|

|

|

|

|||||

|

|

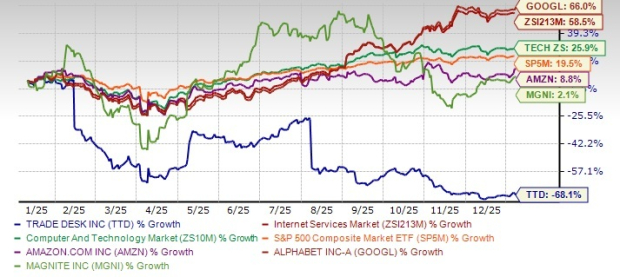

The Trade Desk (TTD) stock has been a laggard performer in the digital ad space. It has seen a sharp 68.1% decline over the past year, an uncomfortable drawdown for a company viewed as one of ad tech’s leading players.

TTD’s decline stands in sharp contrast to the Zacks Internet Services industry’s growth of 58.5% over the same time frame, while the Zacks Computer & Technology sector and the S&P 500 composite have gained 25.9% and 19.5%, respectively.

As investors look ahead to 2026, the focus remains on TTD’s ability to continue durable growth, defend share against rich rivals and translate secular CTV momentum into finacial leverage.

Given all these factors, let’s examine closely to understand if TTD’s slump presents a buying opportunity.

TTD’s sell-off primarily has been due to a confluence of certain company-specific challenges like increasing costs and the slowing pace of revenue growth, macro volatility and intensifying competition.

Amazon’s (AMZN) expanding DSP business is giving tough competition to TTD. Beyond big tech, independent ad-tech companies, such as Magnite (MGNI) and PubMatic, are expanding their efforts and competing for ad dollars.

Even with the recent share-price pressure, several tailwinds continue to support The Trade Desk’s long-term narrative. Shift toward open internet remains the key theme.

Unlike walled-garden platforms like Meta, Alphabet (GOOGL) and Amazon, which are focused on monetizing their own content ecosystems and first-party data, The Trade Desk positions itself as the buyer’s platform for the open internet. TTD had earlier referred to connected TV (“CTV”) as the “kingpin of the open internet.”

The Trade Desk’s strategy revolves around the open Internet, which is where price discovery and competition exist. Management noted that average consumers spend about two-thirds of their online time on the open Internet, but advertisers allocate far less than that proportion of their budgets.

On the last earnings call, management noted that the transition toward biddable CTV is gaining rapid momentum and it expects decision CTV to become the default buying model in the future. The benefits of decision-based buying (like greater flexibility, control and performance) compared with traditional programmatic guaranteed or insertion-order models, are rendering it the logical choice for advertisers.

The rapid rise of retail media networks bodes well. Retail media’s acceleration is fueled by rising demand for measurable, lower-funnel outcomes. Retailers are embracing The Trade Desk as a partner because the platform seamlessly integrates retail data with identity solutions like UID2, enabling precise targeting and attribution across the open Internet.

The Trade Desk price-consensus-eps-surprise-chart | The Trade Desk Quote

Technology investments are likely to amplify the tailwind. Kokai, TTD’s next-generation AI-powered DSP experience, remains central to its strategy. 85% clients use Kokai as their default experience and this is strengthening its competitive moat. TTD highlighted that Kokai delivered (on average) 26% better cost per acquisition, 58% better cost per unique reach and a 94% better click-through rate compared with Solimar.

TTD’s OpenPath, Deal Desk, Pubdesk and OpenAds initiatives further strengthen its ecosystem by connecting advertisers directly to publishers, improving transparency and supply-chain efficiency. It recently announced that OpenAds was now supported by prominent publishers like AccuWeather, The Guardian, The Arena Group, BuzzFeed, Hearst Magazines, Hearst TV, Newsweek, People Inc. and Ziff Davis.

Management estimates that about 60% of its total addressable market lies outside the United States. International business currently represents roughly 13% of total revenues, a clear opportunity for long-term growth.

TTD boasts a strong balance sheet with a cash position (cash, cash equivalents and short-term investments) of $1.4 billion at the end of the third quarter, with no debt. As digital advertising shifts toward AI-driven, outcome-based campaigns, The Trade Desk’s cash strength offers a buffer against macro volatility. In a market increasingly defined by capital discipline and platform efficiency, The Trade Desk’s liquidity and free cash flow generation may prove to be one of its most durable advantages.

The company repurchased $310 million worth of stock in the third quarter and approved a new buyback plan of $500 million.

For the fourth quarter of 2025, the company anticipates revenues of at least $840 million.

TTD stock is trading at a price/book multiple of 7.19X compared with the industry’s 7.8X.

AMZN, MGNI and GOOGL trade at 6.99X, 2.99X and 10.04X, respectively.

Over the past year, the stock prices for Amazon, Magnite and Alphabet have gained 8.8%, 2.1% and 66%, respectively.

At present, TTD carries a Zacks Rank #2 (Buy).

The Trade Desk’s 68% slump over the past year is likely due to a reset in expectations and not a problematic business model. The company remains one of the leading DSP platforms in the ad tech market that is expected to witness strong growth going ahead.

For investors holding a position in TTD, retaining it is wise. While new investors are willing to ride out near-term volatility and focus on the multi-year opportunity, TTD emerges as a buying opportunity.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 9 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours | |

| 14 hours | |

| 15 hours | |

| 18 hours | |

| 18 hours | |

| 20 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite