|

|

|

|

|||||

|

|

CoreWeave, Inc.’s CRWV third-quarter 2025 results reinforced its position as one of the most profitable and fastest-growing AI-focused cloud infrastructure providers. CoreWeave’s adjusted EBITDA was $838.1 million in the third quarter compared with $378.8 million in the prior-year quarter. EBITDA margins exceeded 60%, reflecting strong operating leverage, disciplined cost management and highly contracted revenue streams.

Management emphasized that margin performance continues to benefit from long-term customer agreements, high utilization rates and an infrastructure model optimized specifically for AI workloads rather than general-purpose cloud computing. This specialization allows CoreWeave to extract higher returns per deployed GPU compared with traditional hyperscalers.

Capital expenditures remain elevated as CoreWeave accelerates investments in data centers, power infrastructure and next-generation GPUs. Management characterized this spending as demand-driven rather than speculative, noting that a substantial portion of new capacity is backed by pre-committed contracts.

While near-term margins may fluctuate modestly due to the timing of capacity expansions, management underscored that incremental deployments remain margin-accretive once assets are fully operational. CoreWeave’s backlog and remaining performance obligations provide strong visibility into future revenue and profitability, reducing the risk typically associated with large-scale infrastructure buildouts.

Apart from this, CoreWeave continues to benefit from multiple growth tailwinds. Demand from AI labs, enterprise customers and hyperscale partners remains robust, driven by ongoing shortages of high-performance compute capacity. The company has close ecosystem relationships, including access to advanced GPU platforms. Also, CoreWeave has secured major multi-year agreements, including up to $14.2 billion with Meta, expanded its OpenAI partnership to around $22.4 billion and won a sixth contract with a leading hyperscaler. These deals highlight its transformation from a niche GPU cloud provider into a global AI infrastructure leader, powered by purpose-built HPC networking and large-scale parallel compute.

For 2025, Capex is estimated to be $12 billion to $14 billion compared with $20 billion to $23 billion projected earlier. The company expects 2026 capital expenditures to be more than double the level seen in 2025. While rising capital expenditures introduce execution risk, CoreWeave’s third-quarter performance and forward guidance suggest that its margin profile remains resilient. With strong demand visibility, a highly specialized infrastructure model and disciplined capital allocation, CoreWeave appears well-positioned to maintain EBITDA margins above 60% even as it scales aggressively to support the next phase of AI-driven growth.

Nebius Group N.V. NBIS is another hypergrowth AI infrastructure-focused company. It recently announced a new agreement with Meta to deliver AI infrastructure valued at approximately $3 billion over the next five years. The company’s mega-deals with Microsoft and Meta are expected to begin contributing late in the quarter, with the majority of related revenue ramping up throughout 2026. For 2025, Nebius has tightened its full-year group revenue outlook to a range of $500 million to $550 million from the previous guidance of $450 million to $630 million. It has raised its capital expenditure guidance from approximately $2 billion to around $5 billion. Although the company expects adjusted EBITDA to turn slightly positive at the group level by year-end 2025, it will remain negative for the full year.

Microsoft Corporation MSFT is gaining from its AI strength. Microsoft recently announced plans to increase total AI capacity by more than 80% in 2025 and roughly double the total data center footprint over the next two years. The company unveiled Fairwater in Wisconsin as the world's most powerful AI data center, which will scale to two gigawatts and go online next year. In first-quarter fiscal 2025, the company’s capital expenditures totaled $34.9 billion, with roughly half allocated to short-lived assets, primarily GPUs and CPUs, to support increasing Azure platform demand and first-party applications. Microsoft expects the fiscal 2026 capital expenditure growth rate to be higher than fiscal 2025, driven by accelerating demand and a growing RPO balance.

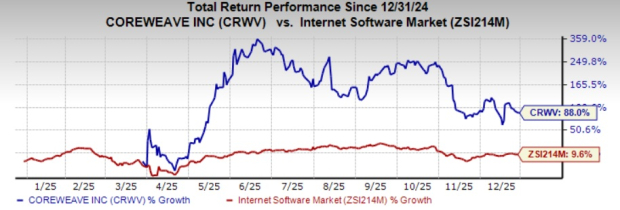

Shares of CoreWeave have gained 88% in the past year compared with the Internet Software industry’s growth of 9.6%.

In terms of Price/Book, CRWV’s shares are trading at 9.44X, way higher than the Internet Software Services industry’s 6.07X.

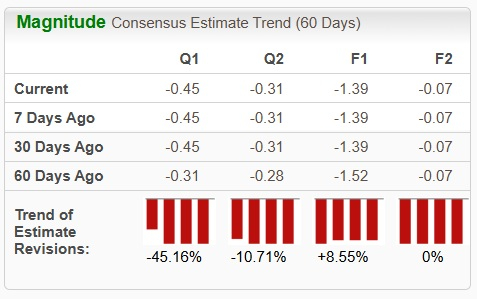

The Zacks Consensus Estimate for CRWV’s earnings for 2025 has been revised north over the past 60 days.

CRWV currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 25 min |

AI Stealth Play Receives Bullish Initiation; Data Center Revenue Expected To Grow 64%

NBIS

Investor's Business Daily

|

| 28 min | |

| 36 min | |

| 38 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite