|

|

|

|

|||||

|

|

The reintroduction of the National Quantum Initiative Reauthorization Act in January 2026 marked a crucial moment for the quantum sector, signaling renewed government commitment to scaling quantum technologies beyond the research phase (Quantum Insider). Building on the funding momentum established in 2025, governments worldwide have shifted from early-stage scientific support to concrete funding and deployment frameworks designed to accelerate commercial quantum adoption. This policy-driven transition is laying the groundwork for 2026 to become an even more consequential year for equity investors in the quantum space.

In this article, we discuss how government intervention is speeding the pace of quantum computing development, shortening the path from lab research to commercial applications. We also highlight three stocks, IonQ IONQ, D-Wave Quantum QBTS and International Business Machines IBM, which are well positioned to benefit in 2026 from rising government quantum investments, given their alignment with national research programs, enterprise partnerships and public-sector demand.

Governments worldwide have stepped up funding significantly. In the United States, the Department of Energy committed $625 million to renew five national quantum research centers, ensuring continued leadership in next-generation computing, sensing and networking. As already stated, last week, U.S. lawmakers also reintroduced the National Quantum Initiative Reauthorization Act, aimed at restoring and expanding federal coordination while accelerating the transition from research to practical quantum applications. Together, these moves signal that Washington views quantum as a core pillar of long-term economic competitiveness and national security.

This momentum began building in late 2025, as legislative discussions increasingly emphasized aligning quantum funding with industrial deployment and defense-related objectives. Such alignment is critical for sustaining long-term market growth, as it reduces uncertainty around funding continuity and strengthens public-private collaboration.

Policy shifts under the Trump administration have introduced strategic support aimed at catalyzing commercial success. While some broader science funding debates have generated controversy, quantum has remained a bipartisan priority, supported by policy levers such as strategic partnerships and industrial engagement that lower commercialization risk for investors heading into 2026.

Globally, quantum investment momentum is equally strong. The United Kingdom continues to channel capital toward quantum commercialization, emphasizing real-world use cases beyond academic research. Canada has also stepped up, committing part of a $334 million, five-year quantum ecosystem program to support domestic companies working toward fault-tolerant quantum computing.

For investors, these government initiatives, combined with clearer policy direction and expanding international collaboration, create a supportive macro backdrop for quantum-related stocks through 2026 and beyond. As funding increasingly shifts from research toward commercialization, companies closest to deployable quantum solutions stand to benefit from more predictable and globally synchronized capital flows.

IonQ: It expanded its government footprint in 2025, strengthening its position as a strategic partner for national and international quantum programs. The company was selected to support South Korea’s National Quantum Center of Excellence and signed an MoU with the U.S. Department of Energy focused on space-based quantum technologies and secure communications. With the launch of IonQ Federal and participation in state-level initiatives such as Texas’ quantum programs, IonQ enters 2026 well-positioned to benefit from rising public-sector quantum investment.

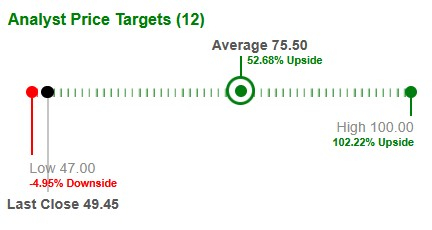

IonQ, a Zacks Rank #3 (Hold) stock, is projected to report earnings growth of 65.8% on revenue growth of 83.3% in 2026. Based on short-term price targets offered by 12 analysts, the average price target represents an increase of 49.7% from the last closing price of $50.5.

D-Wave: It strengthened its public-sector positioning in 2025 by formalizing a U.S. government business unit focused on expanding the adoption of its quantum systems in federal, defense and infrastructure applications, reflecting rising government interest in practical quantum solutions. It also partnered with Carahsoft to make its technology more accessible to U.S. government agencies through established contract vehicles. These government-aligned strategies help set the stage for potential growth in 2026 as public-sector demand for quantum computing rises.

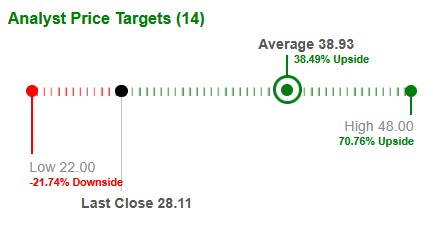

D-Wave, a Zacks Rank #3 stock, is projected to report earnings growth of 7% on revenue growth of 61.1% in 2026. Based on short-term price targets offered by 14 analysts, the average price target represents an increase of 33% from the last closing price of $29.3.

IBM: Its quantum efforts are deeply tied to government-backed initiatives worldwide. It collaborates with four of the U.S. Department of Energy’s National Quantum Information Science Research Centers, advancing quantum-centric supercomputing and hybrid architectures. IBM is also working with regional and national governments, for example, deploying systems like IBM Quantum System Two in Europe and supporting India’s Quantum Valley Tech Park, which helps build sovereign quantum infrastructure. These partnerships position IBM to benefit from expanding public funding and government engagement in quantum technologies throughout 2026.

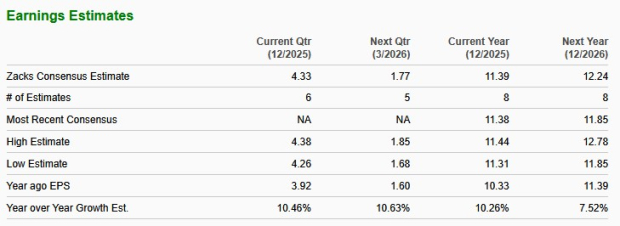

IBM, a Zacks Rank #2 (Buy) company, is projected to report earnings growth of 7.5% on revenue growth of 5% in 2026. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours |

Storage Technology: How To Find & Own America's Greatest Opportunities

IBM

Investor's Business Daily

|

| 4 hours | |

| 8 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Quantum Computing Stocks: Infleqtion Pops In First Day As Public Company

QBTS -6.25% IONQ

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Stock Market Today: Dow, Tech Futures Slide; Nvidia, Palantir, Tesla Extend Losses (Live Coverage)

IBM

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite