|

|

|

|

|||||

|

|

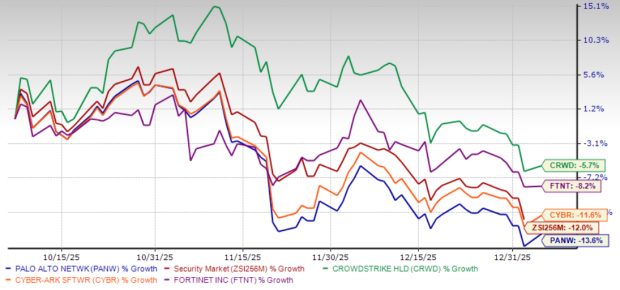

Palo Alto Networks’PANW shares have lost 13.6% over the past three months, underperforming the Zacks Security industry’s decline of 12%. The stock has also underperformed its industry peers and competitors, including CyberArk CYBR, CrowdStrike CRWD and Fortinet FTNT. In the past three months, shares of CyberArk, CrowdStrike and Fortinet have lost 11.6%, 5.7% and 8.2%, respectively.

The underperformance of Palo Alto Networks’ shares raises the question: Should investors continue holding PANW stock or exit the investment?

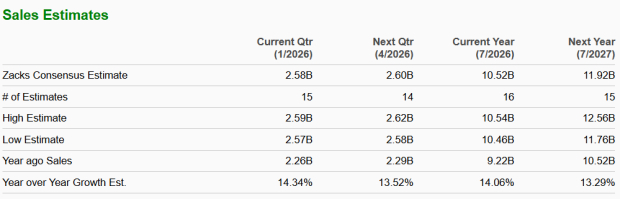

Palo Alto Networks is experiencing a slowdown in its sales growth. Notably, the company’s revenue growth rate has been in the mid-teen percentage range over the past year, a sharp contrast from the mid-20s percentage in fiscal 2023.

This deceleration is expected to continue into fiscal 2026, with the company forecasting full-year revenue growth in the range of 14-15%. In the recently reported financial results for the first quarter of fiscal 2026, revenues grew 16% year over year. The Zacks Consensus Estimate for fiscal 2026 and 2027 indicates revenue growth to remain in the low-to-mid-teen percentage range.

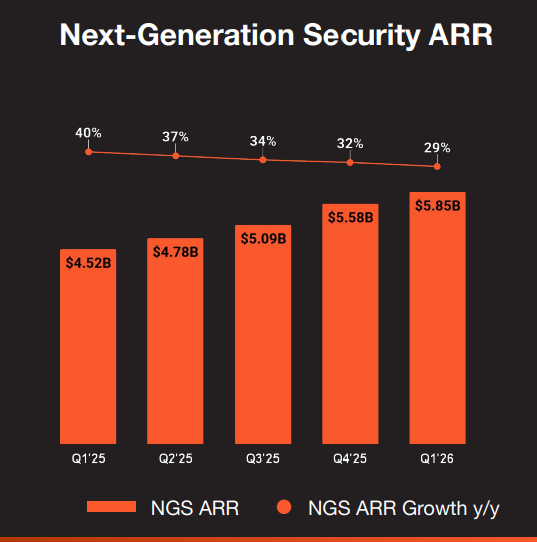

Another concern is the slowing growth of NGS ARR, a key metric for Palo Alto Networks' long-term financial health. The company has reported six consecutive quarters of decelerating NGS ARR growth. Furthermore, for fiscal 2026, Palo Alto Networks expects NGS ARR in the range of $7.00-$7.10 billion, suggesting 26-27% growth. This indicates a slowdown from 32% growth in fiscal 2025 and 45%+ in fiscal 2024.

While this is still impressive, the decelerating momentum has disappointed investors, considering the rising demand for cloud security and AI-powered solutions. However, for investors, not everything is gloom and doom.

Palo Alto Networks is well-positioned to capitalize on the growing demand for advanced cybersecurity solutions. According to Fortune Business Insights, the global cybersecurity market is projected to expand from $218.98 billion in 2025 to $699.39 billion by 2034, representing a massive addressable market. As cyber threats become more sophisticated, enterprises are increasingly prioritizing multi-layered security platforms, which directly contribute to PANW’s strengths.

The company’s continued innovation in AI, automation and cloud security reinforces its competitive lead. AI is increasingly embedded into Palo Alto Networks’ offerings, which is helping it win multi-product deals through platforms like Cortex XSIAM and Prisma AI-Ready Security (Prisma AIRS).

In the first quarter of fiscal 2026, the company said Cortex XSIAM continued to grow strongly. The platform now has about 470 customers. On average, each customer spends more than $1 million in ARR. This shows that Cortex XSIAM is mainly used by large enterprise customers.

Deal sizes are getting larger. During the first quarter, Palo Alto Networks signed its biggest Cortex XSIAM deal so far. A large U.S. telecom company agreed to an $85 million contract. Management said customers are choosing Cortex XSIAM to replace older security tools. The goal is to reduce the number of products they manage and improve response times. More than 60% of customers using Cortex XSIAM have reduced their median time to respond from days or weeks to just minutes.

Furthermore, Palo Alto Networks recently announced that it is expanding its partnership with Google Cloud. Under the expanded partnership agreement, PANW’s Prisma AIRS will be integrated with Google Cloud services, such as Vertex AI and Agent Engine. This will allow customers to secure AI models, data, and agents while they are running on Google Cloud.

Apart from Google Cloud, PANW has integrated Prisma AIRS with several other AI agent platforms, including Factory, Glean, IBM, and ServiceNow. These integrations secure AI agents inside tools that customers already use.

Palo Alto Networks is currently trading at a lower price-to-sales (P/S) multiple compared to the industry. PANW’s forward 12-month P/S ratio sits at 11.24X, slightly lower than the industry’s forward 12-month P/S ratio of 12.22X.

Palo Alto Networks stock trades at a lower P/S multiple compared with CyberArk and CrowdStrike, while trading at a higher P/S multiple compared with Fortinet. At present, CyberArk, CrowdStrike and Fortinet have P/S multiples of 13.83X, 19.86X and 7.73X, respectively.

Palo Alto Networks remains a leader in cybersecurity, with a strong long-term growth trajectory, continued AI-driven innovation and a shift toward a more predictable recurring revenue model. However, slowing revenue and NGS ARR growth rates warrant a cautious approach to the stock.

Despite these headwinds, Palo Alto Networks’ reasonable valuation offers some downside protection. This discounted pricing makes PANW an attractive long-term hold, particularly for investors seeking exposure to cybersecurity growth at a fair price.

Currently, Palo Alto Networks carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Stock Market Today: Dow Dives As EU Makes Trump Tariff Move; Novo Plunges On This (Live Coverage)

CRWD -9.85%

Investor's Business Daily

|

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite