|

|

|

|

|||||

|

|

The artificial intelligence (AI)-driven astonishing bull run of 2023 and 2024 has continued in 2025 too. The momentum of the AI infrastructure segment is in top gear this year. The AI space remains rock solid supported by an extremely bullish demand scenario.

Four of the “magnificent 7” stocks have decided to invest a massive $380 billion in 2025 as capital expenditure for AI-infrastructure development. This marks a significant 54% year-over-year increase in capital spending on the AI ecosystem. Moreover, these companies have also said that AI capex is likely to increase handsomely in 2026.

The Goldman Sachs and Bank of America projected that AI infrastructure capex spending will cross $1 trillion in 2028. JP Moran and Citigroup forecast this figure to total $5 trillion cumulative in 2030. Research firm McKinsey & Co. estimated that global AI-powered data center infrastructure capex will reach around $7 trillion by 2030.

Here, we recommend investing in five small and mid-cap stocks that are likely to benefit significantly next year from massive AI explode. These are: Calix Inc. CALX, Qualys Inc. QLYS, Innodata Inc. INOD, Five9 Inc. FIVN and UiPath Inc. PATH. Each of our picks currently carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

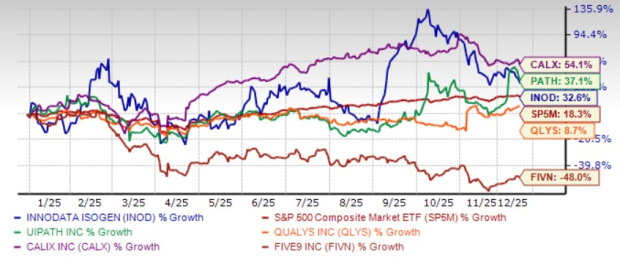

The chart below shows the price performance of our five picks year to date.

Zacks Rank #1 Calix provides the cloud, software platforms, systems and services required for communications service providers to simplify their business, excite their subscribers and grow their value. CALX operates in the United States and internationally. CALX offers its Cloud platform services through Calix Engagement Cloud, Calix Operations Cloud, and Calix Service Cloud.

CALX has integrated AI into its cloud platform and products to enhance broadband experience providers' operations, subscriber engagement, and service delivery. CALX offers AI-powered marketing solutions for the health and finance industries, AI-powered chat bots, and AI-driven initiatives like Calix AI Agents.

CALX’s major clients are large Broadband Service Providers (BSPs) such as Lumen Technologies Inc. (LUMN), Verizon Communications Inc. (VZ), Windstream and several other regional and rural BSPs.

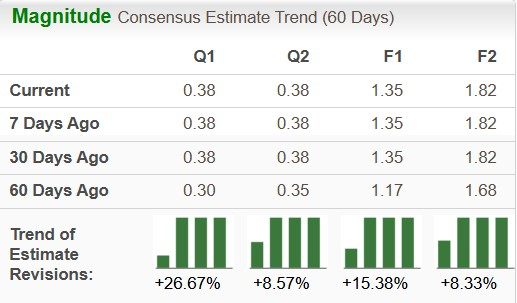

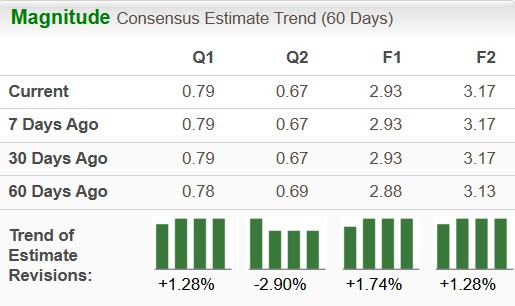

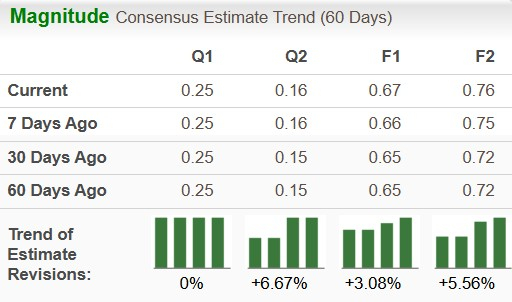

Calix has an expected revenue and earnings growth rate of 12.4% and 35.3%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 8.3% over the last 60 days.

Zacks Rank #1 Qualys is benefiting from the increasing demand for cloud-based cybersecurity solutions amid growing cyber threats and digital transformation initiatives. With a diverse customer base that includes enterprises, SMBs and government entities, QLYS maintains a balanced customer mix, which keeps it resilient against fluctuations in IT spending.

Qualys' strategic acquisitions are pivotal in driving its growth trajectory. Since its inception, the company has acquired seven companies, of which Blue Hexagon, Total Cloud and Spell Security are the most notable ones. Acquired in November 2022, Blue Hexagon's AI/ML(machine language) capabilities enhanced Qualys' threat detection and response solutions, bolstering its cybersecurity offerings.

Two major AI-powered solutions of QLYS include TotalAppSec, a unified application risk management platform for web applications and APIs, and TotalAI, which focuses on AI and Large Language Model (LLM) workloads.

QLYS’ continuous innovation and focus on expanding product capabilities position it well to navigate market challenges and sustain long-term growth despite potential macroeconomic disruptions. A continuous increase in Vulnerability Management, Detection and Response to customer penetration is an upside.

Qualys serves a long list of global enterprises like Accenture plc (ACN), International Business Machine Corp. (IBM), Cognizant Technology Solutions Corp. (CTSH), Infosys Ltd. (INFY), Humana Inc. (HUM) and Sodexo.

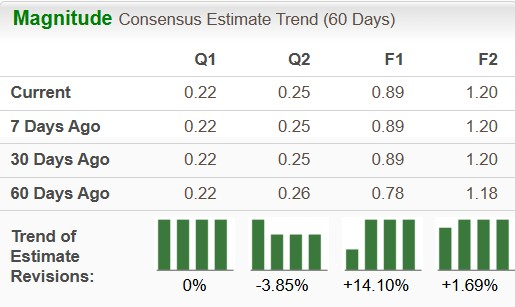

Qualys has expected revenue and earnings growth rates of 7.7% and 6.5%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 1.2 over the last 30 days.

Zacks Rank #3 Innodata has established itself as a crucial partner in the AI revolution providing high-quality data needed to train advanced language models. INOD is expected to benefit from the massive demand for supplying state-of-the-art data engineering to large language model building and maintenance over the long term.

Innodata currently supports five of the seven hyperscalers within the Magnificent 7 domain. Five of these companies raised their 2025 AI-centric capital expenditure on the last-reported earnings conference call.

The long-term growth of INOD’s business model is set to be backed by big techs, other big enterprises, industry-specific demand, federal agencies, public relations and healthcare. One of the most promising aspects of INOD’s strategy is its successful customer diversification efforts.

INOD has launched a GenAI Test and Evaluation Platform focused on Large Language Model validation and risk benchmarking. The platform, built on NVIDIA Corp.’s (NVDA) NIM microservices, enables testing for hallucination, prompt-level adversaries and reliability scoring. Its major clients are giant AI huperscalers like Microsoft Corp. (MSFT), Amazon.com Inc. (AMZN), Alphabet Inc. (GOOGL) and Meta Platforms Inc. (META).

INOD is expanding its delivery capabilities to strengthen operational efficiency and maintain a competitive edge in the fast-evolving AI services market. The company continues to focus on building a stronger delivery framework that supports rising project volume and new customer engagements across major technology clients. By scaling its global operations and enhancing technical delivery, INOD intends to manage increasing demand for complex data and AI integration projects.

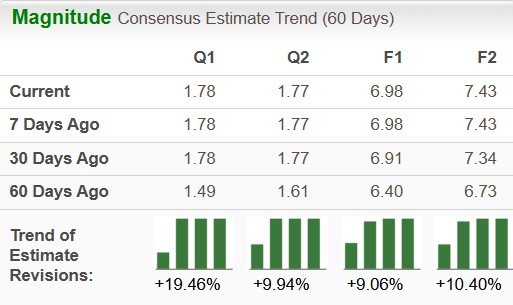

Innodata has an expected revenue and earnings growth rate of 24.1% and 35.6%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 1.7% over the last 60 days.

Zacks Rank #2 Contact center software solutions provider Five9 has been benefiting from FIVN’s strong performance, which was driven by a rise in subscription revenues supported by traction in Enterprise AI revenues. FIVN provides intelligent cloud software for contact centers in the United States, India and internationally.

FIVN offers a virtual contact center cloud platform that delivers a suite of applications, enabling a broad range of contact center-related customer service, sales, and marketing functions.

FIVN’s platform comprises interactive virtual agents, agent assistance, workflow automation, workforce engagement management, AI insights, and AI summaries. It allows the management and optimization of customer interactions across voice, chat, email, web, social media, and mobile channels directly or through its application programming interfaces.

FIVN has been benefiting from the growing adoption of AI tools in its call center services, with personalized AI agents emerging as a major growth driver. Five9 introduced its Intelligent CX Platform powered by Five9 Genius AI on the Google Cloud. FIVN also released new Five9 AI agents tailor-made for Google Cloud.

Ties with big names like Salesforce Inc. (CRM), Microsoft, ServiceNow Inc. (NOW), Verint Systems Inc. (VRNT) and Alphabet helped the company build more tailored AI tools and improve its integration across platforms. This is anticipated to have helped FIVN win new clients and hold on to the existing ones.

Five9 has an expected revenue and earnings growth rate of 9.5% each and 8.3%, respectively, for next year. The Zacks Consensus Estimate for next year’s earnings has improved 1.3% over the last 60 days.

Zacks Rank #2 UiPath provides a robotic process automation platform that uses AI to automate repetitive tasks and streamline operations. PATH offers a suite of interrelated software to build, manage, run, engage, measure, and govern automation within the organization.

The PATH platform's embedded AI, ML, and NLP (Natural Language Processing) capabilities improve decisioning and information processing. PATH introduced new generative AI features, including specialized LLMs such as DocPATH and CommPATH, and Context Grounding, to enhance automated AI models for specific business needs.

PATH is also emerging as a key enabler of the agentic AI trend. its platform now spans automation, orchestration, and generative AI integration, positioning it well as enterprises look to blend AI and automation at scale. UiPath continues to expand strategic relationships with major players, such as Microsoft, NVIDIA, Snowflake Inc. (SNOW), SAP SE (SAP) and Deloitte.

PATH has an expected revenue and earnings growth rate of 9.3% and 14.2%, respectively, for the next year (ending January 2027). The Zacks Consensus Estimate for next-year earnings has improved 1.3% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 min | |

| 4 hours | |

| 8 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite