|

|

|

|

|||||

|

|

Momentum investing is about following stocks that are already doing well, and retaining them as long as the trend remains strong. While some investors worry that momentum means “buying too late,” history shows that stocks with strong price action often continue rising when their gains are backed by solid earnings growth and clear business momentum. As we head into 2026, this idea is becoming especially relevant.

The market in 2025 has not lifted all stocks equally. Instead, investors have focused on a smaller group of companies that consistently beat earnings expectations, raise guidance and show clear visibility into future growth. These stocks have not just bounced back from past weakness; they have stayed strong month after month, often making new highs. That kind of performance usually signals confidence from both institutions and long-term investors.

What makes today’s momentum different from short-lived rallies is the quality behind it. Many of the leading stocks are benefiting from long-term trends such as artificial intelligence investment, healthcare innovation and infrastructure spending. These companies are generating real profits and cash flow, not just promising future growth. As a result, their momentum is supported by improving fundamentals rather than speculation.

Another important factor is earnings visibility. Stocks with clear demand drivers and predictable revenue streams tend to hold momentum longer because investors can better estimate future results. Even when valuations appear expensive, prices can continue to rise if earnings expectations remain high.

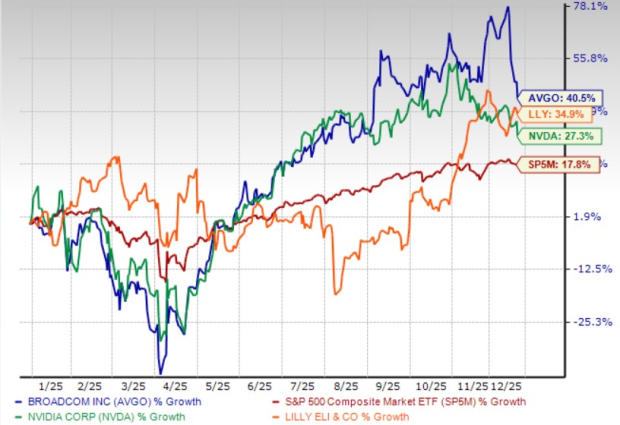

Against this backdrop, stocks like NVIDIA Corporation NVDA, Broadcom Inc. AVGO and Eli Lilly and Company LLY stood out as true momentum leaders in 2025, and these may still have room to run as we move into 2026.

NVIDIA continues to ride the powerful expansion of artificial intelligence and accelerated computing. Surging demand for generative AI and large language models, which rely heavily on GPUs built on the company’s Hopper and Blackwell architectures, is driving strong momentum in data center revenues. At the same time, the steady ramp-up of Ada RTX GPU workstations in the professional visualization market, supported by normalized channel inventory levels, is providing an additional boost to growth.

What makes NVIDIA’s momentum especially powerful is its breadth. Growth is no longer limited to hyperscalers. Enterprises, governments and industrial customers are increasingly investing in AI infrastructure, extending the demand cycle.

The Zacks Consensus Estimate projects fiscal 2027 sales to rise 42.2%, while earnings are expected to grow 52.9% year over year. In the past year, this Zacks Rank #1 (Strong Buy) stock has surged 27.3% compared with the S&P 500’s gain of 17.8%. You can see the complete list of today's Zacks #1 Rank stocks here.

Broadcom is seeing solid momentum driven by expanding demand for AI-focused semiconductors and the ongoing success of its VMware integration. Robust uptake of its networking solutions and custom AI accelerators has been a highlight. The company’s AI business is further strengthened by purpose-built accelerators and advanced networking technologies that enable large-scale AI deployments with higher performance and greater efficiency.

The company’s AI momentum is tied to custom silicon and networking solutions used in data centers, where demand continues to expand. At the same time, its software portfolio provides stability and margin support, helping smooth out semiconductor cyclicality. This balanced model has driven strong free cash flow growth and shareholder returns.

Heading into 2026, Broadcom’s momentum may persist as AI-related infrastructure spending broadens beyond GPUs and into networking, connectivity, and custom chips. With pricing power and disciplined capital allocation, the stock remains well-positioned even after a strong 2025 run.

The Zacks Consensus Estimate projects fiscal 2027 sales to rise by 40.5%, while earnings are expected to grow 39.5% year over year. In the past year, this Zacks Rank #2 (Buy) stock has surged 40.5%.

Eli Lilly represents a different, but equally powerful, form of momentum. In 2025, the stock delivered standout performance driven by explosive demand for its obesity and diabetes treatments. Unlike typical pharmaceutical cycles, Lilly’s growth is tied to a long-duration shift in how metabolic diseases are treated globally.

What supports Lilly’s momentum is visibility. Demand continues to exceed supply, pricing remains favorable, and the company is investing heavily to expand manufacturing capacity. Earnings estimates have consistently moved higher as revenue growth accelerates faster than prior expectations.

The Zacks Consensus Estimate projects 2026 sales to rise by 22.4%, while earnings are expected to grow 41% year over year. In the past year, this Zacks Rank #3 (Hold) stock has surged 34.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite