|

|

|

|

|||||

|

|

The streaming revolution has reshaped how consumers access entertainment, with Roku ROKU and Netflix NFLX emerging as two key beneficiaries of the secular shift away from traditional cable television. Netflix commands one of the world’s largest subscription streaming audiences, supported by a broad global reach and engagement. Roku has established itself as the dominant streaming platform in the United States, anchoring content discovery and streaming access across multiple services through its operating system.

Both companies benefit from common streaming tailwinds, including expanding user bases, rising streaming hours and strategies designed to deepen engagement. Netflix drives this through sustained investment in original content across genres and geographies, while Roku enhances engagement through platform-led distribution and The Roku Channel. Let us delve deeper to determine which is a better investment now.

Roku's platform-agnostic model creates a structural advantage in the streaming ecosystem. The company's proprietary devices and smart TVs connect 85.5 million streaming households, recording 32 billion streaming hours in the third quarter of 2025. Unlike Netflix, which relies on third-party devices and sustained capital investment in content, Roku owns the viewer relationship at the operating-system level and monetises engagement regardless of which services consumers stream.

The Roku Channel reinforces engagement as the number two app on the platform by streaming hours, generating more than 1.6 billion hours in the third quarter. Roku’s 2026 slate includes Originals such as Broad Trip, The Laguna Beach Reunion, This First House and The Great American Baking Show Season 2, alongside third-party titles like The Spiderwick Chronicles and Die Hart Season 3. The Roku Sports Channel extends viewing through live MLB Sunday Leadoff games, NBA G League games, Formula E races and sports originals, including NFL Draft: The Pick Is In and WWE: Next Gen. Howdy, Roku’s low-cost ad-free subscription service, targets price-sensitive viewers and helps lift streaming hours.

Roku's diverse streaming offerings and multi-channel revenue model capture value from expanding streaming consumption. As streaming hours surged 20% year over year, Roku monetizes engagement through home screen advertising, subscription revenue sharing and device licensing fees. Expanding advertiser adoption through Ads Manager and deepened integrations with Amazon DSP and Trade Desk strengthen programmatic capabilities targeting the $30 billion streaming advertising market. This generates superior operating leverage as Roku profits from all streaming activity without the heavy content capital obligations constraining Netflix's margins.

The Zacks Consensus Estimates for Roku’s 2026 EPS is pegged at $1.21, up by 4.3% over the past 30 days, indicating year-over-year growth of 265.6%.

Roku, Inc. price-consensus-chart | Roku, Inc. Quote

Netflix operates a content-first business model that has established it as the leading global destination for streaming. The company ended the third quarter of 2025 with over 301.6 million paid subscribers across 190 countries and continues to capture a growing share of viewing time, achieving a TV view share of 8.6% in the United States. Unlike Roku’s platform-based approach, Netflix concentrates engagement within its own ecosystem, using exclusive content to drive streaming hours and subscriber retention.

Netflix’s 2026 content slate reflects sustaining streaming consumption. Returning series include Stranger Things (finale), Bridgerton Season 4 and Squid Game: The Challenge Season 3. New series such as East of Eden, Man on Fire and The Boroughs expand the scripted pipeline. At the same time, film releases include Narnia: The Magician’s Nephew, APEX, The Rip and Enola Holmes 3, which are expected to support tentpole viewing events. Netflix’s global distribution footprint allows these titles to scale efficiently, spreading production costs across a massive subscriber base and reinforcing per-subscriber economics.

Netflix is diversifying monetization through an advertising-supported tier and gaming initiatives tied to engagement. NFLX is also expanding into selective live sports and event programming in 2026, including MLB Opening Night, the T-Mobile Home Run Derby, MLB at Field of Dreams and ongoing WWE Raw, adding appointment viewing that can lift streaming hours.

However, Netflix’s content-led model requires continuous capital deployment, resulting in gross debt of approximately $14.5 billion amid rising production costs. In contrast to Roku’s asset-light platform model, which benefits from streaming growth without owning content at scale, Netflix must continually reinvest to sustain engagement. The proposed acquisition of Warner Bros. Discovery introduces integration risk and incremental capital demands.

The Zacks Consensus Estimate for NFLX’s 2026 EPS is pegged at $3.21, up by 0.63% over the past 30 days, indicating year-over-year growth of 26.93%.

Netflix, Inc. price-consensus-chart | Netflix, Inc. Quote

Over the past six months, Roku shares have risen 12.6%, while Netflix has declined 22.6%. The divergence reflects preference for Roku’s asset-light platform model, while Netflix’s content-heavy strategy and roughly $14.5 billion debt weigh on sentiment.

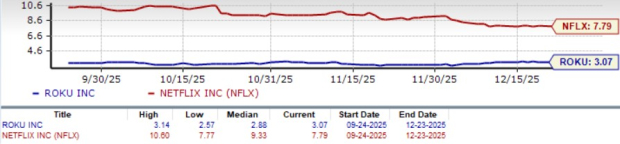

Despite recent share price weakness, Netflix trades at a significant premium to Roku, with a forward twelve-month P/E of 7.79x versus Roku’s 3.07x. NFLX’s valuation reflects priced-in scale and earnings stability, while ROKU’s lower multiple offers greater upside potential as its asset-light platform model and streaming monetisation continue to scale.

Roku and Netflix benefit from the ongoing shift away from traditional television toward streaming. However, Roku’s asset-light platform model provides broader and more efficient exposure to industry-wide streaming growth and improving monetisation, while Netflix’s content-first approach involves heavier capital investment, high debt and ongoing reinvestment requirements. At current levels, Roku appears better positioned on a risk–reward basis, whereas Netflix may warrant a more attractive entry point. ROKU currently carries a Zacks Rank #2 (Buy), whereas NFLX has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite