|

|

|

|

|||||

|

|

As AI initiatives grow, enterprises face new operational challenges regarding GPU availability across regions, planning capacity for multiple teams and ensuring predictable access to resources. Nebius Group N.V. NBIS is addressing these needs with the launch of Nebius AI Cloud 3.1, the latest release of its full-stack AI cloud platform. Building on the Nebius AI Cloud “Aether" framework, version 3.1 infuses next-generation NVIDIA NVDA Blackwell Ultra infrastructure, transparent GPU capacity management, expanded AI/ML developer tools and improved enterprise security and compliance features. These updates position Nebius AI Cloud as an ideal platform for enterprises scaling AI workloads in production.

Nebius is now rolling out NVIDIA Blackwell Ultra globally, including HGX B300 and GB300 NVL72 systems, becoming the first cloud provider in Europe to run both in production and the first worldwide to deploy GB300 NVL72 with 800 Gbps NVIDIA Quantum-X800 InfiniBand. Paired with accelerated networking, storage and filesystem scaling, Nebius AI Cloud 3.1 removes AI infrastructure bottlenecks and reinforces its position with top MLPerf Training v5.1 results. Furthermore, version 3.1 introduces Capacity Blocks and a real-time dashboard, providing enterprises with full visibility into reserved GPU capacity across regions. Additionally, project-level quotas and new storage rules enable tighter control over resources and costs.

Beyond infrastructure and operations, Nebius AI Cloud 3.1 expands its ecosystem to streamline AI development, offering simplified access to NVIDIA BioNeMo NIM microservices for healthcare and life sciences without requiring NGC keys or NVDA AI Enterprise licenses. The release also enhances developer experience with improved Slurm orchestration, FOCUS-compliant billing and a refined console, while strengthening enterprise security with HIPAA-ready audit logs, granular access controls, VPC security groups and Microsoft Entra ID–based IAM for regulated and government workloads.

As AI models grow larger and more complex, platforms like Nebius AI Cloud 3.1 are poised to play a key role in enabling enterprises to innovate faster, without compromising on performance, governance, or control. While capacity expansion supports NBIS’ revenue outlook, with 2025 guidance now set at $500–$550 million, up from the prior $450-$630 million, near-term risks remain. Power constraints, supply-chain uncertainty and intensifying competition from top players like Amazon AMZN and rivals such as CoreWeave, Inc. CRWV could limit capacity growth and weigh on execution in an increasingly crowded AI infrastructure market.

CoreWeave continues to ramp up investments in data centers and server infrastructure to keep pace with the ongoing traction in customer demand. CRWV grew from a niche GPU provider into a leading AI cloud by buying large GPU inventories and carving out relationships with AI labs and companies that need lots of H100/Blackwell-class GPUs. A major force behind its momentum is its multi-billion-dollar agreements with NVDA. Third-quarter highlights include being the first to deploy NVIDIA GB300 NVL72 systems for large-scale frontier AI workloads and the first to offer NVIDIA RTX PRO 6000 Blackwell Server Edition instances, giving CRWV an early lead in real-time AI and simulation workloads.

Amazon is rapidly expanding AWS’ power capacity, doubling what it had in 2022 and on track to double again by 2027. In the fourth quarter alone, it expects to add another 1 GW. The expansion includes power, data centers and chips like AWS’ Trainium and NVIDIA GPUs. AMZN continues to deepen partnerships with NVIDIA, AMD and Intel, placing large chip orders and expanding these relationships over time. Backed by strong security, performance and enterprise focus, AWS continues to dominate major enterprise and government cloud migrations, driving AI demand. To support this, AWS added over 3.8 GW of capacity in the past year, more than any other cloud provider.

Shares of Nebius have gained 179% in the past year compared with the Internet – Software and Services industry’s growth of 26.8%.

Valuation-wise, Nebius seems overvalued, as suggested by the Value Score of F. In terms of Price/Book, NBIS shares are trading at 3.95X, higher than the Internet Software Services industry’s 3.74X.

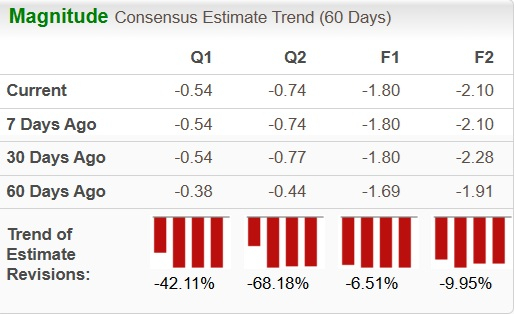

The Zacks Consensus Estimate for NBIS’ 2025 earnings has seen a downward revision over the past 60 days.

NBIS currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 | |

| Mar-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite