|

|

|

|

|||||

|

|

The performance of the Interactive Brokers Group IBKR stock has been impressive this year. Its shares have rallied 47.2%, outperforming the industry’s 38.5% growth and the S&P 500 Index’s 19.7% rise. Moreover, IBKR’s price performance has been better than that of its close peers, Charles Schwab SCHW and Tradeweb Markets Inc. TW. The Schwab stock has gained 35.9% this year, whereas shares of Tradeweb Markets have declined 17.6%.

Does the Interactive Brokers stock have more upside left despite showing recent strength in share price? Let us dig into its fundamentals and growth prospects to get a clear picture.

Technological Excellence: Interactive Brokers’ technological superiority remains one of its strongest aspects. The company processes trades in stocks, digital assets, futures, options and forex on more than 160 exchanges across several countries and currencies.

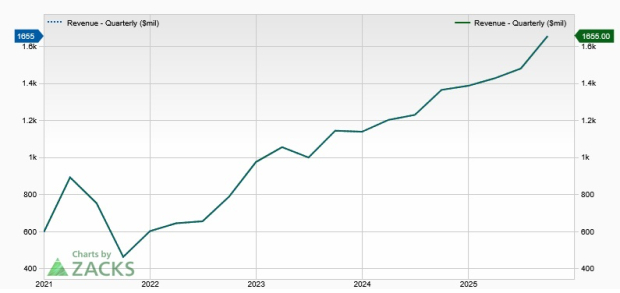

IBKR’s compensation expenses relative to net revenues (10.4% in the first nine months of 2025) remain below its industry peers due to its superior technology. Further, the company has been emphasizing developing proprietary software to automate broker-dealer functions, leading to a steady rise in revenues. Over the last five years (2019-2024), total net revenues witnessed a compound annual growth rate (CAGR) of 21.8%, with the upward momentum continuing in the first nine months of 2025.

IBKR also has a robust Daily Average Revenue Trades (DARTs) number, which, along with a favorable trading backdrop, is expected to keep driving the top line. The company’s technological superiority, combined with easier regulations to improve product velocity, will likely help its net revenues through higher client acquisitions.

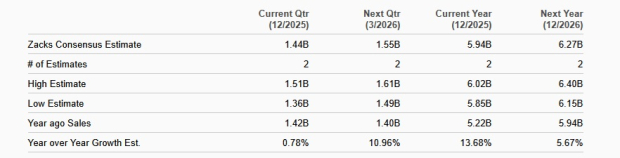

The Zacks Consensus Estimate for IBKR’s 2025 and 2026 revenues is $5.94 billion and $6.27 billion, which indicates year-over-year growth of 13.7% and 5.7%, respectively.

Product Diversification Efforts: Interactive Brokers has continuously been making efforts to expand the product suite and reach of its services. In October 2025, the company launched the Karta Visa card for its clients to make purchases globally with a card linked to their IBKR account. In August, it introduced Connections, a feature designed to help investors discover trading opportunities and evaluate investments by highlighting related ideas across global markets.

Also, it has pioneered nearly 24-hour overnight trading on U.S. stocks and ETFs, launched commission-free IBKR Lite and introduced the Impact Dashboard for sustainable investing.

Other notable launches include the IBKR Desktop platform and low-cost cryptocurrency trading through Paxos Trust Company.

These initiatives are expected to strengthen Interactive Brokers’ market share amid stiff competition and help diversify operations.

Global Market Access: IBKR’s greatest strength in the brokerage space stems from its deep, multi-asset global market access, which remains unmatched by most retail and even many institutional-focused competitors. The global breadth not only differentiates the firm from brokers that are predominantly U.S.-centric, but also positions it as the preferred choice for sophisticated investors, hedge funds, proprietary traders and internationally active retail clients.

In order to enhance its global presence, Interactive Brokers has continuously been undertaking several initiatives. At the beginning of December 2025, the company announced that eligible clients outside of Brazil can now trade Brazilian equities through B3, the Brazil Stock Exchange, giving investors more ways to access emerging market opportunities across Latin America. Also, IBKR announced the introduction of United Arab Emirates equities through two leading exchanges.

A few months ago, the company launched zero-commission U.S. stock trading in Singapore and NISA accounts to help Japanese investors build wealth tax-free. After launching Forecast Contracts (those whose value is based on whether a specific event will occur at or before a particular time) for eligible clients in the United States and Hong Kong, IBKR has expanded it into Europe.

Apart from these, IBKR has expanded its offerings with Plan d’Epargne en Actions accounts for French clients and the IBKR GlobalTrader app for global stock trading. Its clients are also allowed to trade stocks on one of the largest stock exchanges in Southeast Asia, Bursa Malaysia.

In 2023, IBKR announced the consolidation of its brokerage operations in the European Union, which aligns with its commitment to operational efficiency through automation. Also, after becoming the first SFC-licensed securities broker to be approved to allow retail clients to trade cryptocurrencies in Hong Kong, the company launched crypto trading in the U.K.

Robust Liquidity Position: As of Sept. 30, 2025, IBKR had cash and cash equivalents (including cash and securities segregated for regulatory purposes) of $92.6 billion. Moreover, the company uses insignificant debt to finance its operations. Thus, given a solid liquidity position, IBKR’s capital distribution actions look sustainable, through which it is expected to keep enhancing shareholder value.

While Interactive Brokers has been consistent with its dividend payment for a long time, it has been increasing its quarterly dividends in the last two years. In April 2025, it announced a 28% jump in dividend, which followed a whopping 150% surge in 2024. Additionally, it had a four-for-one forward split of its common stock in June 2025 to make shares more accessible to investors.

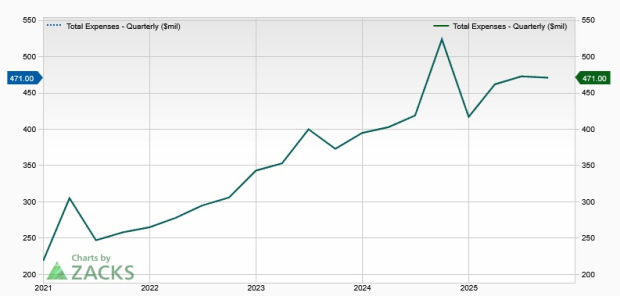

Elevated Expense Base: Interactive Brokers has been witnessing a steady increase in non-interest expenses over the past few years. Expenses witnessed a CAGR of 13.8% over the five years ended 2024.

The increase in expenses has primarily been due to higher execution, clearing and distribution fees. While expenses trended lower in the first nine months of 2025, continued investments in franchises, the launch of new products and services, and the upgrade of technology are expected to keep expenses elevated in the near term.

High Reliance on International Revenues: IBKR is a geographically diversified company with a presence across the globe. The company generates a large portion of its revenues (almost 37% of total net revenues) from overseas operations.

Several risks stemming from the regulatory and political environment, foreign exchange fluctuations and the performance of local economies may hurt its financials.

Interactive Brokers remains well-positioned for growth in the current volatile operating environment. While the company’s profitability is expected to be hampered because of elevated expenses, its strong technological capabilities and diversified product offerings enhance its global reach, supporting long-term growth.

Also, rapidly evolving trends will benefit the company’s revenues and expand its market share.

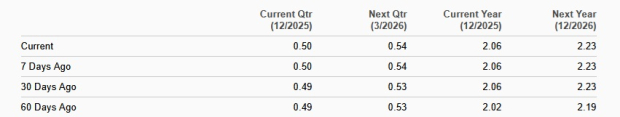

Over the past 60 days, the Zacks Consensus Estimate for the company’s 2025 and 2026 earnings has moved upward. The estimates reflect year-over-year growth rates of 17.1% and 8.1% for 2025 and 2026, respectively.

The upward earnings estimate revisions reflect that analysts are optimistic regarding IBKR’s earnings growth potential. Thus, it seems to be a wise idea to invest in the stock now.

At present, IBKR carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 9 hours | |

| 9 hours | |

| 15 hours | |

| 18 hours | |

| 19 hours | |

| 19 hours | |

| 19 hours | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite