|

|

|

|

|||||

|

|

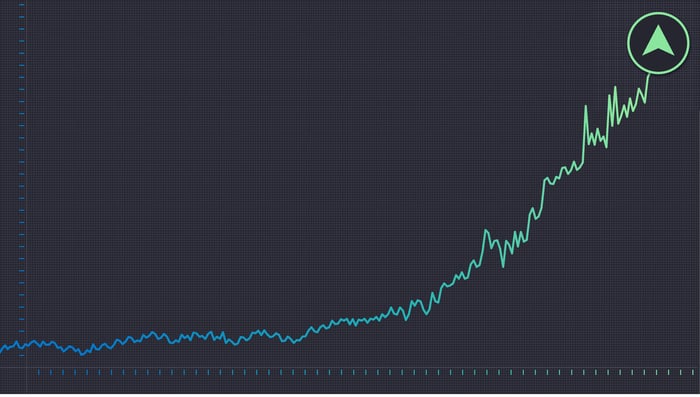

Over the last 20 years, this trucking company's stock has vastly outpaced the broader market.

The current downcycle has lingered, and the company's latest updates indicate that volumes remain under pressure.

Even after the stock's pullback, shares still carry a premium valuation.

For investors looking to build their portfolios with investments in high-quality businesses, Old Dominion Freight Line (NASDAQ: ODFL) is the kind of company that tends to end up on the shortlist. It is a leading less-than-truckload (LTL) carrier in North America, and it has built a reputation around exceptional service and disciplined pricing.

But the last few years haven't been representative of the company's typical, consistently strong growth. Freight volumes have been in a slump that has lasted longer than most industry onlookers expected, leading many to call it a "freight recession." And since a key part of Old Dominion's business model is that it maintains excess capacity during slow periods so that it can quickly take market share when volumes finally pick back up, its business sees an outsize negative impact during times like this.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

As investors wait for freight volumes to pick back up, is it a good time to buy shares of this long-term compounder?

Image source: Getty Images.

Old Dominion's long-term track record is difficult to ignore. Not only has its stock compounded at approximately a 20% annualized return over the last 20 years, but the company's business model, which focuses on great service, a robust fleet, and owning the majority of its own service centers instead of leasing them, helps it rapidly gain market share during economic booms.

Even during this rough patch, the company is maintaining its high standards for service. In Q3, management said the company again delivered 99% on-time service and a cargo claims ratio of 0.1%.

Of course, great execution doesn't eliminate macro pressure.

In Old Dominion's third-quarter 2025 results, total revenue fell to about $1.41 billion, down 4.3% year over year. Net income declined, and diluted earnings per share fell 10.5% year over year to $1.28.

Explaining the company's outsize decline in earnings relative to revenue, Old Dominion's operating ratio (operating expenses as a percent of revenue) rose to 74.3% from 72.7% a year earlier. Management attributed that to "deleveraging" -- when volumes fall, many of its costs do not fall in tandem, so margins compress.

The company's operating metrics put the spotlight on the weak environment: LTL tons per day fell 9% in the quarter, reflecting a 7.9% decline in shipments per day and a 1.2% decline in weight per shipment. Pricing, at least, stayed firm: LTL revenue per hundredweight excluding fuel surcharges rose 4.7%.

A later inter-quarter update focusing on November suggests the demand picture still hasn't turned. In its November 2025 operating update, Old Dominion said revenue per day declined 4.4% year over year, driven by a 10% drop in LTL tons shipped per day. And shipments per day were down 9.4%. As usual, pricing held up, with quarter-to-date revenue per hundredweight (excluding fuel) up 5.2% versus the prior year period.

That combination -- weaker volumes but positive pricing yield -- is a good snapshot of Old Dominion's typical quarter recently; the company is protecting price, but it cannot force freight demand to recover.

One reason Old Dominion has historically come out of downturns stronger is that it tends to keep investing and returning capital even when conditions get uncomfortable.

In the third quarter of 2025, the company generated about $437.5 million in operating cash flow, and about $1.1 billion over the first nine months of 2025. It also reaffirmed an expectation for roughly $450 million in 2025 capital expenditures, with spending directed toward service center expansion, equipment, and technology.

Additionally, Old Dominion continued returning capital to shareholders. Over the first nine months of 2025, Old Dominion returned about $782.6 million -- $605.4 million via share repurchases and $177.2 million via dividends. With a market capitalization of $32 billion, capital returns of this magnitude can make a significant impact on share count and long-term shareholder returns.

Even after the stock's recent pullback, Old Dominion shares aren't an obvious bargain. Shares currently trade at a price-to-earnings ratio of 32 -- a valuation reflecting confidence in a rebound and in Old Dominion's ability to keep compounding over time.

Of course, that confidence is likely justified. The company is still holding strong on pricing, delivering top-tier service, reinvesting in its business, and returning significant capital to shareholders -- traits that have been vital to its long-term outperformance and position the stock well for an eventual recovery in freight volumes.

Still, the freight downturn persists, and there's no clear indication of when a recovery will ensue. Tonnage and shipments were down meaningfully in the third quarter, and the November update showed continued year-over-year volume declines.

Overall, I think the stock's pullback may be worth buying into. But investors who buy shares today will have to keep a close eye on the freight market, and they should consider keeping their position small since there's no clear sign of freight volumes improving. When freight volumes finally do recover, Old Dominion shareholders will almost certainly benefit -- the question is about timing. No one knows how long freight volumes will remain soft.

Before you buy stock in Old Dominion Freight Line, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Old Dominion Freight Line wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $490,703!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,157,689!*

Now, it’s worth noting Stock Advisor’s total average return is 966% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 3, 2026.

Daniel Sparks and his clients have no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Old Dominion Freight Line. The Motley Fool has a disclosure policy.

| Feb-17 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-09 | |

| Feb-07 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite