|

|

|

|

|||||

|

|

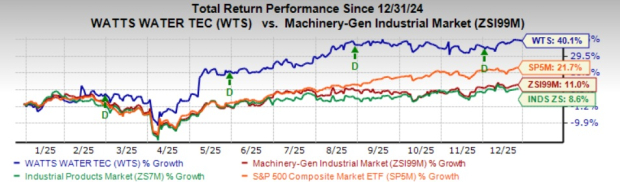

Watts Water Technologies, Inc. WTS is gaining from robust acquisitions, aggressive cost-reduction actions and a strong balance sheet. In the past year, shares of the company have surged 40.1%, outperforming the Zacks Manufacturing - General Industrial industry’s growth of 11%. It has also outpaced the Zacks Industrial Products sector and the S&P 500 composite’s growth of 8.6% and 21.7%, respectively.

It closed the last trading session at $282.62, hovering close to its 52-week high of $287.89. Let’s take a closer look at WTS’ fundamentals, growth drivers, competitive advantages and potential risks to assess its growth potential in 2026.

Watts Water has continued to strengthen its portfolio through a series of strategic acquisitions. Recently, Watts completed the acquisition of Saudi Cast, a Riyadh-based manufacturer of cast iron and stainless-steel drainage solutions for non-residential and industrial markets. The business generates approximately $20 million in annualized sales and will be included in Watts’ APMEA region. In November 2025, Watts Water completed the buyout of Superior Boiler, a leading designer and manufacturer of customized steam and hot water boilers for commercial, institutional and industrial applications. Superior generates approximately $60 million in annualized sales.

In the third quarter of 2025, Watts acquired Haws Corporation, a leading provider of emergency safety and hydration solutions, broadening its specified product portfolio and enabling the company to deliver more comprehensive solutions to customers. In June 2025, Watts acquired the assets of EasyWater, which designs and manufactures innovative water conditioning and filtration solutions across residential, commercial and industrial markets, enhancing the company’s water quality portfolio. In January 2025, Watts acquired I-CON Systems, a leading provider of plumbing control solutions for the corrections market, supporting the company’s strategy to drive innovation, expand digital offerings and deepen penetration in institutional end markets.

These acquisitions contributed meaningfully to recent performance. In the third quarter of 2025, additional sales from I-CON and EasyWater, along with favorable foreign exchange, added approximately $11 million, or about 3%, to reported growth in the Americas. For fourth-quarter 2025, management expects roughly $20 million in incremental regional sales from the combined impact of the I-CON, EasyWater and Haws acquisitions.

Watts Water is focused on enhancing organic growth and driving margin expansion, and reinvesting in productivity initiatives. The company focuses on augmenting growth through new product development and geographic expansion. Watts Water aims to launch smart and connected products, which are likely to provide it with further differentiation in the marketplace. In October 2024, Watts Water unveiled its intelligent water management solution – Nexa. The company is expanding its go-to-market strategies with a growing pipeline and positive customer feedback on value creation through risk mitigation, water savings and enhanced comfort. Watts Water aims to further scale its digital solutions ecosystem. The company’s margin performance is also benefiting from aggressive cost reduction actions.

Watts Water Technologies, Inc. price-consensus-chart | Watts Water Technologies, Inc. Quote

For the fourth quarter of 2025, the company remains on track to meet its full-year target of converting free cash flow at a rate equal to or greater than 100% of net income. It expects the adjusted operating margin to be between 17% and 17.5%, implying growth of 20-70 basis points (bps) year over year. Watts Water anticipates fourth-quarter seasonality to drive strong operating and free cash flow.

For 2025, the adjusted operating margin is expected at 19.1%–19.2%, up 140–150 bps. The company had previously guided adjusted operating margin to be between 18.2% and 18.8%, implying an improvement of 50-110 bps year over year. Also, the company anticipates reported sales to rise 7%–8% in 2025 (previous guided range was between 2% and 5%), with organic sales up 4%–5% (previous guided range was from flat to an increase of 3%).

Potential tariff headwinds, softness in the European segment and intensifying competition remain key concerns for Watts Water. In third-quarter 2025, net sales in Europe were down 2% year over year on an organic basis. Organic sales declined as lower volumes in drains and ongoing market weakness outweighed pricing gains. The company anticipates weakness in the Europe segment to persist. For the fourth quarter, sales in Europe are expected to decline 3% to grow 1%. For 2025, sales in Europe are expected to decrease between 6% and 5%.

The stock trades at price-to-book (P/B) ratio of 4.82, below the industry’s average of 8.14.

With strong cash flow, synergies from acquisitions, a consistent share repurchase program and margin expansion, WTS continues to offer attractive upside despite the stock’s near-term headwinds. Hence, investors can consider adding it to their portfolio now.

At present, WTS sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some other top-ranked stocks from the broader technology space are Helios Technologies, Inc. HLIO, Dover Corporation DOV and Illinois Tool Works Inc. ITW. HLIO sports a Zacks Rank #1, while DOV & ITW carry a Zacks Rank #2 (Buy).

Helios Technologies’ earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 16.8%. In the last reported quarter, HLIO delivered an earnings surprise of 10.77%. HLIO shares have surged 23.9% over the past year.

DOV’s earnings beat the consensus estimate in each of the trailing four quarters, with the average surprise being 3.92%. In the last reported quarter, Dover delivered an earnings surprise of 4.8%. Its shares have jumped 8% in the past year.

ITW’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 2.24%. In the last reported quarter, ITW delivered an earnings surprise of 4.46%. Its shares have gained 1.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite