|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The education market in the United States is shifting its focus from a traditional approach to a more digitalized one, mainly inclining towards career-focused and workforce-aligned programs. This shift is driven by the changing demand patterns of students and parents, alongside federal and state initiatives favoring higher education and workforce development. Besides, the ongoing buzz for AI-based offerings is catalyzing digital programs over traditional education services.

The market’s resilience can be substantiated by the Zacks Schools industry’s median share price performance, which is standing above the Zacks S&P 500 composite’s median value in the year-to-date period. Although the current stock performance of the industry is riding below the S&P 500 composite so far this year, the mid and long-term prospects of the industry look promising.

Notably, the education market faces headwinds in the form of elevated tuition fees and access disparities. Nonetheless, backed by the favorable market trends and a hopeful growth trajectory, we have bundled up five education stocks that are expected to offer more than 10% year-over-year earnings growth rate in 2026 (fiscal or calendar year). The bunch includes Chegg, Inc. CHGG, Adtalem Global Education Inc. ATGE, Grand Canyon Education, Inc. LOPE, Nerdy, Inc. NRDY and Legacy Education Inc. LGCY.

Re-Defined Learning Model: With parents and students shifting rapidly toward digital offerings, education companies offering a more hybrid and digital-focused learning model are witnessing growth. Such business models are attracting strong enrollment growth and revenue visibility as students and learners embrace flexible, hybrid formats that combine online and in-person instruction, unlike traditional learning approaches.

Besides, companies like Chegg and Nerdy are directly benefiting from growth in online and hybrid learning and deeper technology integration, given the type of their product and service offerings. A digital platform with AI-enhanced learning integration is more appealing in today’s education market, leading to higher student engagement and retention rates. Adaptive learning systems, subscription-based digital content and scalable software solutions are translating into better financial performance. With continued tech investments, the education companies will be able to bridge the gap between technology and education.

Career-Focused Offerings: The increasing demand for credentialed skills, with the focus shift of education companies toward career-focused and skill training programs, is an encouraging aspect. Education companies like Adtalem, Grand Canyon Education and Legacy Education mainly offer career-oriented programs, particularly in healthcare education and related professional fields. The focus on high-demand fields like nursing and medical training coincides with broader workforce needs, supporting enrollment and revenue growth.

With tight labor markets and rising demand for skilled labor, programs emphasizing career readiness and workforce enhancements are gaining popularity in the U.S. market. Moreover, offering such programs through online platforms additionally catalyzes the demand trends, thus benefiting the education companies’ prospects.

Government Initiatives: Besides students and parents shifting toward a digital-focused and career-enhanced education approach, the federal and state support for promoting EdTech adoption, higher education support and workforce development are benefiting the education companies of the United States. In November 2025, the Department of Education announced six new interagency agreements with the Departments of Labor, Interior, Health and Human Services, and State to streamline program delivery and reduce administrative burdens. Moreover, an important 2025 workforce initiative combined education and workforce systems under a joint framework with the Departments of Education and Labor, aimed to enhance skills training, adult learning and alignment with employer needs.

Besides, in April 2025, a national policy to advance Artificial Intelligence (AI) education for American youth across all learning stages was established, primarily aimed at preparing students for technology-driven careers and supporting innovation leadership.

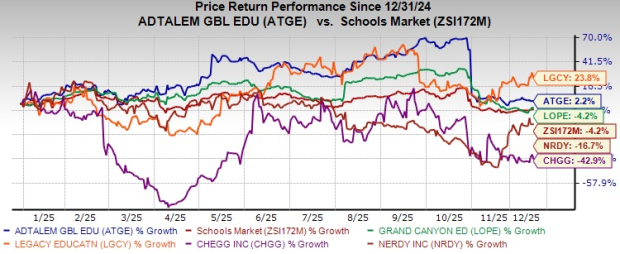

Using the Zacks Stock Screener, we have identified five School stocks that currently sport a Zacks Rank #1 (Strong Buy) or carry a #2 (Buy), along with more than 10% of earnings estimate growth rate, in 2025. The share price performance trajectory in the year-to-date (YTD) period is given below.

YTD Price Performance

Chegg: CHGG presently sports a Zacks Rank of 1 and has dropped 42.9% in the year-to-date period. It has a trailing four-quarter negative earnings surprise of 64.1%, on average. The 2026 earnings per share (EPS) estimate has increased to 18 cents from break-even earnings over the past 60 days. Earnings for 2026 are expected to grow a whopping 228.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Adtalem: ATGE presently carries a Zacks Rank of 2 and has inched up 2.2% in the year-to-date period. It has a trailing four-quarter earnings surprise of 17.4%, on average. The fiscal 2026 EPS estimate has increased to $7.85 from $7.73 over the past 60 days. Earnings for fiscal 2026 are expected to grow 17.7%.

Grand Canyon Education: LOPE currently carries a Zacks Rank of 2 and has inched down 4.2% in the year-to-date period. It has a trailing four-quarter earnings surprise of 3.7%, on average. The 2026 EPS estimate has increased to $10.10 from $10.09 over the past 60 days. Earnings for 2026 are expected to grow 11.2%.

Nerdy: NRDY presently carries a Zacks Rank of 2 and has tumbled 16.7% in the year-to-date period. It has a trailing four-quarter earnings surprise of 34.7%, on average. The 2026 bottom-line estimate has narrowed to a loss per share of 20 cents from 30 cents over the past 60 days. Earnings for 2026 are expected to grow 35.9%.

Legacy Education: LGCY presently carries a Zacks Rank of 2 and has gained 23.8% in the year-to-date period. It has a trailing four-quarter earnings surprise of 4.6%, on average. The fiscal 2026 EPS estimate has increased to 66 cents from 64 cents over the past 60 days. Earnings for fiscal 2026 are expected to grow 11.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite