|

|

|

|

|||||

|

|

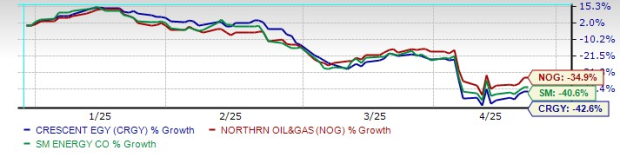

Crescent Energy Company CRGY stock has tanked more than 50% from its January highs. With concerns mounting over a global recession, oil demand expectations are under pressure, and CRGY shares have reflected that sentiment. That said, the company has underperformed its peers, Northern Oil & Gas NOG and SM Energy SM, so far this year. Crescent Energy is down 43% during this period compared to Northern Oil & Gas’ 35% decline and SM Energy’s 41% drop. Clearly, the market has had a harsher view of CRGY despite its operational strides.

Crescent Energy Company is a Houston-based exploration and production (E&P) firm focused on the Eagle Ford and Uinta basins. Operating both conventional and unconventional assets, Crescent emphasizes free cash flow generation, disciplined capital allocation, and bolt-on acquisitions. The company owns around 74,000 net royalty acres and maintains a presence in enhanced oil recovery (EOR) projects across multiple basins. With low base decline rates and a mineral-heavy portfolio, Crescent seeks to offer stable production and shareholder returns.

There’s no doubt 2024 was a pivotal year for Crescent. Management executed five acquisitions worth more than $3 billion, expanding its Eagle Ford footprint and securing its spot among the top three producers in the basin. This scale-up was accompanied by a 100% year-over-year increase in free cash flow — a remarkable feat in a challenging energy market. The company generated $259 million in Q4 free cash flow, surpassing Wall Street expectations. Production guidance for 2025 sits at 254,000–264,000 BOE/d, with planned capital spending of around $975 million, designed to maximize shareholder returns.

The SilverBow Resources acquisition is central to Crescent’s transformation. It brought not just scale, but operational synergies, lower G&A costs, and enhanced access to dry gas assets, especially in Webb County. With natural gas prices showing strength early in the year, this flexibility in CRGY’s asset base positions it to navigate volatile commodity cycles better than many competitors. Management’s capital allocation strategy — including opportunistic divestitures and selective M&A — gives CRGY the ability to balance growth with financial prudence. That said, competitors like Northern Oil & Gas and SM Energy offer similar production profiles, often with fewer moving parts.

In a recent update, Crescent Energy converted all shares of Class B stock into Class A stock, simplifying the corporate structure.

Still, for all the positives, risks abound. EPS estimates for Crescent Energy have sharply declined. Over the last 60 days, 2025 and 2026 EPS projections have fallen around 22% and 27%, respectively. The outlook for profitability is also concerning, with earnings projected to dip by 2.8% over this year and another 4.5% in 2026. This downward trend signals mounting concerns over margin compression, operational execution, and perhaps inflated synergy expectations from the recent M&A activity. Moreover, Crescent’s heavy reliance on acquisition-driven growth clouds earnings visibility. Management even admitted that the 2025 outlook is “only valid until the next acquisition,” underscoring this lack of clarity.

(Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

The underperformance in Uinta also casts a pall. While initial results from the joint venture in the basin appear promising — with new wells delivering 1,500 barrels per day over 30 days — the region remains largely underdeveloped. Many formations still lack adequate testing, and Crescent’s historically light investment in the area means results could remain inconsistent. Given the company’s stronger focus on the Eagle Ford, there’s a real risk that Uinta will become a capital drain rather than a growth driver.

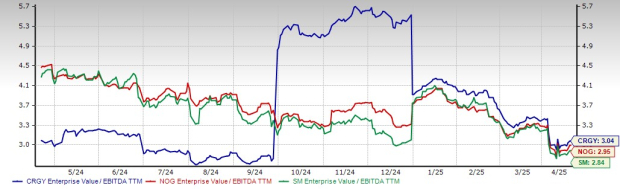

Crescent’s valuation raises additional questions. While the company boasts a strong free cash flow generating ability, the current EV/EBITDA multiple of 3.04 makes it pricier than peers like Northern Oil & Gas (2.95) and SM Energy (2.84). A lot of the potential upside relies on smooth execution, steady well performance and properly managing new assets — all challenging tasks in today’s unpredictable oil market.

Despite Crescent Energy’s bold expansion and improved free cash flow metrics, the stock carries considerable execution risk and valuation concerns. Compared to Northern Oil & Gas and SM Energy, CRGY’s path forward feels less certain. With declining EPS revisions, persistent market underperformance, and no clear valuation edge, the stock lacks a near-term catalyst. While the long-term potential is there, investors may be better off waiting on the sidelines. At this point, CRGY stock lands a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 10 hours | |

| Mar-08 | |

| Mar-06 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Feb-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite