|

|

|

|

|||||

|

|

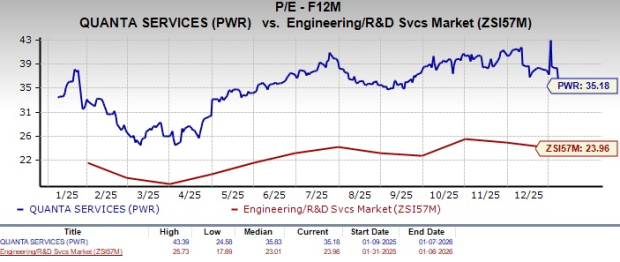

Quanta Services, Inc. PWR is currently trading at a premium compared with the Engineering - R and D Services industry peers and the broader Construction sector, with a forward 12-month price-to-earnings (P/E) ratio of 35.18. The industry’s average currently is 23.96, while the sector’s valuation is 19.87.

The enhanced valuation of PWR stock can be substantiated by its increased exposure to secular power demand, lower execution risks, margin improvement efforts and the self-perform model. The company’s positioning for the upcoming infrastructure cycles highlights its growth durability and earnings visibility, which is encouraging for investors looking for long-term growth. Moreover, the favorable public infrastructure spending environment and declining Fed interest rates boost Quanta’s growth prospects.

Sitting at the center of the fastest-growing and most capital-intensive segment of the United States’ infrastructure market, Quanta faces notable competition from key market players, including EMCOR Group, Inc. EME, MasTec, Inc. MTZ and MYR Group Inc. MYRG. EMCOR, MasTec and MYR Group are currently trading at a forward 12-month P/E ratio of 23.72, 28.65 and 28.32, respectively.

Shares of this specialty contracting services provider have trended upward 14.3% in the past six months, outperforming the industry, the sector and the S&P 500 Index.

However, PWR is prone to execution risks and project delays for large-scale projects, alongside tariff-related challenges and supply-chain inconveniences. Also, skilled labor availability and wage inflation are key challenges in the current uncertain macro scenario.

Secular Power Demand Strength: Quanta is capitalizing on the booming trends surrounding electric transmission, grid modernization and power generation tied to AI, data centers, electrification and reshoring. Expectations for rising power needs continue to expand the scope of work across all forms of energy generation. The management indicated that accelerating demand in the Electric segment and broad activity across key end markets are reinforcing these trends and strengthening overall project momentum. Unlike EMCOR and MasTec, Quanta’s revenue is directly linked to utility rate-base spending, which is regulated, multi-year and less cyclical.

As of the third quarter of 2025, PWR’s backlog reached a record $39.2 billion, up from $33.96 billion a year ago, underscoring robust demand visibility. Also, upcoming large projects (which are not yet included in the backlog), such as transmission work and the new power generation program, are expected to add volume once permitting milestones are met. This supports long-term revenue visibility and strengthens the company’s outlook for sustained growth.

Improved Project Execution: Unlike many peers, Quanta self-performs 80–85% of its work. This approach provides greater control over costs, schedules and quality, mitigating risks associated with subcontracting. Customers value this execution certainty, particularly for large, multi-year programs where delays or overruns can be costly. Moreover, its craft-skilled workforce and integrated solutions model, combining engineering, technology and program management, enhance its ability to deliver full-lifecycle services.

Disciplined bidding, effective risk management and a favorable project mix are primary drivers of PWR’s margin expansion and consistency. Margin improvement is structural, not cyclical, reflecting better project selection and operational discipline rather than temporary market conditions. In the first nine months of 2025, operating margin increased to 5.5% from 5.2% on a year-over-year basis. During the same time frame, gross margin expanded 50 basis points year over year to 14.8%.

Disciplined Capital Allocation: Quanta consistently focuses on reducing leverage while maintaining capacity for selective acquisitions, organic investment and shareholder returns. It generated $563 million in operating cash flow and $438 million in free cash flow in the third quarter, bringing year-to-date free cash flow to $726.3 million. During the first nine months of 2025, PWR repurchased 538,559 shares for $134.6 million, with $365.1 million remaining under its buyback program. The balance between reinvestment and shareholder returns demonstrates disciplined capital management, enhancing long-term value creation. For 2025, the company expects free cash flow of $1.3-$1.7. It had reported $1.55 billion in 2024.

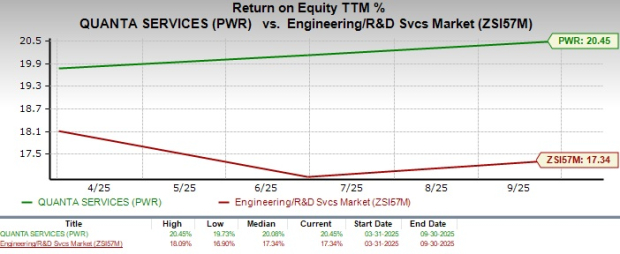

Quanta’s trailing 12-month return on equity (ROE) of 20.5% significantly exceeds the industry’s average, underscoring its efficiency in generating shareholder returns.

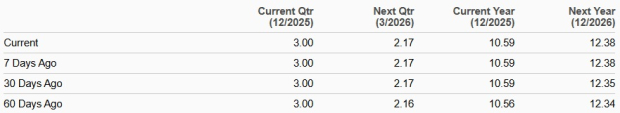

PWR’s earnings estimates for 2025 have trended upward in the past 60 days, while those of 2026 have increased in the past 30 days. The estimates for 2025 and 2026 imply year-over-year growth of 18.1% and 16.9%, respectively.

Although demand visibility is strong, execution risk remains elevated due to the increasing size and complexity of infrastructure projects. Large transmission, generation and data center-related programs often face permitting delays, interconnection bottlenecks and regulatory approvals that can push Quanta’s revenue recognition to the south. Supply chain constraints and project sequencing remain ongoing challenges, particularly for equipment-heavy transmission and generation work. Additionally, while renewable and battery projects remain active, the pace of growth is moderating compared to prior years, creating variability in quarterly mix.

Besides, skilled labor availability remains tight industry-wide, and wage inflation continues to require careful pricing discipline. While Quanta’s scale and workforce investments provide an advantage, rapid volume growth can still create short-term inefficiencies if labor ramp-up outpaces productivity gains.

As highlighted above, Quanta remains well-positioned at the center of the U.S. power and energy infrastructure buildout. It is benefiting from secular demand tied to grid modernization, electrification, AI-driven data center load growth and reshoring. The company’s high self-perform model enhances cost control and execution certainty, contributing to steady margin expansion. Upward revisions to 2025 and 2026 earnings estimates reflect confidence in project momentum and disciplined bidding.

However, PWR stock’s elevated valuation, combined with execution-related risks, tempers near-term visibility and clouds investors’ judgment. Further, supply-chain constraints, labor availability challenges and moderating growth in certain renewable segments could introduce quarterly volatility.

Overall, Quanta’s fundamentals remain solid with durable long-term drivers, but the current valuation and execution risks suggest a balanced risk-reward profile. Thus, it is prudent for existing investors to retain this Zacks Rank #3 (Hold) stock for now. New investors are advised to wait and look for a better entry point when the near-term trends favor PWR stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite