|

|

|

|

|||||

|

|

After a volatile year defined by persistent inflation, tariff-related complexity, elevated borrowing costs and cautious consumer spending, the broader retail sector appears to be stabilizing, with conditions turning more supportive. Amid an improving scenario, a handful of retailers have delivered double-digit gains over the past month, outperforming the S&P 500 on holiday-driven optimism, resilient fundamentals and improving operating trends.

What makes this rally notable is that it has not been purely sentiment-driven, but rather momentum-driven. Investors are increasingly rewarding companies showing visible progress on margins, inventory discipline and traffic trends. Many are supported by better-than-expected earnings performance, disciplined cost management and strategies that protect profitability even in a mixed macro environment.

Markedly, the recent surge in the stock price hasn’t stretched valuations to uncomfortable levels. Many continue to trade below their historical price-to-earnings multiples. These stocks are also backed by a favorable Zacks Rank, which typically reflects rising earnings estimates.

Here are four retail stocks — Victoria's Secret & Co. VSCO, Five Below, Inc. FIVE, American Eagle Outfitters, Inc. AEO and Brinker International, Inc. EAT — that have climbed more than 10% over the past month but still look attractive based on an improving earnings outlook, supportive analyst revisions and business momentum.

Catalyst: Victoria's Secret is demonstrating a powerful brand resurgence by successfully executing its "Path to Potential" strategy, which has revitalized its core intimate business. The company’s focus on product innovation across its Victoria's Secret, PINK, and Beauty brands is driving significant customer acquisition and market share gains, even within a challenging retail environment. Operationally, the business is scaling effectively by leveraging a disciplined promotional strategy and a solid operational foundation to deliver robust margin expansion and increased profitability. Strategic investments in digital-first marketing and enhanced store experiences, such as the "Store of the Future" concept, further solidify its leadership position in the global intimates and beauty markets.

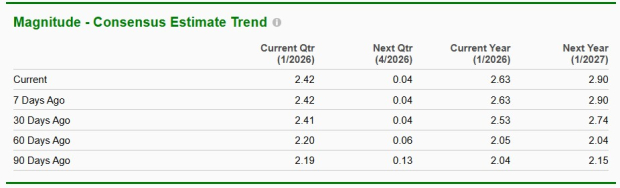

Earnings Estimate Revisions: Earnings estimates are moving sharply higher. Over the past 30 days, the Zacks Consensus Estimate for the current fiscal year has climbed 10 cents to $2.63. For the next fiscal year, the estimate has also surged 16 cents to $2.90 over the same period.

Valuation: VSCO trades at 21.18 times forward 12-month price-to-earnings (P/E), below its one-year high of 25.13, indicating valuation remains supportive even after the recent rally, particularly given the company’s improving margin and earnings trajectory.

Technical Setup: VSCO’s technical picture remains constructive, with the stock finishing the last trading session at $60.95 and holding firmly above its 50-day moving average of $44.54, a signal that the uptrend remains intact.

Surprise History/Zacks Rank: Victoria’s Secret sports a Zacks Rank #1 (Strong Buy) and has delivered an average earnings surprise of 55.5% over the past four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

Catalyst: Five Below continues to strengthen its position as a leading value retailer, offering a trend-focused product assortment that strongly appeals to its core demographic of teens and tweens. Management noted consistent increases in foot traffic, driven by engaging merchandising, frequent product updates and a treasure-hunt shopping experience that encourages repeat visits. Operational innovations, such as the use of AI for inventory management and a shift toward creator-led social media marketing, have generated significant traffic growth and enhanced customer engagement. Supported by a strong pace of new store openings and steady momentum across all household income groups, the brand demonstrates notable resilience and gains in market share.

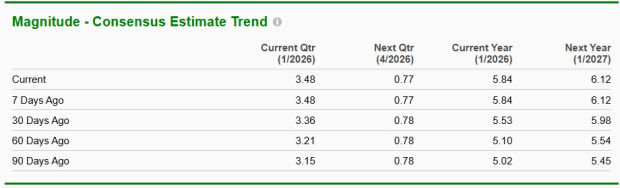

Earnings Estimate Revisions: Over the past 30 days, the Zacks Consensus Estimate for the current fiscal year has increased by 31 cents to $5.84. The consensus estimate for the next fiscal year has also risen 14 cents to $6.12 over the same timeframe.

Valuation: On a forward 12-month P/E basis, Five Below trades at 32.86, which is not stretched relative to its one-year peak of 33.15, suggesting valuations remain reasonable despite the recent rally.

Technical Setup: The technical backdrop remains supportive for FIVE, as the stock continues to trade above its 50-day moving average ($169.00) after closing at $200.61 in the last trading session.

Surprise History/Zacks Rank: Five Below sports a Zacks Rank #1 and has delivered an average earnings surprise of 62.1% in the trailing four quarters.

Catalyst: American Eagle is benefiting from strong momentum at Aerie and OFFLINE, which continues to drive market-share gains and a more diversified revenue mix. The company's strategic pivot toward high-impact marketing campaigns and high-profile collaborations has successfully revitalized brand desirability, leading to accelerated traffic and strong customer acquisition across all digital and physical channels. Operational resilience is evident through a disciplined focus on inventory management, cost efficiencies and a modernized store remodeling program that elevates the overall shopping experience. By leveraging its dominance in core categories like denim while aggressively expanding into lifestyle segments such as activewear and sleep, the company is effectively broadening its reach across diverse consumer cohorts.

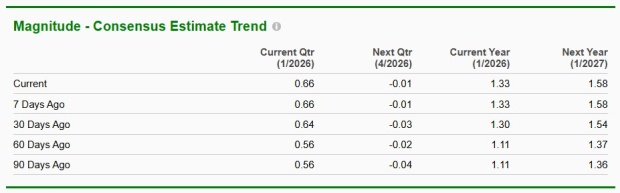

Earnings Estimate Revisions: The Zacks Consensus Estimate for the current fiscal year has increased by 3 cents to $1.33 over the past 30 days. For the next fiscal year, the estimate has also moved higher, rising 4 cents to $1.58 during the same period.

Valuation: On a forward 12-month P/E basis, American Eagle is trading at 17.35, still below its one-year high of 18.29, indicating the stock remains reasonably valued despite its recent run.

Technical Setup: Closing yesterday’s trading session at $27.17, shares of American Eagle are trading above the 50-day moving average of $21.80, a bullish technical signal reflecting improving momentum.

Surprise History/Zacks Rank: This Zacks #1 Ranked company has a trailing four-quarter earnings surprise of 35.1%, on average.

Catalyst: Brinker International is outperforming the casual dining industry with double-digit same-store sales and positive traffic growth for six consecutive quarters. The company’s bullish case is anchored by the explosive momentum of the Chili’s brand, where strategic "better than fast food" marketing and high-impact menu innovations are driving record guest experience scores. Management is further accelerating growth through a modern "Greenville" restaurant reimage program and a disciplined "Back to Maggiano’s" turnaround plan. Leveraging advanced tokenized data to ensure sustainable guest frequency and robust free cash flow for shareholder returns, Brinker is strategically optimizing its portfolio and operational efficiency.

Earnings Estimate Revisions: The Zacks Consensus Estimate for the current fiscal year has increased by 3 cents to $10.23 over the past 30 days. For the next fiscal year, the estimate has also moved higher by 3 cents to $11.74 during the same period.

Valuation: On a forward 12-month P/E basis, Brinker trades at 14.17, sitting below its one-year peak of 27.63 and slightly under its median level of 15.67, suggesting valuation remains reasonable despite the recent rally.

Technical Setup: From a technical standpoint, EAT remains in an upward trend, finishing the last session at $156.23 and holding above its 50-day moving average of $133.91, a supportive signal for continued momentum.

Surprise History/Zacks Rank: Brinker International carries a Zacks Rank #2 (Buy) and has delivered an average earnings surprise of 18.7% over the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 6 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite