|

|

|

|

|||||

|

|

Fulgent Genetics, Inc. FLGT recently entered into an agreement to acquire selected assets of Bako Diagnostics and to acquire StrataDx — two well-known pathology testing companies — in a combined transaction valued at $55.5 million. Expected to close in the first half of 2026, the transaction will be funded with cash on hand and is aimed at expanding Fulgent’s laboratory services platform into high-quality anatomic pathology and dermatopathology services. By acquiring companies like Bako and StrataDx, FLGT aims to strengthen its customer base and gain pathology experts, as well as a larger sales team to sell its tests nationwide.

Per management, Fulgent has been growing at double-digit rates for several quarters and the acquisition of Bako and StrataDx fits well with the company’s long-term strategy of scaling its laboratory services business. By using its AI technology and digital pathology infrastructure, Fulgent expects to improve efficiency and test quality of its diagnostic capabilities in the pathology testing market.

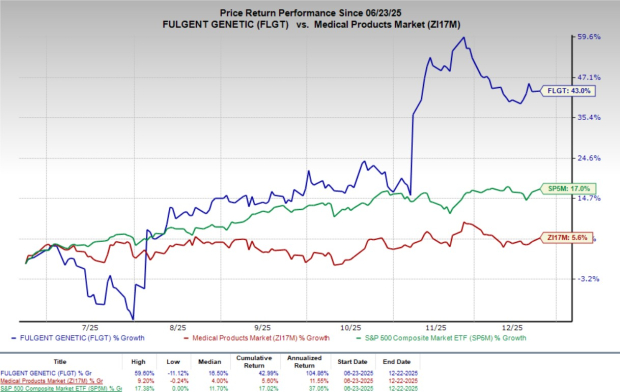

Following the announcement, shares of FLGT gained 0.1% at yesterday’s closing. Over the past six months, shares of the company have climbed 43% compared with the industry’s 5.6% growth and the S&P 500’s 17% rise.

In the long run, by adding Bako Diagnostics and StrataDx, Fulgent will strengthen its laboratory services, offer new tests, expand insurance coverage and increase its national customer base to position it as a comprehensive diagnostics provider. Further, FGLT’s strong lab operations, data analysis, workflows and AI, in combination with Bako’s advanced molecular and PCR-based tests and StrataDx’s specialization in dermatopathology, support the company’s growth and margin expansion in the pathology testing market.

FLGT currently has a market capitalization of $853.49 million.

For Fulgent, acquiring Bako Diagnostics and StrataDx expands its presence in the anatomic pathology and dermatopathology testing market. The company’s investments in digital pathology and AI tools, such as Eziopath — a proprietary image management system that can be used to process tests at Bako’s and StrataDx’s laboratories to increase efficiency — reduce turnaround time and maintain high-quality diagnostic results. In addition, Bako’s proprietary PCR tests allow faster and more cost-effective results to expand Fulgent's testing menu in the pathology sector.

The transaction delivers meaningful commercial synergies. Bako’s comprehensive testing menu includes complete anatomic pathology services, proprietary molecular genetics and PCR-based tests and peripheral neuropathy immunohistochemical testing. StrataDx leads in providing strong dermatopathology testing services with a national client base. As pathology shifts toward digital and AI-assisted workflows, together, these assets broaden Fulgent’s diagnostic offerings and enhance its appeal as a one-stop diagnostic services provider.

By integrating the broad testing services and national sales teams of both Bako and StrataDx, Fulgent aims to achieve its objective of providing comprehensive, nationwide diagnostic services. Bako's national sales force is expected to double the size of Fulgent's current pathology sales team, thereby allowing FLGT to connect with more patients and offer a complete range of diagnostic products and services, leading to better healthcare delivery. Overall, the acquisition extends Fulgent’s footprint with CLIA, CAP and NY State-certified laboratories in Georgia and Massachusetts, offering a wide range of tests across different medical specialties while improving efficiency and expanding its national footprint.

Going by data provided by Precedence Research, the digital pathology market is valued at $1.28 billion in 2025 and is expected to witness a CAGR of 8.05% through 2034. Factors like the rising potential for AI-based disease screening, reduced workload or fatigue for pathologists and improved patient outcomes like higher quality and faster results are driving the market’s growth.

Fulgent announced encouraging preliminary Phase 2 data for FID-007 combined with cetuximab in recurrent or metastatic head and neck cancer, to be presented at ESMO 2025, highlighting progress in its oncology pipeline alongside strong diagnostics business revenues.

The company has also received EU IVDR CE certification for its germline next-generation sequencing system, including FulgentExome and Pipeline Manager software. The certification covers over 4,600 validated genes, making Fulgent a comprehensive end-to-end germline testing lab for hereditary disease diagnosis in Europe.

Fulgent Genetics, Inc. price | Fulgent Genetics, Inc. Quote

Currently, FLGT carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Omnicell OMCL, CareCloud CCLD and Schrodinger SDGR.

Omnicell, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 51 cents, which surpassed the Zacks Consensus Estimate by 41.67%. Revenues of $311 million beat the Zacks Consensus Estimate by 5.64%. You can see the complete list of today’s Zacks #1 Rank stocks here.

OMCL has an estimated long-term earnings growth rate of 9.4% compared with the industry’s 27.9% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 38.65%.

CareCloud, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 adjusted EPS of 10 cents, which surpassed the Zacks Consensus Estimate by 25.00%. Revenues of $31.1 million beat the Zacks Consensus Estimate by 8.34%.

CCLD has an estimated earnings recession rate of 45.31% for 2025 against the industry’s 22.4% growth. The company missed earnings estimates in the trailing four quarters, the average surprise being 2.88%.

Schrodinger, currently carrying a Zacks Rank #2, reported a third-quarter 2025 loss per share of 45 cents, which surpassed the Zacks Consensus Estimate by 40.00%. Revenues of $54.3 million beat the Zacks Consensus Estimate by 8.68%.

SDGR has an estimated long-term earnings growth rate of 37.8% compared with the industry’s 27.9% growth. The company’s earnings have missed estimates in the trailing four quarters, the average surprise being 0.93%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 hours | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite