|

|

|

|

|||||

|

|

Talks of a possible recession in 2026 are increasing as the economy shows signs of slowing after a long expansion. While growth has not collapsed, momentum has clearly cooled. Consumers are becoming more cautious, borrowing costs remain elevated, and companies are showing greater curbs on spending and hiring. Together, these trends have pushed investors to reassess risk as the cycle matures.

The current state of the U.S. economy can best be described as stable but uneven. Household spending is still holding up, but it is increasingly focused on essentials rather than discretionary purchases. At the same time, businesses are facing margin pressure from higher costs and a more selective behavior from consumers. This backdrop does not signal an immediate recession, but it does increase the risk of slower growth heading into 2026.

In periods of uncertainty or low growth, investors often rotate away from cyclical sectors and toward companies with steady demand and predictable cash flows. That is where consumer -staple stocks tend to stand out.

Staple companies sell everyday products such as food, beverages, cleaning supplies and personal-care items — categories consumers continue to buy regardless of economic conditions. These companies typically benefit from strong brands, large scale and the ability to manage pricing and costs more effectively than discretionary peers. As a result, earnings tend to be more resilient, making the sector a traditional defensive choice.

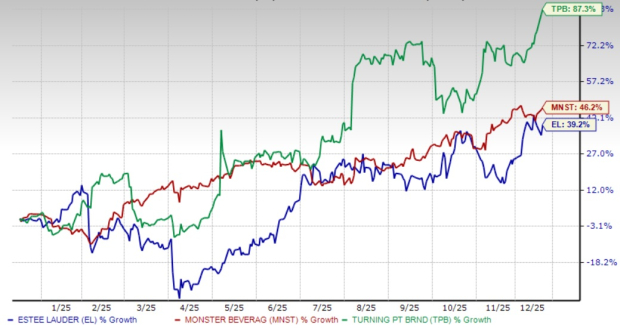

On that note, we have picked three standout names from the Zacks Consumer Staples sector that combine defensive strength with compelling growth potential. Each of these companies sports a Zacks Rank #1 (Strong Buy), reflecting favorable earnings trends and strong fundamentals. Supported by resilient business models and clear strategic drivers, all three stocks have gained more than 35% over the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Estee Lauder Companies Inc. EL, a global leader in prestige beauty across skincare, makeup, fragrance and hair care, offers a strong defensive investment case amid economic uncertainty. Its diversified brand portfolio and global reach provide stability, while management’s Beauty Reimagined strategy is helping reset the business for sustainable growth. The company is prioritizing innovation, digital expansion and sharper consumer targeting, alongside tighter cost discipline.

Early signs of recovery are visible in market-share gains and improving profitability. With solid pricing power, disciplined execution and a renewed focus on efficiency, Estee Lauder is positioned to deliver more resilient earnings through a slower economic cycle.

The Zacks Consensus Estimate for EL’s current and next fiscal-year earnings per share (EPS) suggests growth of 41.7% and nearly 36%, respectively. Estee Lauder has a trailing four-quarter earnings surprise of 82.6%, on average. Shares of this cosmetics giant have rallied 39.2% in the past year.

The Estee Lauder Companies Inc. price-consensus-eps-surprise-chart | The Estee Lauder Companies Inc. Quote

Turning Point Brands, Inc. TPB has soared a whopping 87.3% over the past year. This U.S.-based consumer product company, with a mix of legacy tobacco-related brands and a fast-growing modern oral nicotine portfolio, offers a unique blend of stability and growth. The company generates strong cash flows from established businesses while reinvesting aggressively in higher-growth, reduced-risk nicotine products.

Turning Point Brands is focused on expanding distribution, strengthening manufacturing capabilities and building brand equity, all while maintaining cost discipline. This balanced strategy supports margin durability and long-term earnings visibility, positioning the company as a resilient investment choice in an increasingly dynamic economic landscape.

The Zacks Consensus Estimate for TPB’s current and next fiscal-year EPS suggests growth of 50.6% and 7.1%, respectively. Turning Point Brands has a trailing four-quarter earnings surprise of 17%, on average.

Turning Point Brands, Inc. price-consensus-eps-surprise-chart | Turning Point Brands, Inc. Quote

Monster Beverage Corporation MNST, one of the world’s leading energy drink companies, continues to stand out for its ability to pair steady demand with strong profitability. The company, which has gained 46.2% in a year, benefits from a growing global energy drink category and deep brand loyalty, supported by consistent innovation and high-impact marketing.

International markets remain a key growth driver, helping diversify revenue streams. Monster Beverage’s asset-light operating model, localized production and disciplined pricing approach support margin strength, even amid cost pressures. With a robust product pipeline and expanding global footprint, MNST is well-positioned to sustain earnings growth while offering relative stability in a volatile macro environment.

The Zacks Consensus Estimate for MNST’s current and next fiscal-year EPS suggests growth of 22.2% and 13.2%, respectively. Monster Beverage has a trailing four-quarter earnings surprise of 5.5%, on average.

Monster Beverage Corporation price-consensus-eps-surprise-chart | Monster Beverage Corporation Quote

If economic growth slows in 2026, consumer-staple stocks could provide relative stability. While no stock is immune to downturns, companies with essential products, strong brands and disciplined execution — such as EL, TPB and MNST — are often better positioned to navigate periods of economic stress.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 |

Monster Beverage, Stock Of The Day, Near Buy Point As Growth Accelerates

MNST

Investor's Business Daily

|

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite