|

|

|

|

|||||

|

|

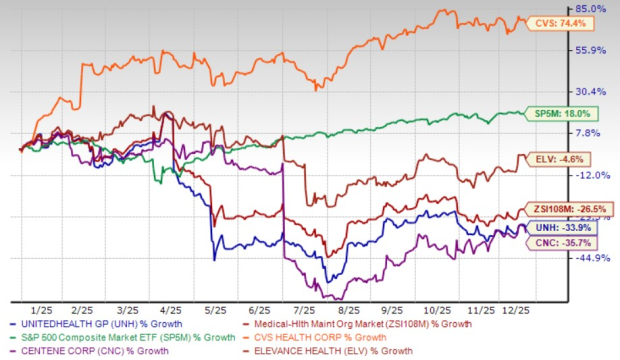

The overall healthcare sector entered 2025 on shaky ground. Managed care stocks, especially HMOs, were weighed down by stubbornly high medical utilization, tighter reimbursement assumptions, and lingering uncertainty around government-sponsored plans. Investors questioned whether insurers could reassert pricing discipline after absorbing elevated claims across Medicare Advantage, Medicaid, and ACA plans.

Fast forward to today, and the tone is shifting. The industry isn’t roaring back yet, but it has clearly found a pulse. Cost trends are now better assumed in the models, rate visibility is improving, and insurers are regaining control over margins after an uneven post-pandemic reset. For long-term investors, this matters. Managed care is not a cyclical story; it’s a scale, execution and demographics story. Heading into 2026, those fundamentals are beginning to realign.

The biggest drag on HMOs this year came from higher-than-expected medical utilization. Many insurers underestimated how quickly patient behavior would normalize after years of deferred care. That miscalculation pressured medical benefit ratios and forced companies to recalibrate pricing and guidance. At the same time, regulatory noise around Medicare Advantage reimbursement and risk-adjustment models created uncertainty, keeping valuation multiples compressed. Investors largely stayed on the sidelines, waiting for clearer signals on cost control and earnings durability.

Companies like UnitedHealth Group Incorporated UNH, Elevance Health, Inc. ELV and Centene Corporation CNC were sold off on worsening medical-cost trends and weaker earnings visibility, while CVS Health Corporation CVS rallied because it delivered upside results and raised guidance after credibly resetting its business.

The signals are now emerging. Utilization trends are now better handled, insurers are repricing plans more accurately, commercial margins are high and cost management initiatives are showing results. The result: a sector that looks far more investable heading into 2026 than it did at the start of the year.

Three forces are driving the turnaround.

First, pricing discipline is returning. After absorbing elevated claims, insurers are now better aligned on premiums versus actual medical costs. This improves visibility and reduces the risk of earnings surprises.

Second, scale is reasserting its advantage. Large HMOs with diversified member bases and integrated care platforms are better positioned to manage volatility than smaller peers. High-margin commercial plans are acting as earnings buffers, and recent policy shifts are expected to push more lives into commercial coverage.

Third, demographics remain a long-term tailwind. An aging population and rising prevalence of chronic diseases continue to drive enrollment, ensuring steady demand regardless of short-term economic conditions.

Together, these trends set the stage for healthier earnings trajectories in 2026.

Given this backdrop, we have selected three stocks that offer a mix of innovation, stability and growth potential heading into 2026. While no investment is without risks, these companies are well-positioned to deliver strong returns. Each of these large-cap companies currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

UnitedHealth remains the bellwether of the HMO industry. Its strength lies in diversification: insurance operations are complemented by Optum’s data, pharmacy and care delivery platforms. While UNH faced margin pressure earlier this year due to higher utilization, its scale and analytics-driven approach allow it to adapt faster than most peers.

As medical cost trends stabilize, UnitedHealth’s ability to balance pricing, care coordination, and value-based models becomes a clear advantage. Optum continues to be a strategic growth engine, helping the company manage costs while expanding service offerings. Heading into 2026, UNH stands out as a high-quality compounder with new leadership, less volatile than smaller HMOs, but still positioned for steady earnings growth as industry conditions normalize.

The Zacks Consensus Estimate for UnitedHealth’s 2026 earnings is pegged at $17.60 per share, indicating 8% growth from the estimated 2025 figure of $16.30. It has witnessed nine upward estimate revisions in the past 60 days against two in the opposite direction. UNH beat the Zacks Consensus Estimate for earnings in two of the last four quarters and missed twice.

Upside to Average Price Target: 15.8%

Market Cap: $308.98 billion

UnitedHealth Group Incorporated price-consensus-eps-surprise-chart | UnitedHealth Group Incorporated Quote

CVS Health is an integrated healthcare platform with insurance, benefits management and care delivery under one roof. The company spent much of the past year restructuring underperforming operations and refocusing on profitability rather than pure scale. That reset is paying off. CVS has improved cost controls across its Aetna insurance business while leveraging its retail and pharmacy footprint to drive engagement and efficiency.

The company’s push toward data-driven care coordination and AI-enabled member management strengthens its ability to manage medical costs more effectively. As margins stabilize and execution improves, CVS enters 2026 as a credible story with multiple levers for earnings growth.

The Zacks Consensus Estimate for CVS Health’s 2026 earnings is pegged at $7.14 per share, indicating a 7.5% increase from the 2025 expected figure of $6.65. It has witnessed five upward estimate revisions in the past 30 days against one in the opposite direction. CVS beat the Zacks Consensus Estimate for earnings in each of the last four quarters, with an average surprise of 26.5%.

Upside to Average Price Target: 18.2%

Market Cap: $101.16 billion

CVS Health Corporation price-consensus-eps-surprise-chart | CVS Health Corporation Quote

Centene has been one of the most volatile names in managed care, largely due to its heavy exposure to ACA and Medicaid plans. Earlier cost missteps and pricing challenges hurt investor confidence, but they also forced a strategic reset, positioning Centene for recovery.

Improved pricing discipline, a clearer regulatory outlook and continued enrollment growth in government-sponsored programs will support a rebound in profitability. While CNC carries a higher risk than UNH or CVS, it also offers significant upside if execution improves. For investors willing to tolerate volatility, Centene represents a levered bet on stabilization within the HMO space heading into 2026.

The Zacks Consensus Estimate for Centene’s 2026 earnings is pegged at $2.94 per share, indicating a 46.6% surge from the 2025 estimated figure of $2. The estimates remained stable over the past week. CNC beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed once, with an average surprise of 75.2%.

Upside to Average Price Target: 1.4%

Market Cap: $19.88 billion

Centene Corporation price-consensus-eps-surprise-chart | Centene Corporation Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 4 hours | |

| 6 hours | |

| 11 hours | |

| 14 hours | |

| 16 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite