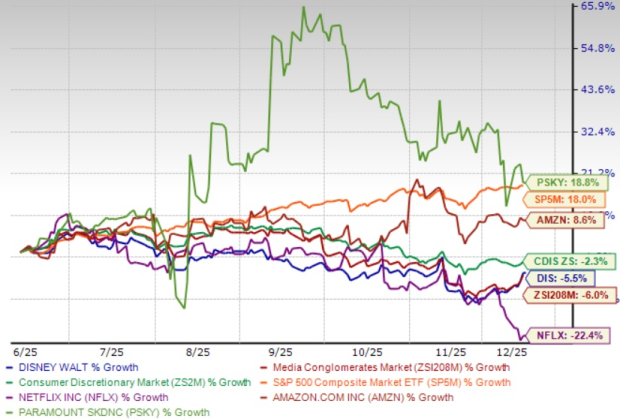

Disney shares have lost 5.5% in the past six-month period, compared with the Zacks Consumer Discretionary sector which has declined 6% in the same period. Competitors like Netflix NFLX commands premium multiples reflecting streaming leadership with 302 million subscribers, while Amazon AMZN continues aggressive sports rights investments through Prime Video. Paramount Skydance PSKY has emerged as a consolidation catalyst following its August 2025 merger completion.

The stock currently trades at a forward 12-month price-to-earnings ratio of 16.6X, representing a meaningful discount to the Zacks Media Conglomerates industry average of 18.56X. This relative undervaluation earns Disney a Zacks Value Score of A, indicating the shares offer attractive value characteristics for patient investors.

Compared to Netflix, Amazon, and Paramount Skydance, Disney's discounted valuation reflects market skepticism about navigating the streaming transition while managing linear declines. The current multiple suggests investors are not fully pricing Disney's franchise value, yet competitive pressures from Netflix, Amazon, and Paramount Skydance warrant the discount until growth acceleration materializes.

Disney's OpenAI partnership represents genuine strategic progress in positioning the company for an AI-driven entertainment landscape. The combination of streaming profitability, the Experiences segment strength, and expanding shareholder returns provides fundamental support. However, linear television declines, intensifying streaming competition, and near-term earnings headwinds justify maintaining current positions rather than building additional exposure. Investors should hold the stock while awaiting evidence of sustained streaming subscriber growth and successful AI monetization before considering adding to positions at more attractive entry points. DIS currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite